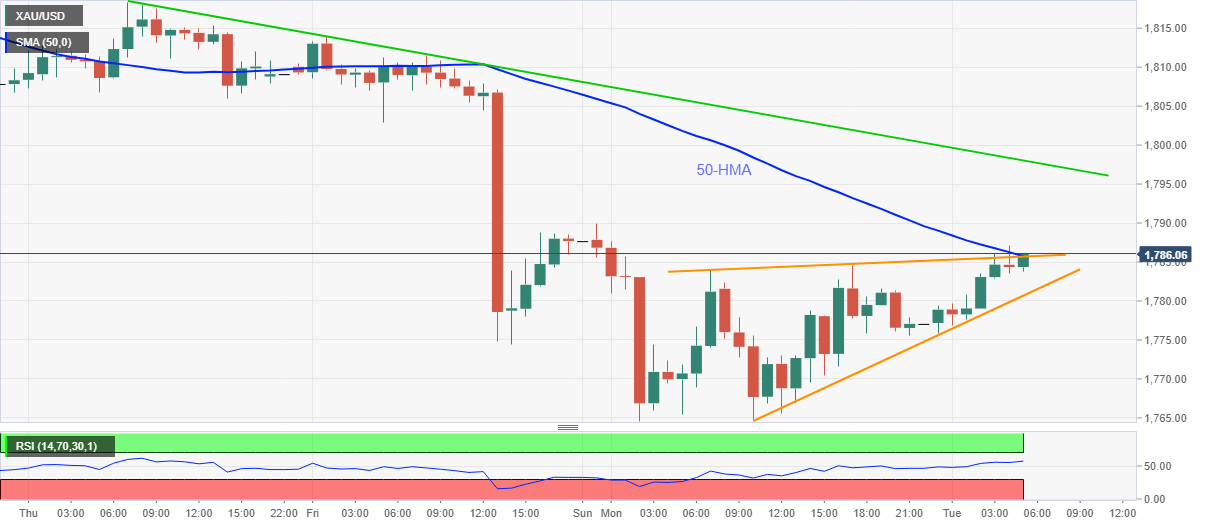

- Gold prices battle key resistance confluence around $1,785/86.

- Three-day-old falling trendline adds to the upside filters.

- Fresh selling will wait for a confirmation of the bearish chart pattern.

Gold picks up the bids near $1,785, up 0.50% intraday, while heading into Tuesday’s European session. The yellow metal dropped to the five-month low the previous day, before bouncing off $1,764.60.

While oversold RSI conditions favored the bullion buyers to portray gradual recovery moves, the underlying bearish pattern, rising wedge, keeps sellers hopeful. Additionally, failures to cross 50-HMA and short-term resistance line are some extra points favoring the gold bears.

However, the south-run needs confirmation from the downside break of rising wedge’s support, at $1,780.70 now, before eyeing the latest multi-month low near $1,764. It should also be noted that May 2018 peak surrounding $1,765 adds strength to the support ahead of highlighting the April 218 high of $1,747.82.

Meanwhile, an upside clearance of $1,786 resistance confluence needs to cross a falling trend line from November 26, currently near $1,798 before confirming the further recoveries.

During the quote’s sustained run-up past-$1,798, the $1,800 round-figure holds the key to further north-run towards September’s low around $1,849.

Gold hourly chart

Trend: Pullback expected