- Gold price gains momentum moving well above the $1,750.

- Taking bond and currency markets out of yesterday’s sell-off should be viewed as a positive signal.

- As long as global central banks remain soft enough and gold can withstand the general downtrend, investors have more confidence they won’t start a global sell-off of assets.

- FOMC meeting ahead may provide some fresh impetus to the market.

The gold price analysis suggests some recovery towards the $1,800 mark as the US dollar retreats on Tuesday while the risk-off flows may be directed to the precious metal.

-Are you looking for the best CFD broker? Check our detailed guide-

On Monday, the Dow Jones index fell 600 points or 1.8%, its steepest decline in ten months. S&P500 index also shed 1.7%. On the other hand, the dollar index reached monthly highs and traded above 93.0.

In the middle of the day, the S&P500 plunged more than 5% from its highs in early September, snapping a 10-month winning streak.

In spite of this, it is hard to argue that markets were frightened. For example, during yesterday’s stock market sell-off, FX, bond, and precious metals markets showed sudden resilience or indifference.

Taking bond and currency markets out of yesterday’s sell-off should be viewed as a positive signal because these markets are often considered the wisest and deepest. There is, however, a large amount of buying this evening into strong stocks after the recent downturn.

Even more noteworthy was the purchase of gold stocks. A jump of around 3% in the stocks of the largest gold companies yesterday interrupted the sector’s long-term decline. The precious metal rose 0.5% after falling below $1,750 and gaining support shortly thereafter.

As in previous months, gold has the solid support of around $1,700. But it appears that active buyers have moved to the $1,750 area.

As long as global central banks remain soft enough and gold can withstand the general downtrend, investors have more confidence they won’t start a global sell-off of assets.

The volatility risks ahead of the Fed meeting on Wednesday must, of course, be recognized. Based on the meeting results and the comments that followed, any trend (bullish for the long run and bearish in the short term) could be broken or reinforced. However, in practice, the FOMC uses a very streamlined wording that attracts little backlash.

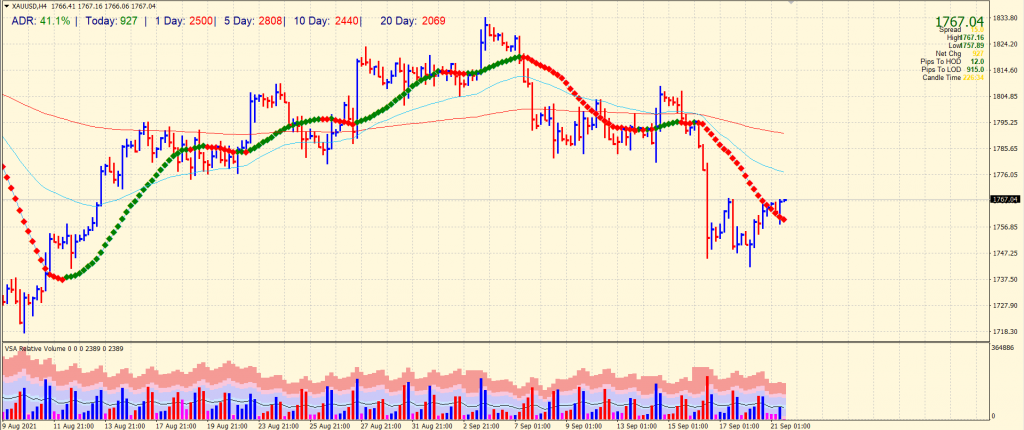

Gold price technical analysis: $1750 keeping bulls alive

The gold price remains well supported above $1,750 support. The metal surged up with a rising volume while the minor consolidation showed a dried volume. This is an indicator of smart buying around the key support.

-Are you looking for forex robots? Check our detailed guide-

The price has moved above the 20-period SMA on the 4-hour chart. However, the 50-period SMA at $1,776 may resist gains ahead of 200-period SMA at $1,790. The average daily range is 41% so far. Hence, we may expect some action around the New York session.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.