- Gold bears fighting back control as DXY recovers ground.

- Risk-off mood returns amid Brexit, stimulus deadlock.

- 21-day SMA is the level to beat for the bulls, vaccine news awaited.

The recovery in Gold (XAU/USD) from Wednesday’s 1% slide lost traction in European trading this Thursday, as the US dollar bulls regain control amid the downbeat market mood.

The sentiment remains dampened by the deadlock on the US fiscal stimulus and Brexit talks, which fuels the haven demand for the greenback across the board. Meanwhile, investors remain cautious ahead of the US FDA approval of the coronavirus vaccine.

Also, critical US macro data, including the CPI and Jobless Claims, are eagerly waited for fresh cues on the strength of the economic recovery, which could impact the Wall Street sentiment and risk flows.

From a broader perspective, optimism over the covid vaccine-driven global economic recovery in 2021 and massive ETF outflows have been the main catalysts behind the recent downtrend in the yellow metal.

At the time of writing, gold trades modestly flat at $1838.

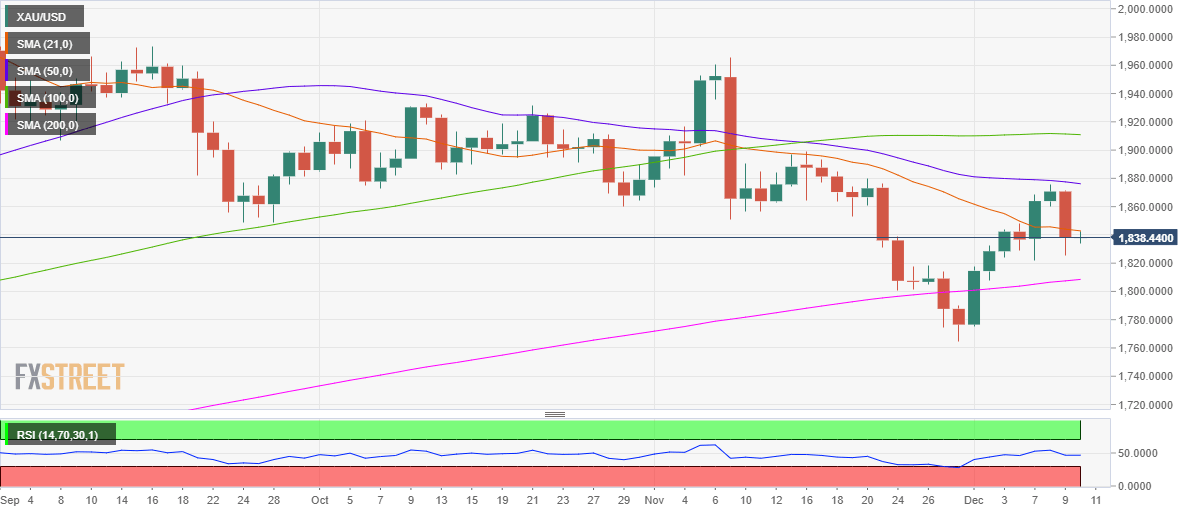

Gold Price Chart: Technical outlook

Daily chart

Gold has formed a doji candlestick on the daily chart so far this Thursday, suggesting a lack of clear directional bias.

The bearish 21-day moving average (DMA) at $1843 is seen capping the recovery attempts in the metal from Wednesday’s low of $1833.

A daily closing above the latter is needed to revive the recovery momentum.

Further up, the horizontal 50-DMA at $1876 is the level to beat for the XAU bulls.

Alternatively, a breach of Wednesday’s low could call for a test of the upward-sloping 200-DMA at $1808.

Acceptance below that level could expose the sub-$1800 levels.

The 14-day Relative Strength Index (RSI) trades flat just below the midline, suggesting that the bearish bias persists in the near-term.

Gold: Additional levels