- There is a rise in gold prices near the nine-month-old resistance area.

- Aversion to risk remains relevant as fears of nuclear war and Zelenskyy’s assassination surface ahead of Kyiv-Moscow talks.

- The DXY remains firm as the NFP week begins, and stock futures and yields are falling.

Earlier in the week, gold (XAU/USD) price analysis guarded a gap around $1,905 amid risk-on sentiment during Monday’s Asian session.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

After rallying to the July 2021 high, the yellow metal is also on a three-week uptrend. On the other hand, headlines over the weekend about Russia-Ukraine tensions fueled risk aversion and led to an upward gap at the start of the NFP week.

A report in the UK Times claiming that Russia ordered 400 mercenaries to assassinate Zelenskyy and his government and set up the conditions for Moscow to take control garnered a lot of attention. Ursula von der Leyen, president of the European Commission, told EU News that the European Union (EU) would like Ukraine to be part of the bloc, adding: “You are one of us.”

Russian President Vladimir Putin stood firm despite harsh sanctions imposed by the West over the weekend, putting his nuclear arsenal on high alert raising fears of nuclear war. According to recent headlines from Belarus, the country will abandon its non-nuclear neutral status. However, as both countries are willing to negotiate, there is a glimmer of hope.

The US Dollar Index (DXY) continues its three-week uptrend, while the US 10-year Treasury yield declines six basis points (bp) daily to at least 1.90%. Moreover, stocks in Asia-Pacific are also falling, while S&P 500 futures are down almost 2.50%.

The short-term direction will likely be influenced by talks between Russia and Ukraine. At the same time, US trade data for January and Chicago Purchasing Managers’ Index for February could drive intraday movement. The US non-farm payrolls (NFP) report will be important this week as traders temper expectations of a rate hike in March by 0.50%.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

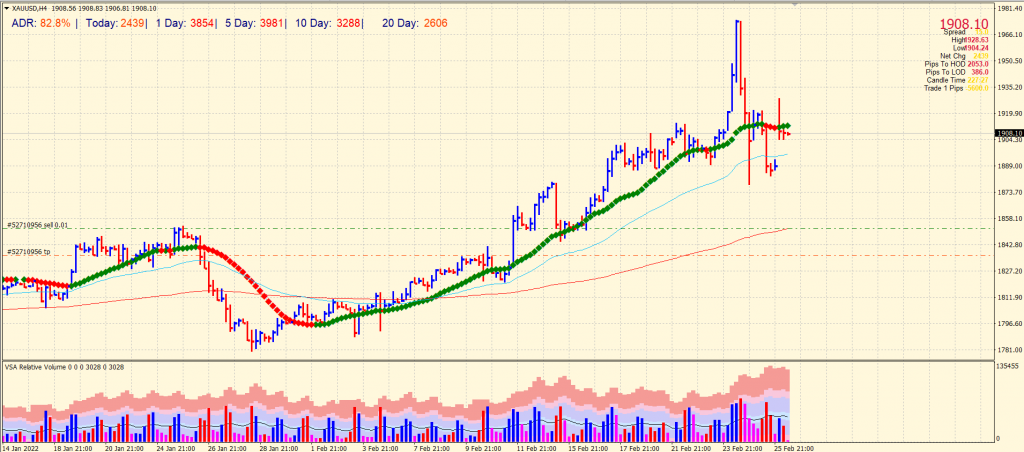

Gold price technical analysis: Bears emerging above $1,900

The gold price started the new week with a gap up bar above the $1,900 area. However, the metal faces a hurdle to sustain a meaningful rally above the key level. The gold has formed a hidden upthrust on the 4-hour chart and closed below the 20-period SMA. The important support levels for the yellow metal are a 50-period SMA at $1,890 ahead of swing lows around $1,875.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money