- Gold bears in full control below a critical old support structure.

- There is room for a 61.8% Fibonacci retracement for a strong resistance confluence.

- With eyes on the Fed, bulls remain on the sidelines, expecting higher prices, eventually.

The price of gold has been on the back foot this week, breaking below the psychological $1,850s area, plummeting to a fresh weekly low of $1,800.40.

Meanwhile, with the Dow above 30,000 and the S&P500 closing at a fresh all-time high this week, there is limited upside for gold in the near-term due to the combination of the vaccine news and the beginning of the Biden transition.

Today, the spot market is consolidated between $1,805.99 and $1,818.23 where it meets the old July resistance and Thanksgiving holidays in the US.

”The recent capitulation in gold will likely mark the end of the consolidation phase,” analysts at TD Securities explained.

”The recent liquidations are likely associated with a capitulation in positioning, as a break below support crossed a pain threshold for many.”

”Notwithstanding, we also find that macro headwinds have contributed to liquidations over the past month — after all, nominal rates have risen substantially during that time period, likely contributing to the outflows seen in ETFs,” the analysts added.

However, going forward, there are prospects for a weaker US dollar which would tend to support gold prices higher.

The focus will be on the Federal Reserve on December 15-16 and whether the adoption of new COVID-related restrictions has added to downside risks for the economy in coming months, in the central bank’s view.

”We expect that the Fed will ease by extending the weighted average maturity of its Treasury purchases, ultimately increasing the effectiveness of QE,” analysts at TD Securities explained.

”As real rates to resume their downward trajectory, we expect investment inflows into precious metals to rise substantially, supporting gold prices north of $2,000/oz. The market will be looking for any discussions on these dimensions of QE in the Fed’s Minutes.”

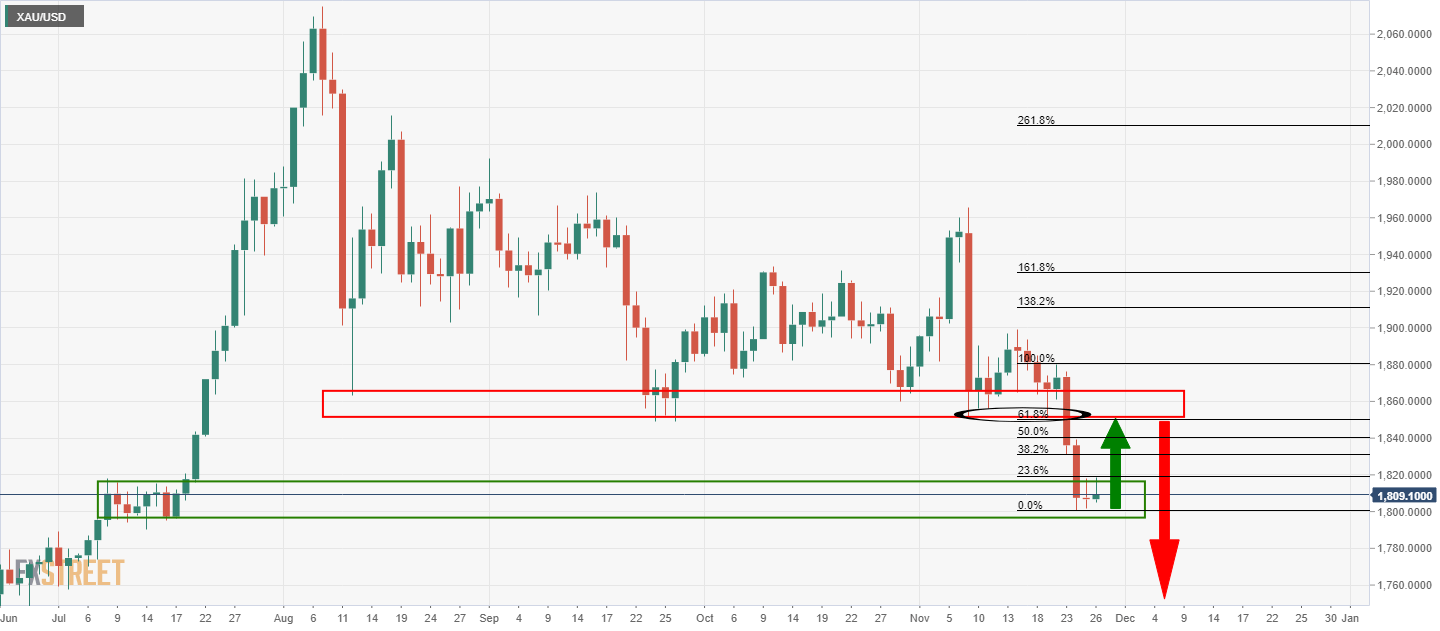

Daily chart

From a technical perspective, the price is moving in an extension of the monthly bearish correction.

The daily chart shows that the price is now below old support that will be expected to act as resistance in a 61.% Fibonacci retracement.

In waiting for the retracement, committed bears will be seeking a discount to target the next lower low.

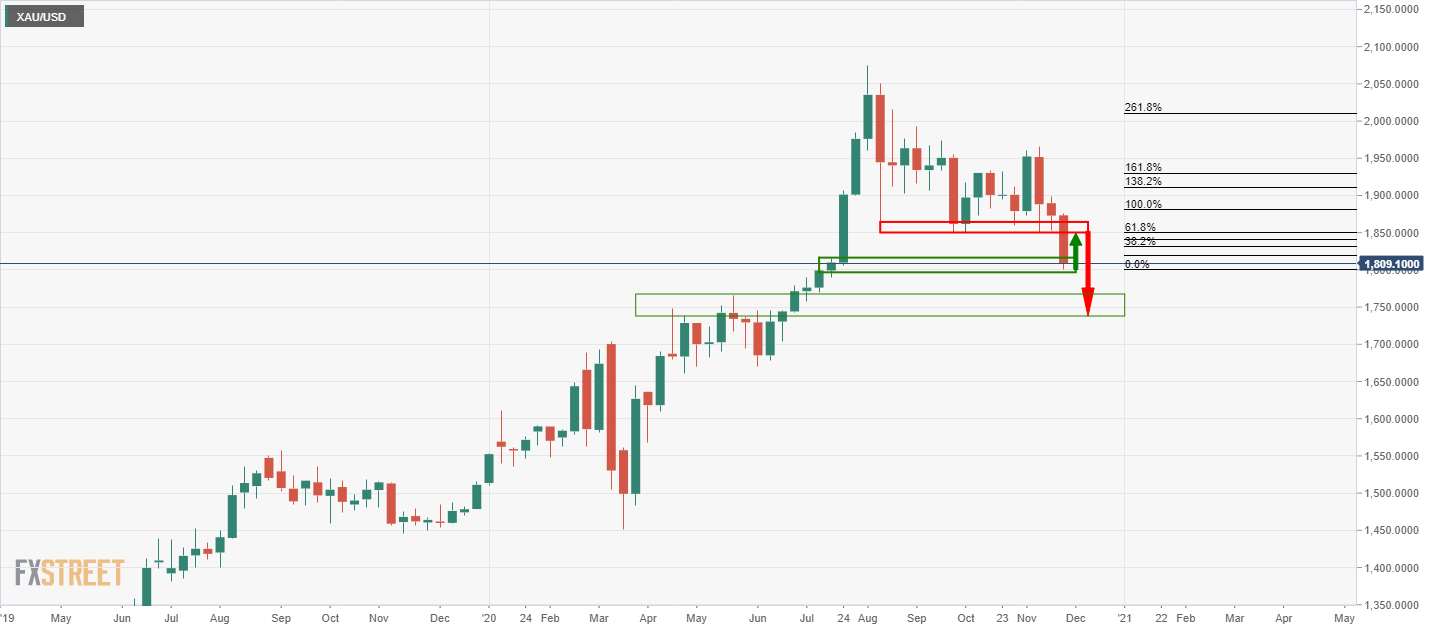

The weekly chart below offers the prospects of a new lower low to an old resistance structure.

Weekly chart