- Gold’s daily close below resistance, or old support, offers further conviction to the downside.

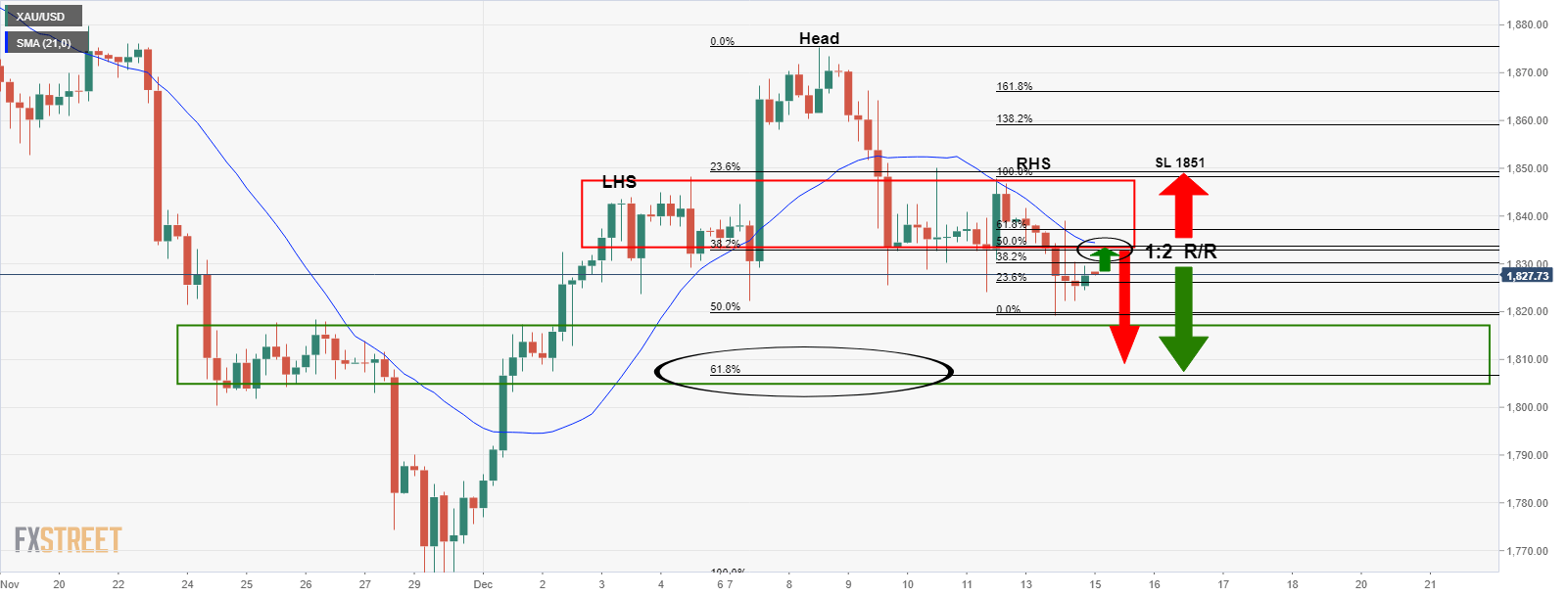

- There needs to be a restest of the structure from where bears can set up for a 1:2 risk to reward.

Gold continues to move in accordance with the prior analysis in progress which can be delved into here: Gold Price Analysis: Bears below key support

The following is a top-down analysis which illustrates where the opportunity lies in the current price action.

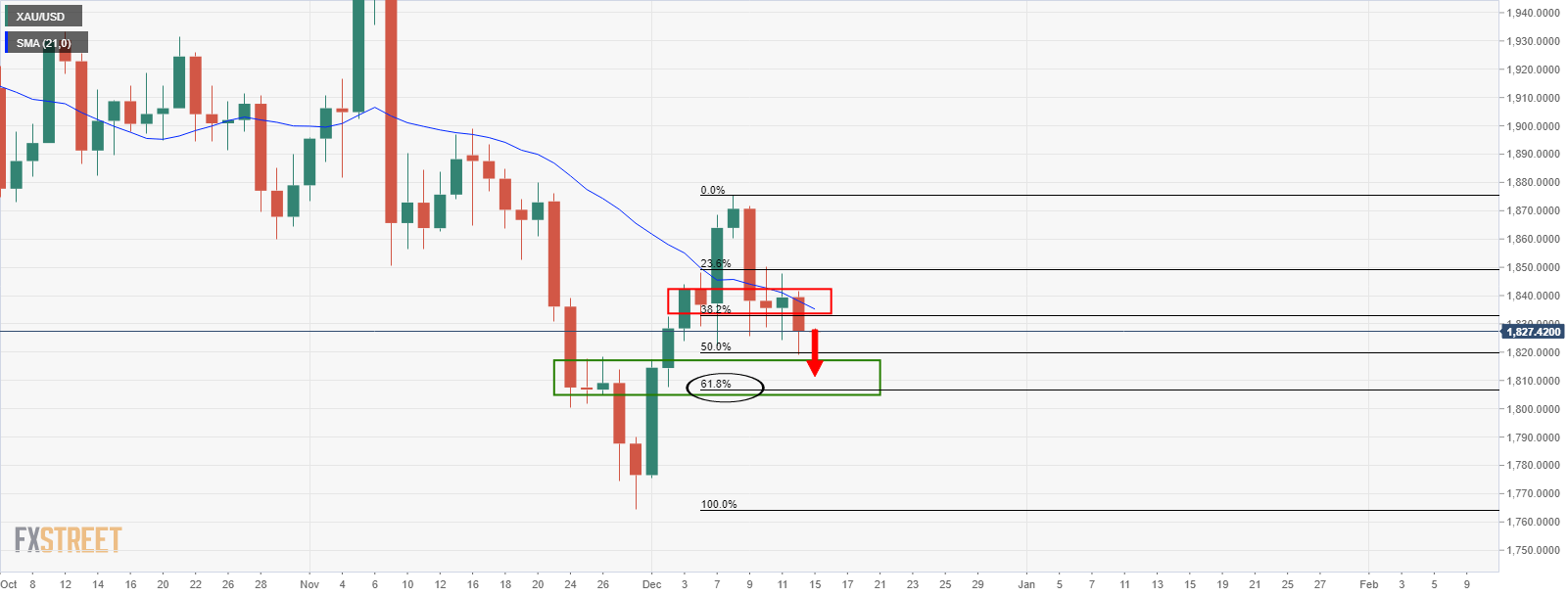

Daily chart

We have seen a daily close below resistance, or old support, which opens the prospects further for a run to the 61.8% target.

4-hour chart

The 4-hour chart’s bearish head and shoulders show that the bears can take advantage of a sell limit order from the structure for a high probability trade setup with a 1:2 risk to reward.

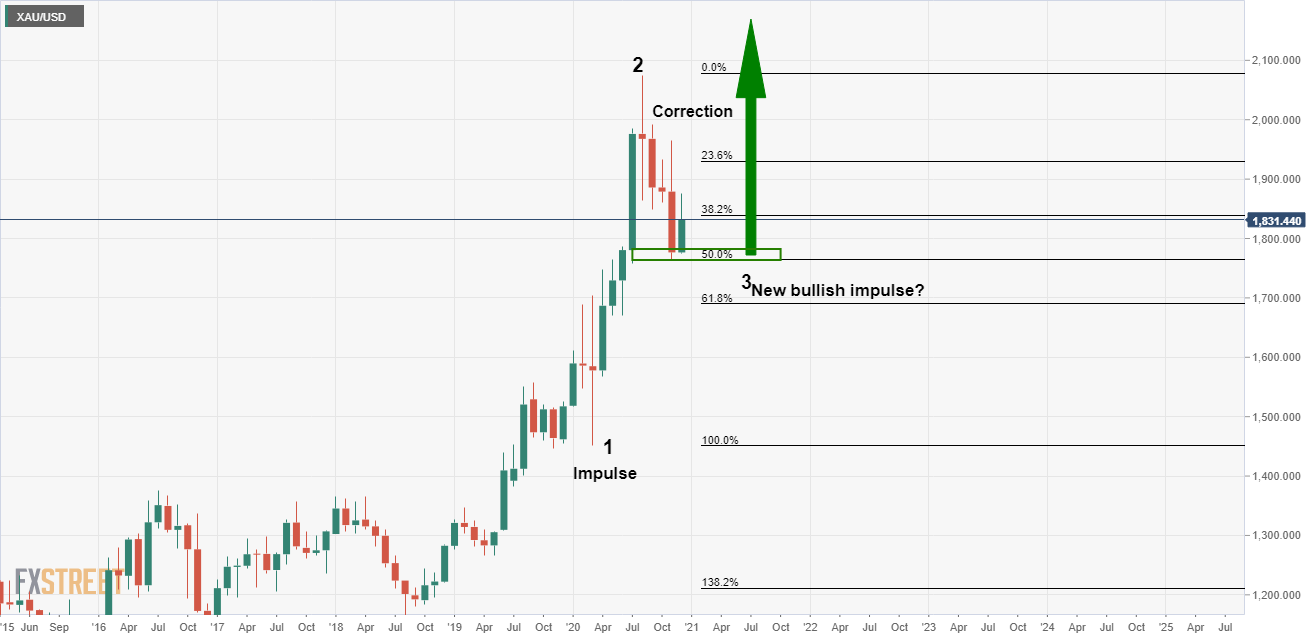

However, as explained fully in the prior analysis, there are long-term risks skewed to the upside from both a positioning, spot and technical standpoint.

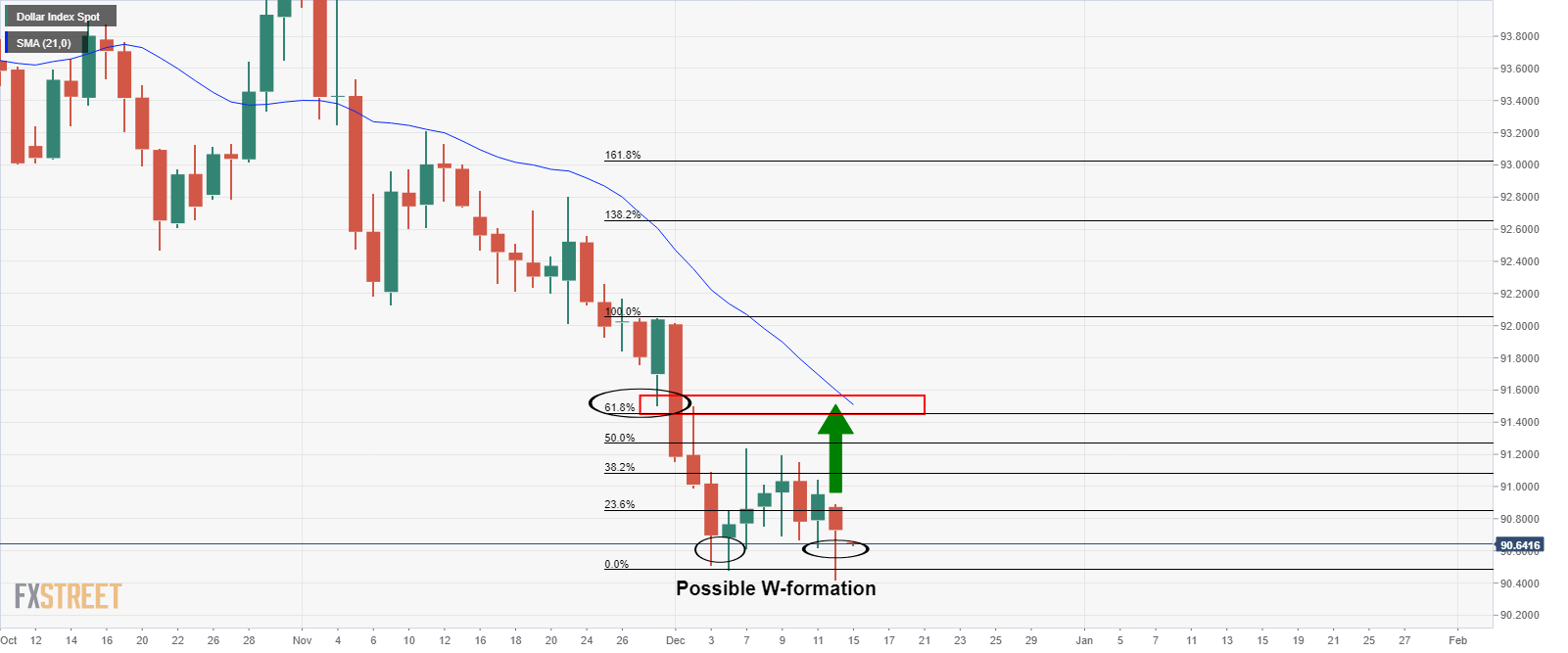

As for the US dollar, there could be a bottoming pattern in the making as follows: