- Gold prices are under pressure as the US dollar stabilises.

- A meanwhile bottoming in the greenback could be in the making ahead of the Fed.

The price of gold is trading at $1,828.68, down some 0.6% and has travelled between a low of $1,819.16 and $1,855.60.

The US dollar is a major focus this week and is carving out a bottoming pattern on the daily chart.

Not only have there been covid vaccine progress, as well as hopes for US fiscal stimulus, but we will have the final Federal Open Market Committee meeting this week.

Investors have dumped the US dollar this year considering the size of the Fed’s balance sheet and a preference for flexible, average inflation targeting.

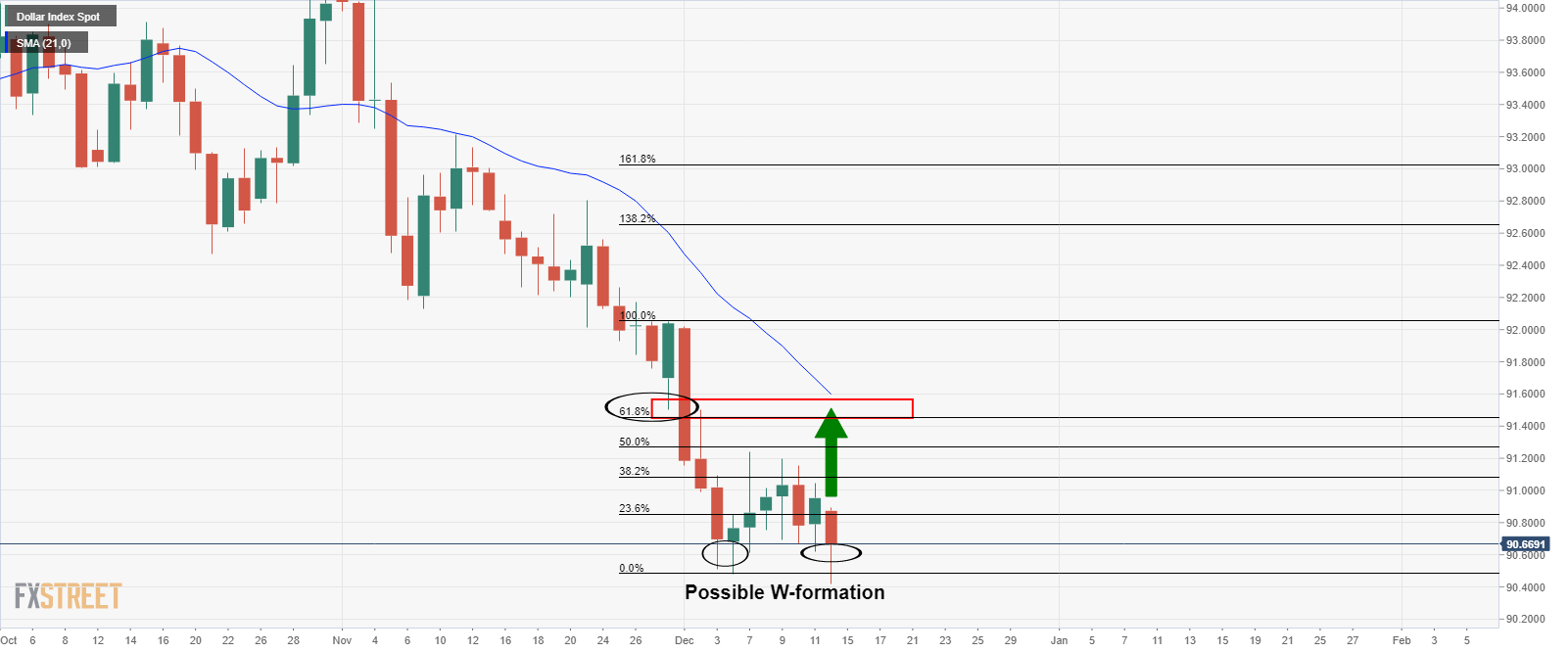

DXY W-formation in the making?

The DXY is under pressure but traders will take note of what could be the formation of a double bottom pattern leading towards a bullish W-formation.

Meanwhile, investors are expecting the FOMC to produce more clarity on forward guidance, but there could be a major twist to the plot given how dire the US economic outlook is.

”Given that US economic recovery is losing momentum and that a fresh fiscal package is still awaited from Congress, we see a chance that the Fed could go beyond forward guidance this week,” analysts at Rabobank argued.

”That said, our central view is that the Fed will wait until outstanding issues surrounding the election have been cleared and hopefully until there is more fiscal stimulus in place before taking further policy stimulus.”

If there is a dovish outcome, on the other hand, gold could attract another speculative interest in the precious metal which has suffered from massive ETF outflows over the last six weeks.

”Following one of the largest monthly outflows in years, gold’s call skew has strengthened, suggesting that the recent capitulation may have ultimately sparked speculative interest in gold’s allure once again,” analysts at TD Securities argued.

”The combination of additional stimulus and lower yields should keep real rates reverting on a downward trajectory and weigh on the USD, fueling capital allocations into precious metals.”

”Trend followers also hold a substantial amount of dry-powder to add to their net length in gold down the road, yet the waning upside momentum threatens to catalyze further liquidations from CTA trend followers should the yellow metal print a new low below $1770/oz.”

Gold technical analysis

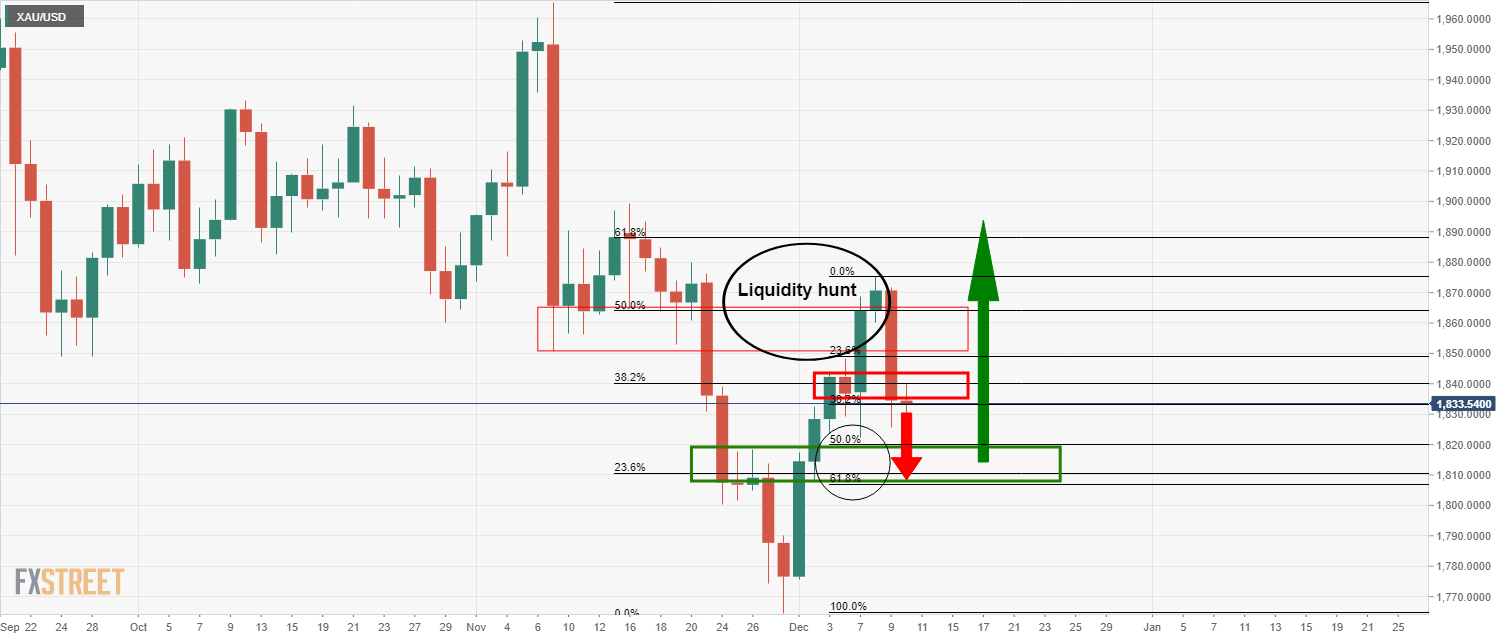

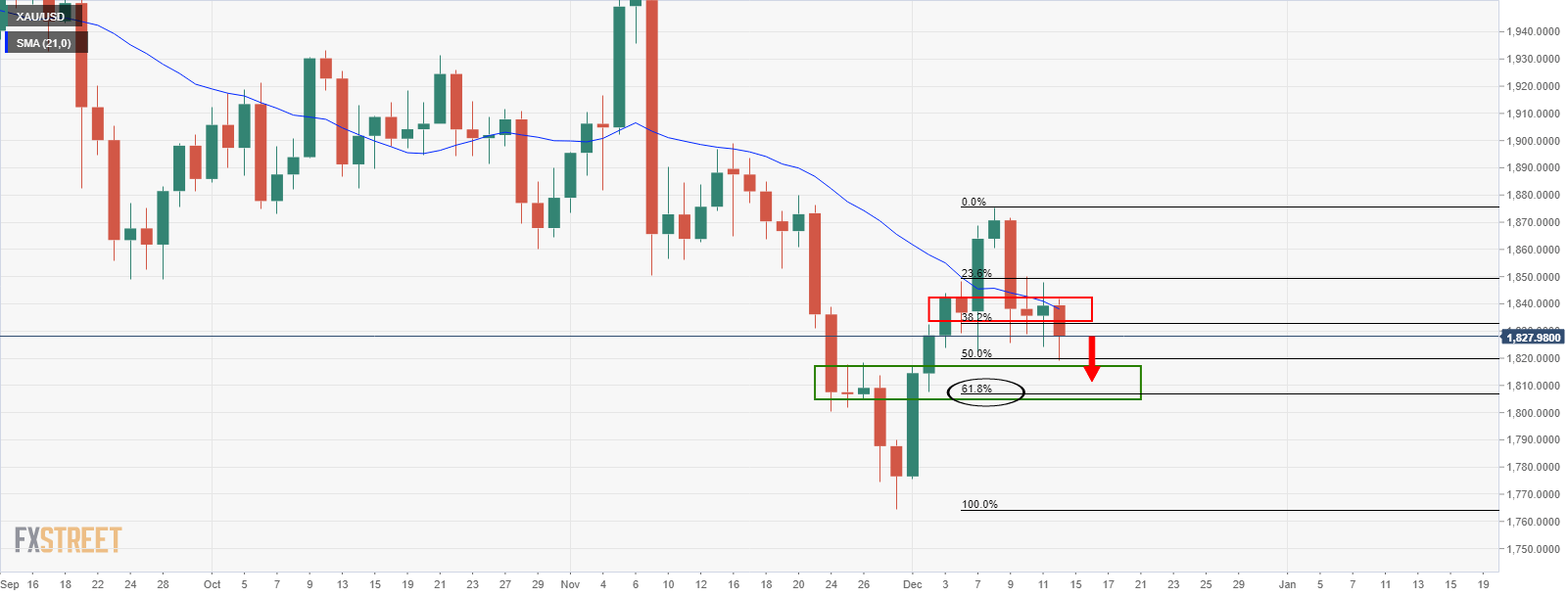

The price action is sideways at support, but the bias remains weighted towards the downside and target of the confluence of a 61.8% Fibonacci retracement, structure and volume, analysis explained here.

Prior analysis:

Latest price action:

The bears remain in control having made a lower low. There would be more conviction on a daily close below resistance and ahead of the FOMC this week.