- Gold prices bottoming on the monthly chart, raising prospects of fresh cycle rally.

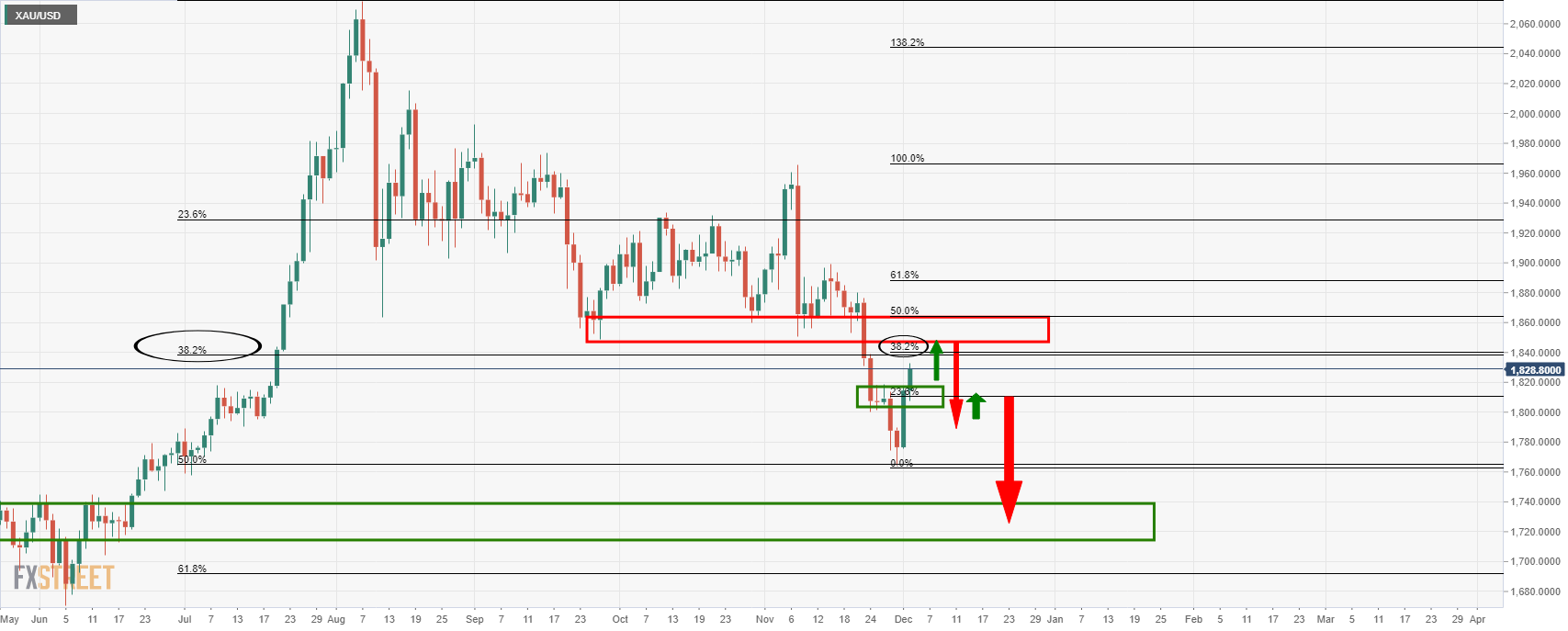

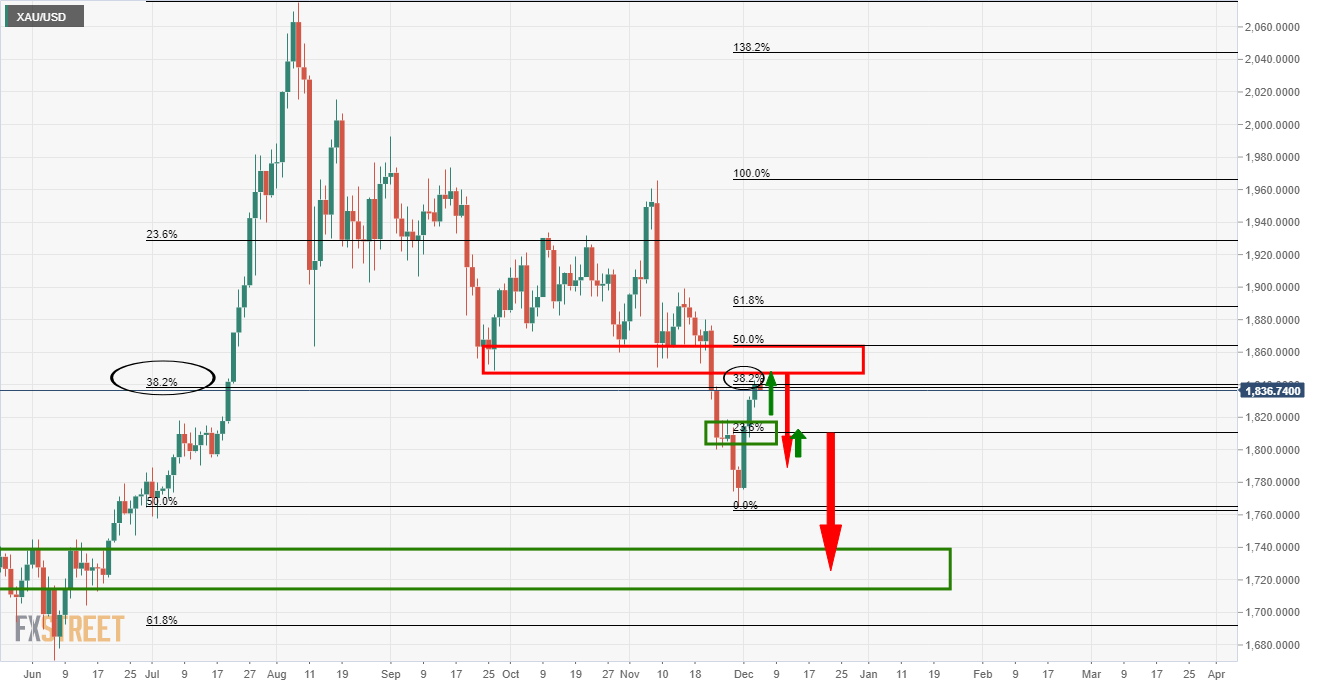

- Daily price action is playing out towards the nose of the W-formation.

- Hedge funds have increased their net long positioning.

Further to the start of the week’s analysis, Gold Price Analysis: Gold bears seeking run to W’s neckline and The Chart of the Week: Gold bears in anticipation of break of $1,805, the price action continues to play out just as expected:

Price action tracking

Today’s price

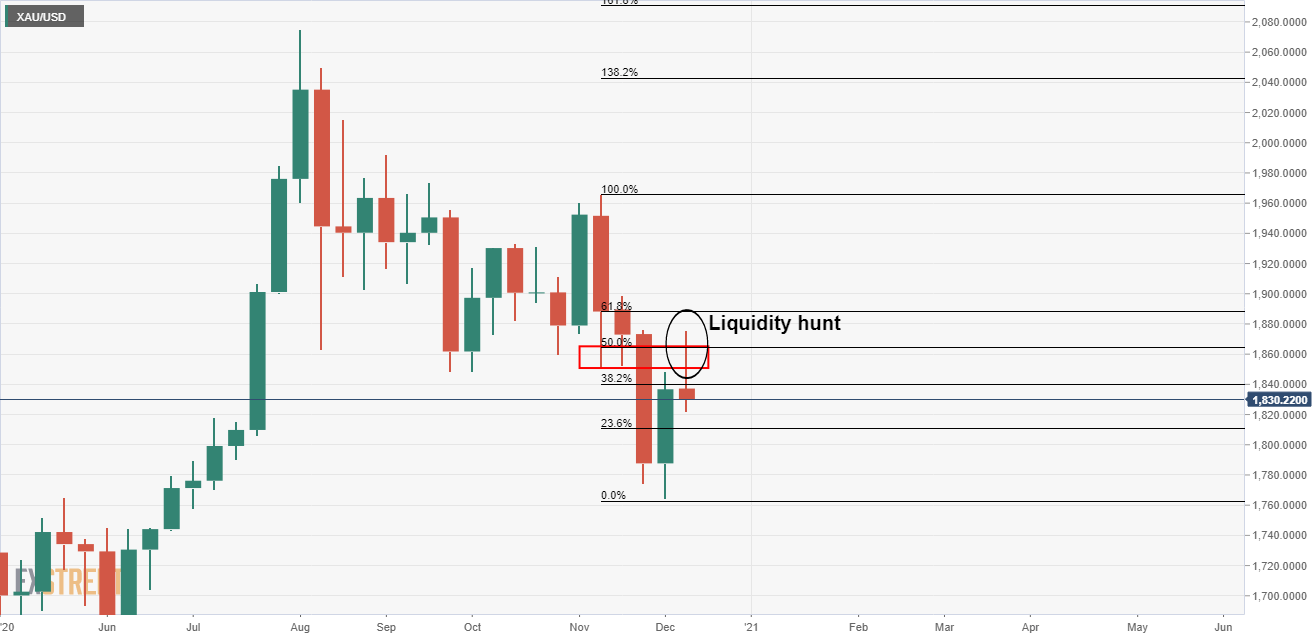

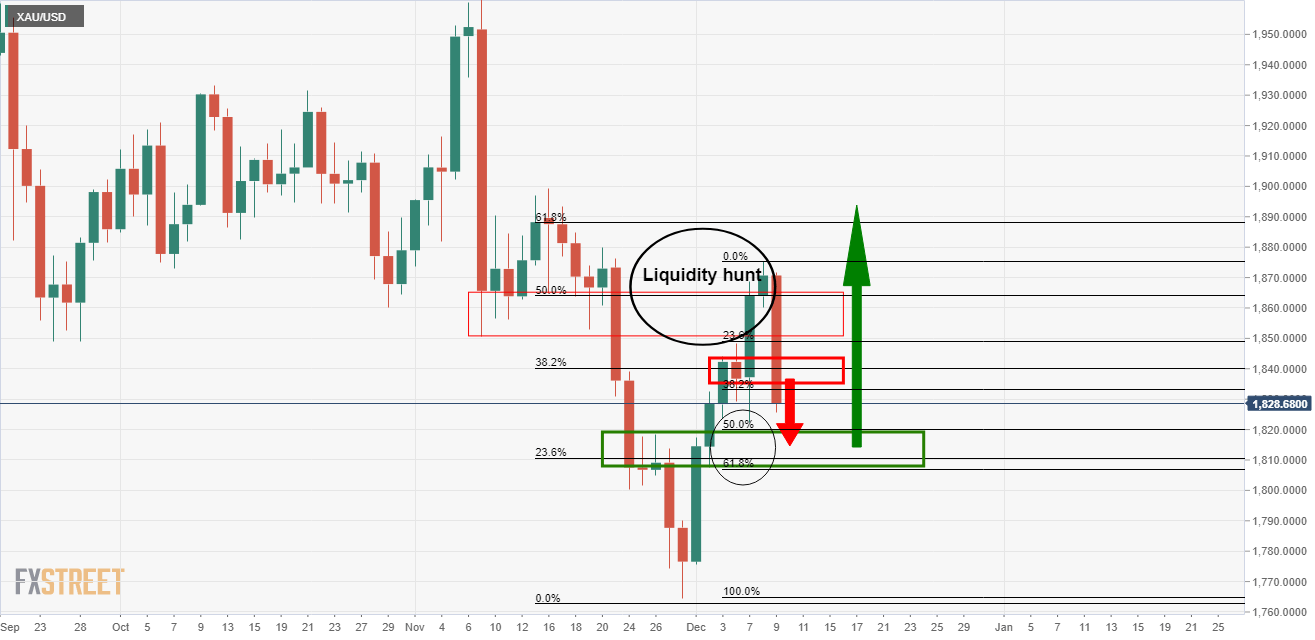

In the weekly chart above, we can see that there was a liquidity hunt before the price resumed the expected direction.

In the above daily chart, the price has fallen below prior support which will be expected to act as resistance on a retest.

The current market is retracing towards a 50% mean reversion and the nose of the W-formation.

However, the bearish bias on the weekly chart has been somewhat negated by the latest position data and therefore, the upside cannot be ruled out.

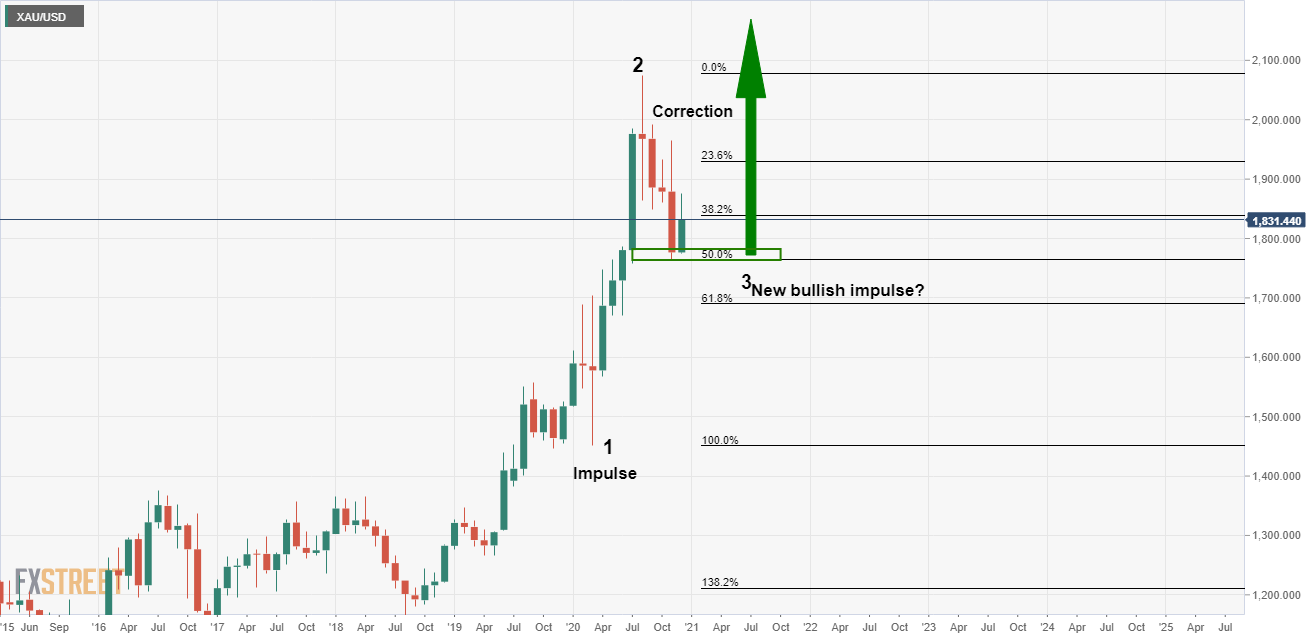

Hedge funds have added longs which makes the month impulse, correction and impulse scenario more compelling.

They close 12k shorts and opened 4k longs, increasing net positions from 243k to 260k with 324k longs and 64k shorts.

”Speculators aggressively added to their net length in gold, covering their shorts following the technical breakdown in gold prices,” analysts at TD Securities noted.

Monthly chart

”Overall, the mosaic of information suggests that while we crossed a significant pain threshold, catalyzing a stop-out, the lower prices ultimately saw buyers emerge,” the analysts at TD Securities argued.

”This creates a powerful set-up which could mark the end of the consolidation phase in gold’s ongoing bull market, as we approach the December FOMC in which we expect the Fed to ease by extending the weighted average maturity of Treasury purchases, while negotiations on fiscal stimulus may move past a stalemate, fueling higher inflation expectations.”

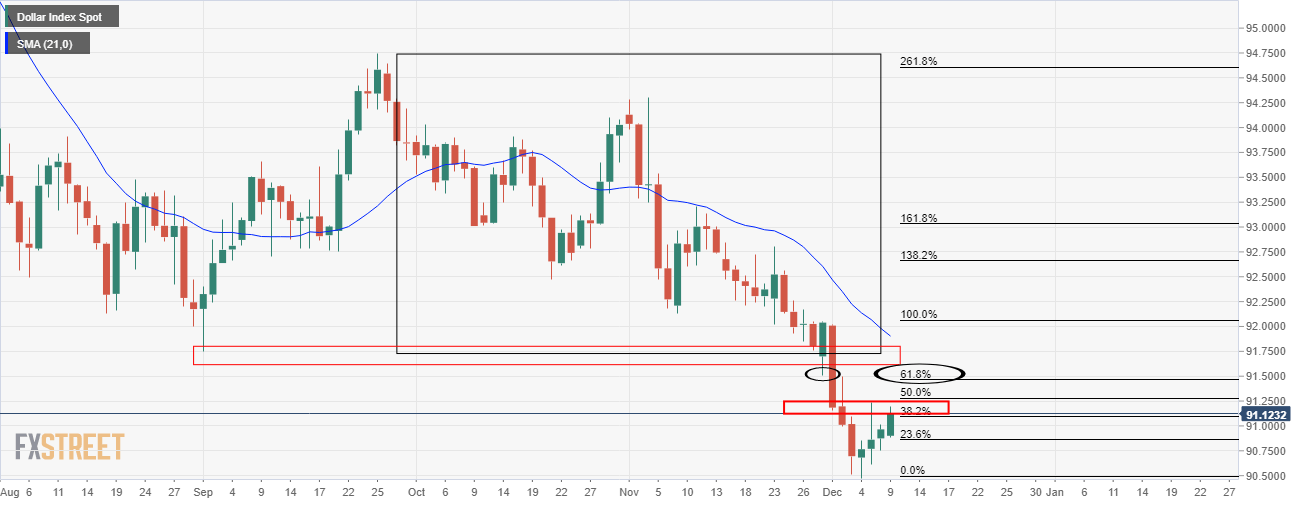

DXY bulls in charge

For the meantime, however, the US dollar is better bid and pressuring gold towards the nose of the W-formation.

While further weakness in the greenback is expected, for now, the bulls are in charge and correcting the recent bout of supply.

A break of the 38.2% Fibonacci retracement level opens scope for a 61.8% Fib and structure confluence of anticipated liquidity at daily prior lows.