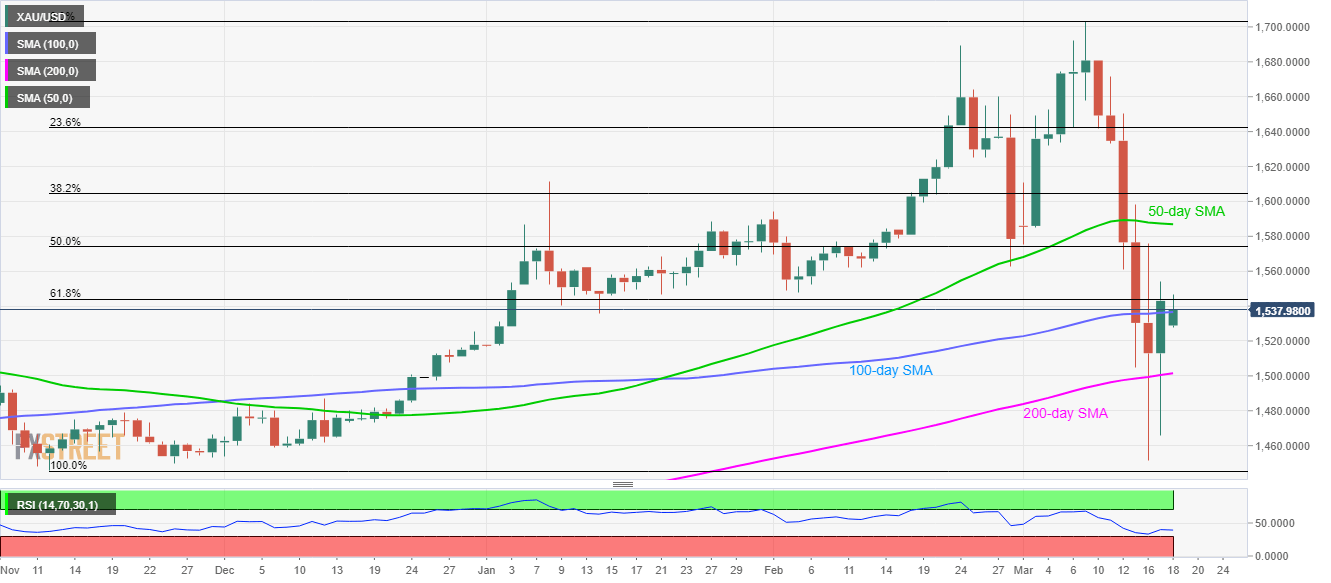

- Gold prices hold onto recovery gains from 200-day SMA, pierce 100-day SMA.

- 61.8% Fibonacci retracement questions the run-up to 50-day SMA.

- RSI recovery favors further pullback.

While extending its recovery gains, Gold prices rise 0.58% to $1,537.50 during the initial Asian session on Wednesday. In doing so, the bullion accelerates the U-turn from 200-day SMA beyond 100-day SMA while also confronting 61.8% Fibonacci retracement of the precious metal’s rise from November 2019 to March 2020.

A sustained break of 1,544 immediate resistance, comprising 61.8% Fibonacci retracement, will still need to cross the 50% of Fibonacci retracement, at $1,575 to aim for 50-day SMA level of $1,587.

In a case where the bulls manage to dominate past-$1,587, a $1,600 round-figure will be on their radars.

Also supporting the recovery moves is the RSI conditions that also bounce off the oversold area.

Alternatively, a daily closing below 200-day SMA level of $1,500 will set the tune for the bears to print fresh yearly lows under the recent one near $1,451.

Gold daily chart

Trend: Further recovery expected