Gold licks wounds after the extension of Tuesday’s slide to three-week lows, as the bears take a breather in the run-up to the US CPI release. Broad US dollar strength remains in vogue amid the downbeat market mood, as concerns over coronavirus and US-China conflict linger.

Update: XAU/USD has been extending its recovery and seems to have found its feet at around $1,930 as of Thursday. US bond yields have stabilized after a debt issuance by the US government, helping the precious metal find a new balance. After overcoming $1,900, there are new levels to watch. See Have gold prices reached their peak? [Video]

The yellow metal lost nearly 6% on Tuesday, booking the biggest drop in seven years while on track for a 7.5% weekly loss. The rebound in the US Treasury yields lifted the greenback and downed the metal. How is gold positioned on charts ahead of the US CPI?

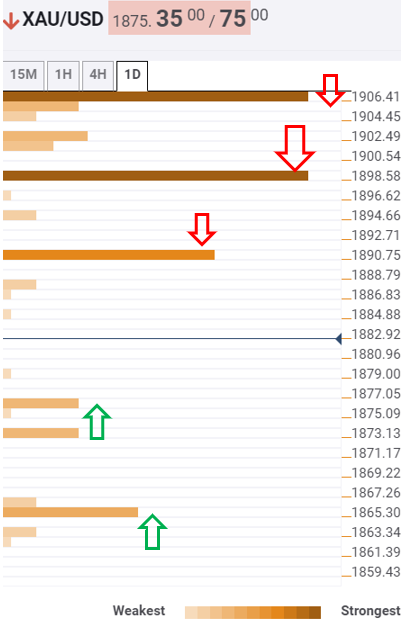

XAU/USD: Key resistances and supports

The tool shows that the bounce in the bright metal will likely be capped at the powerful resistance at $1900, which the Fibonacci 38.2% one-month.

Acceptance above the latter will open doors towards $1906.50, which also appears to be a tough nut to crack for the XAU bulls.

Meanwhile, the immediate upside remains limited by the Fibonacci 61.8% one-week at $1890.

The path of least resistance remains to the downside amid a lack of healthy support levels. The immediate target for the sellers is seen around $1875/72, the confluence of the three-week lows and SMA200 4H.

The critical support awaits at $1865, the pivot point one-day S1. A break below which trigger a fresh sell-off towards $1850.

Here is how it looks on the tool

About the Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence