- Gold is gyrating the $1,200 mark since August 28.

- Friday’s bull breakout failed, putting the yellow metal bears back into the driver’s seat. However, the metal has rebounded from $1,195 to $1,200 in Asia.

- Last month’s long-tailed candle indicates the 5-month losing streak has likely run out of steam. So, a corrective rally is more likely in the short-run.

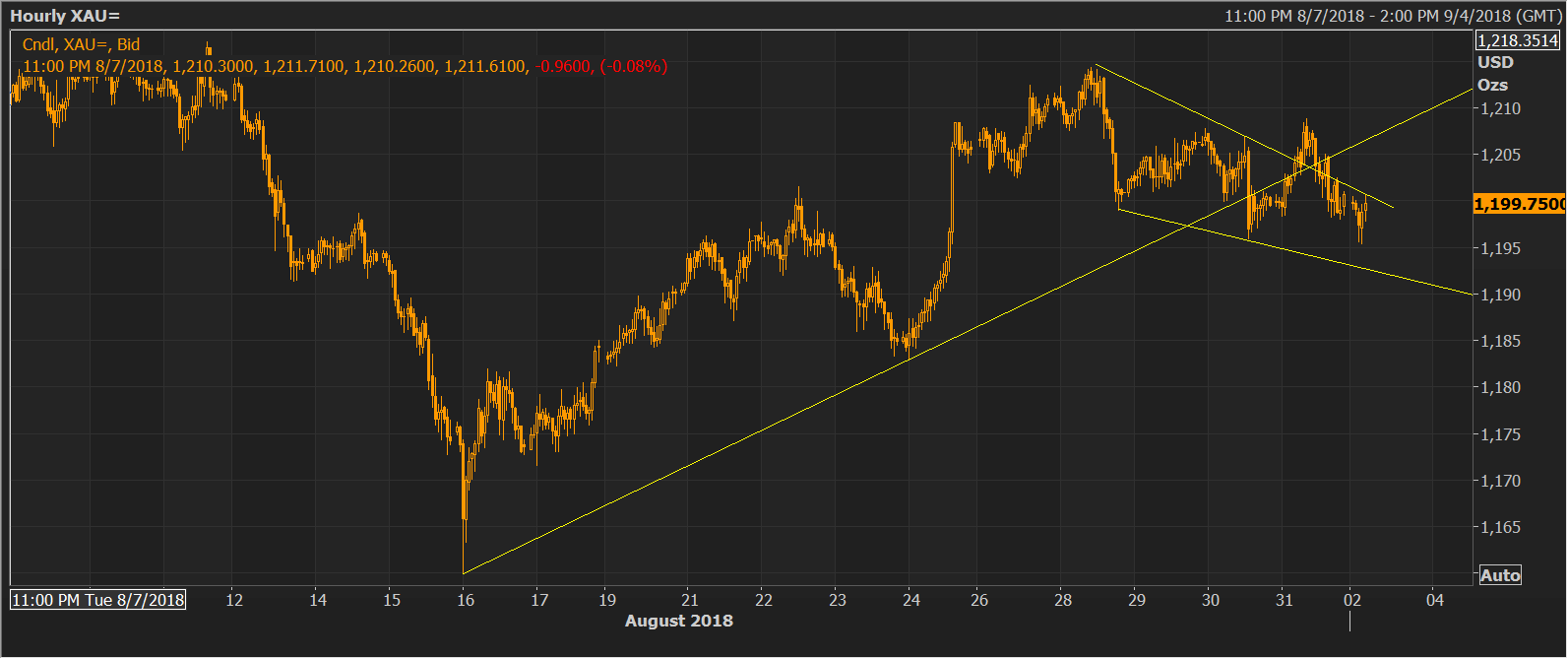

Hourly chart

Spot Rate: $1,200

Daily High: $1,201

Daily Low: $1,195

Trend: Neutral to bullish

Resistance

R1: $1,204 (100-hour moving average)

R2: $1,209 (Aug. 31 high resistance on the hourly chart)

R3: $1,214.30 (Aug. 28 high)

Support

S1: $1,195 (Sep. 3 low)

S2: $1,187 (50% Fib R of $1,160/$1,214.30)

S3: $1183.28 (Aug. 24 low)