Gold has been on a roll, hitting the highs of $2,046.44 at the time of writing. What’s next for XAU/USD? Fundamentally, the precious metal depends on more fiscal stimulus from Washington – as Republicans and Democrats are inching closer to a larger package.

Another factor to watch is economic data, and clues toward Friday’s Non-Farm Payrolls. The recent resurgence of coronavirus may push the economy lower and raise interest for gold.

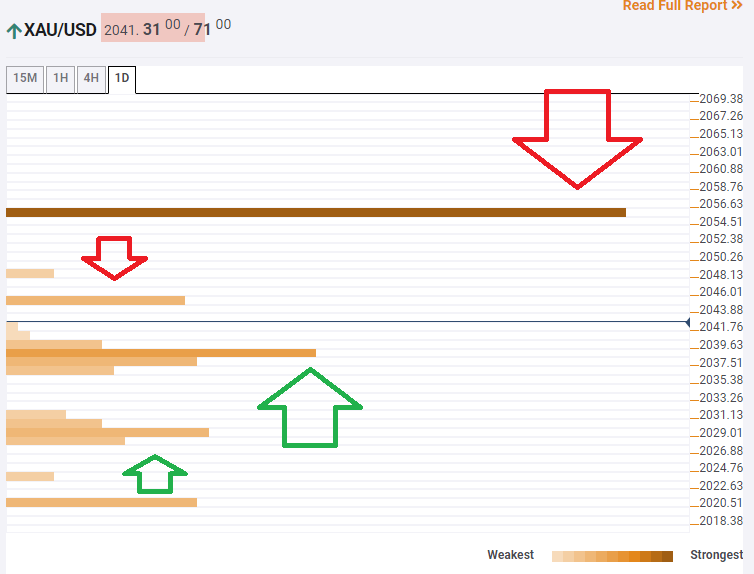

How is XAU/USD technically positioned?

The Technical Confluences Indicator is showing that gold faces resistance at $2,045, which is the convergence of the previous 4h-high and the Bollinger Band 15min-Upper.

The most significant hurdle awaits XAU/USD at $2,055, which is the confluence of two pivot points – the one-month REsistance 1 and the one-day Resistance 2.

Looking down, some support awaits at $2,038, which is a juncture including the BB 15min-Middle and the PP one-week R2.

Further down, the next cushion is at $2,029, where the BB one-day Upper and the Simple Moving Average 5-4h converge.

All in all, without holding onto the support, it would be hard to attack the next technical hurdle.

More: Gold: Temporary pullback before moving to $2100 – TDS

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence