- A new higher high activates further growth.

- False breakouts may announce a new sell-off in the short term.

- The US data could bring sharp movements later.

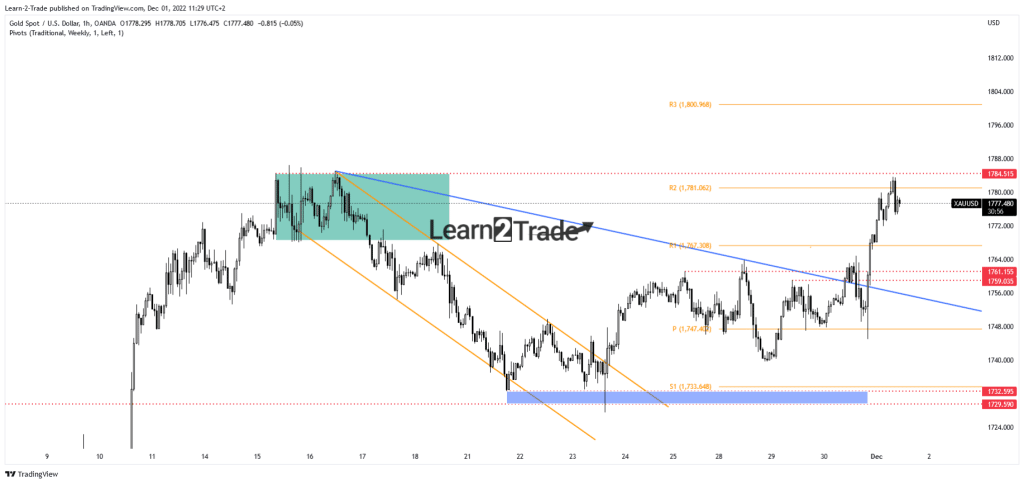

Today, the gold price climbed as high as $1,783, registering a new high. The metal is now trading at $1,777. After a sharp rise, minor corrections may occur.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The XAU/USD developed a strong leg higher as the USD depreciated versus its rivals. Fundamentally, the yellow metal turned upside as Fed Chair Powell signaled a 50 bps hike in December.

After lower inflation was reported in October, the FED is expected to deliver a smaller rate hike. Still, in my opinion, the November inflation data could be decisive.

Today, the US economic data could have a big impact. The Core PCE Price Index may report a 0.3% growth, ISM Manufacturing PMI could drop from 50.2 points to 49.7, while the Unemployment Claims indicator is expected at 234K below 240K estimates.

In addition, Personal Income could report a 0.4% growth again, Personal Spending is expected to register a 0.8% growth, while Final Manufacturing PMI could remain steady at 47.6 points.

The ISM Manufacturing Prices, Construction Spending, and Wards Total Vehicle Sales indicators will also be released.

Tomorrow, the US NFP, Average Hourly Earnings, and Unemployment Rate are seen as high-impact events and could bring sharp movements.

Gold price technical analysis: Bulls correcting before continuation

Technically, the price is almost kissing the $1,784 static resistance. However, it has failed to stay above the R2 (1,781), signaling exhausted buyers after its strong growth. Still, the precious metal may challenge R2 again.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Testing this upside obstacle, registering only false breakouts could announce a new sell-off. Only a valid breakout through $1,784, a new higher high, could activate further growth. Better-than-expected data could force the yellow metal to drop, while poor figures could lift the XAU/USD. After its amazing growth, a correction could be normal, but we still need confirmation. The bias remains bullish unless the sellers push the price back below the pivot point of $1,747.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.