- Gold corrects the daily bearish impulse but remains within the bearish territory.

- The weekly outlook is bearish despite the strength of the correction.

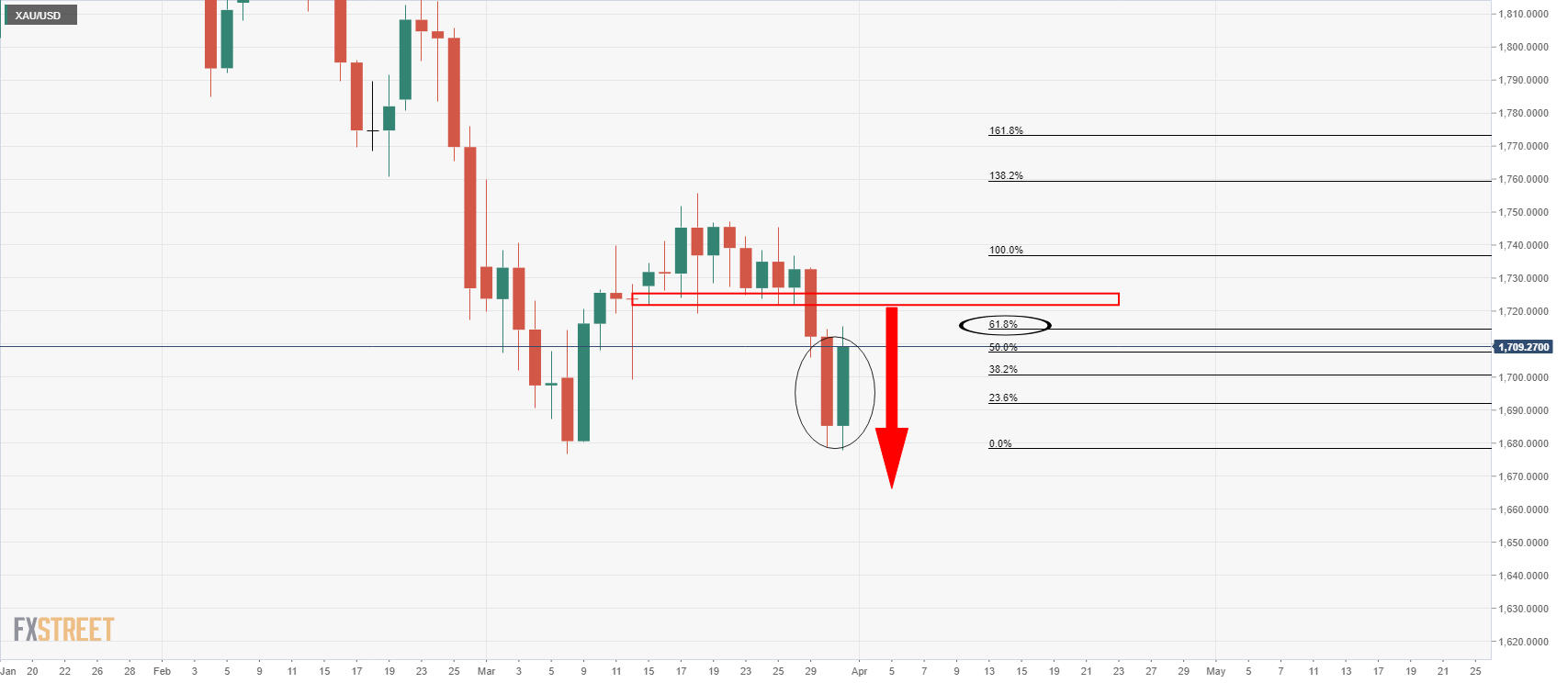

Further to the prior analysis made in Asia, Gold Price Analysis: Upside correction from daily support on the cards? the price has indeed corrected from daily support testing the 61.8% Fibonacci retracement level of the prior daily bearish impulse.

At the time of writing, XAU/USD is trading some 1.50% higher at $1,710 after climbing from a low of 41,677.95 to a high of $1,715.28.

We are just over two days away from the close for the week and as its stands, the candle looks set to close lower which leaves bearish prospects for the start of the next quarter.

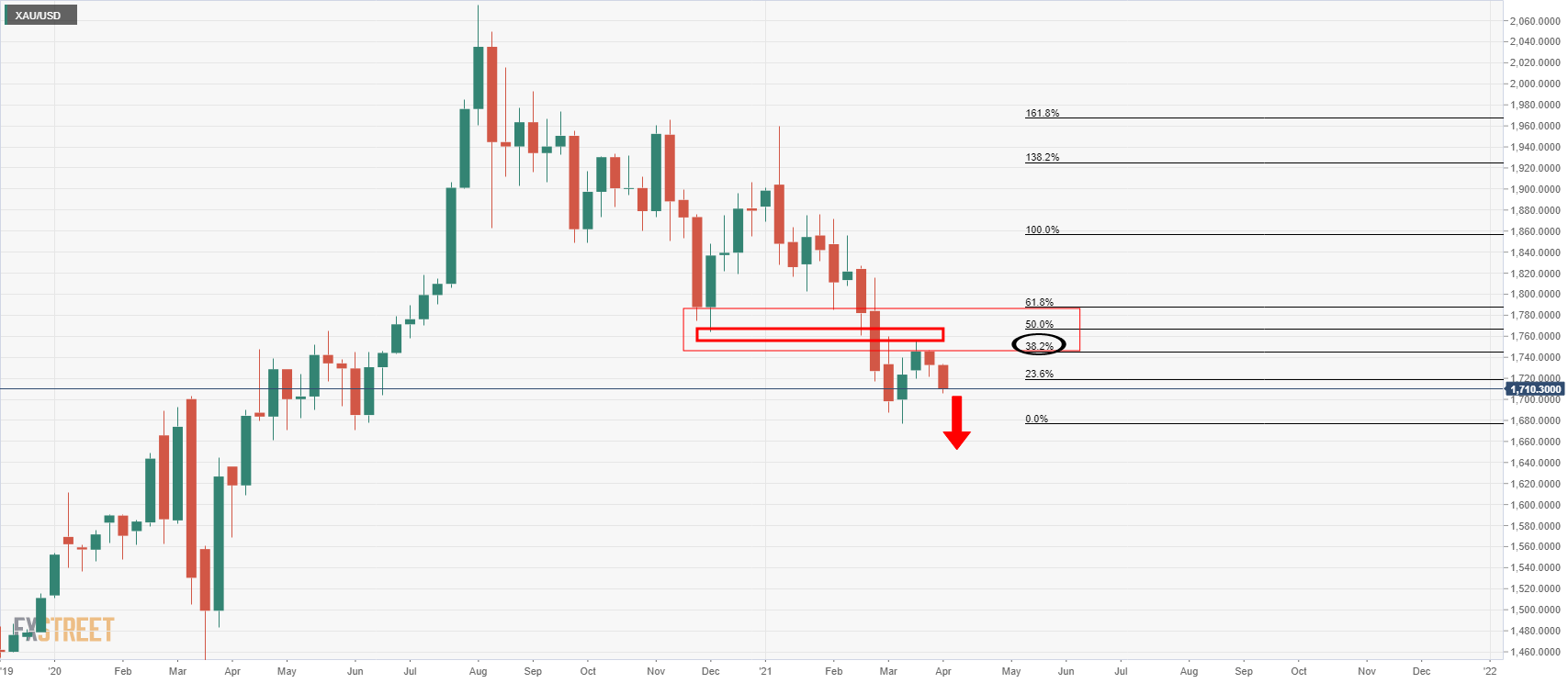

Prior analysis, weekly chart

The weekly outlook is bearish in that the market has corrected the bearish impulse in a significant Fibonacci retracement which would now be expected to see a continuation to the downside.

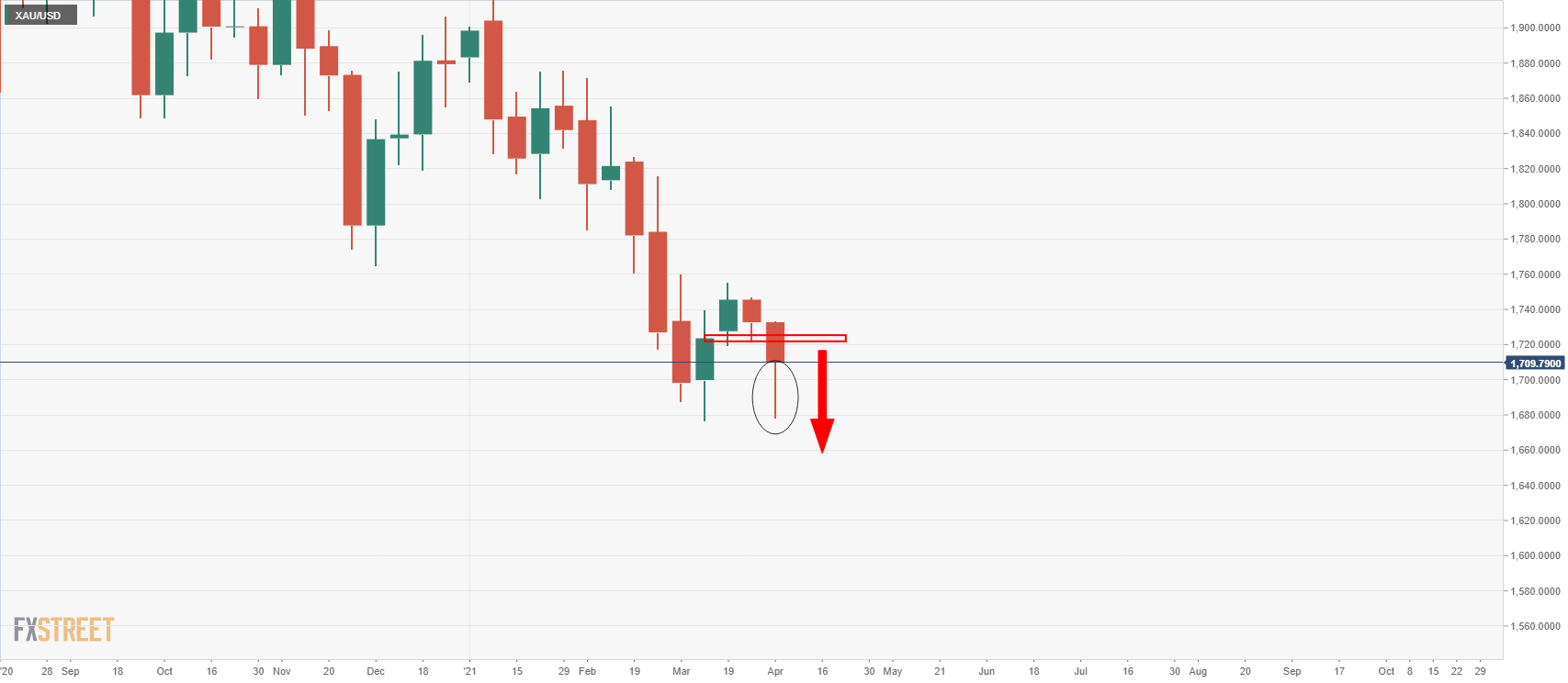

Live market, weekly chart

The bearish candle for the current week has seen an upside correction on the lower time frames.

This wick would be expected to be filled in, if not this week, then next week if there is a bearish close on Friday.

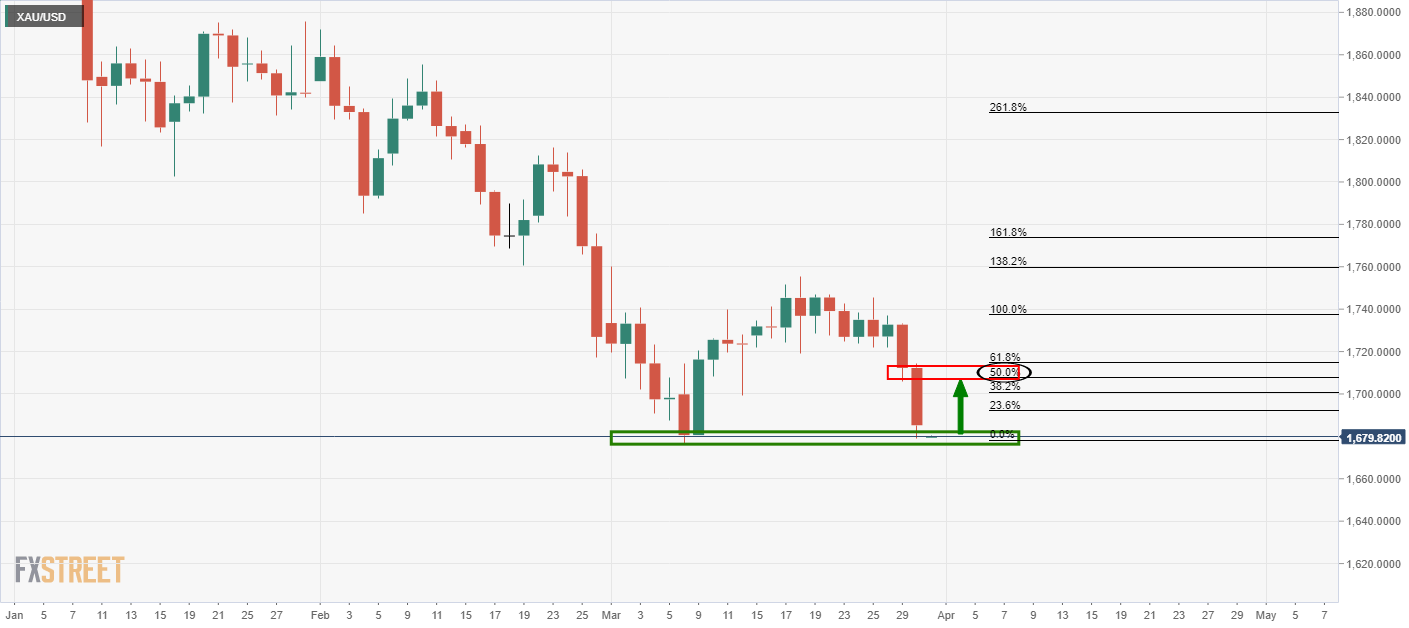

Prior analysis, daily chart

… a 50% mean reversion from support could be on the cards at this juncture, especially if traders need to sell-back dollars to square their books for the quarter-end.

Live market, daily chart

The price has indeed corrected the bearish impulse and with vigour.

This leaves the prior support exposed and the potential for an upside drift towards the structure as the correction decelerates.

Either way, a downside extension would be expected on failures to continue beyond the resistance structure, inline with the weekly bearish playbook.