- Gold mixed in late NY amid a disparate trade session.

- Investors grow wary of covid variant and Washington’s stimulus gridlock.

- Bears are testing the bull’s commitments at critical 15-min support.

Gold is consolidating around $1,855 at the time of writing having travelled between a low of $1,847 and $1,867, virtually flat on the day so far.

The mood on Wall Street was mixed at the start of the week with stocks pulling back from record highs amidst covid concerns and stimulus uncertainty.

US lawmakers continue to debate the coronavirus aid package and investors have questions over the efficacy of the vaccines in curbing the pandemic.

Over the weekend, a bipartisan group of senators, the same group that was key to passing a $900 billion package in December, told White House officials that the stimulus spending in President Joe Biden’s coronavirus relief plan provides too much money to high-income Americans.

Gold, which holds a negative correlation to the US dollar, would be expected to come under pressure if the greenback firms on such hold-ups.

”Weakening US Treasury yields are supporting the yellow metal’s safe-haven attributes in the tug-of-war against its inflation-hedge features,” analysts at TD Securities said.

”This price action is putting a halt to the recent steepening in the yield curve, which is supportive of gold in the near-term but also highlights gold’s new regime — in which prices are relying on a slump in Treasury yields, rather than rising inflation expectations. This doesn’t bode well for gold flows as the bloated positioning slate still suggests that a modest rise in rates could reinforce the pain-trade lower,” the analysts continued, adding:

”Nonetheless, this week’s FOMC will likely feature a push-back against recent tapering talk, which should play into gold’s favour.”

Gold technical analysis

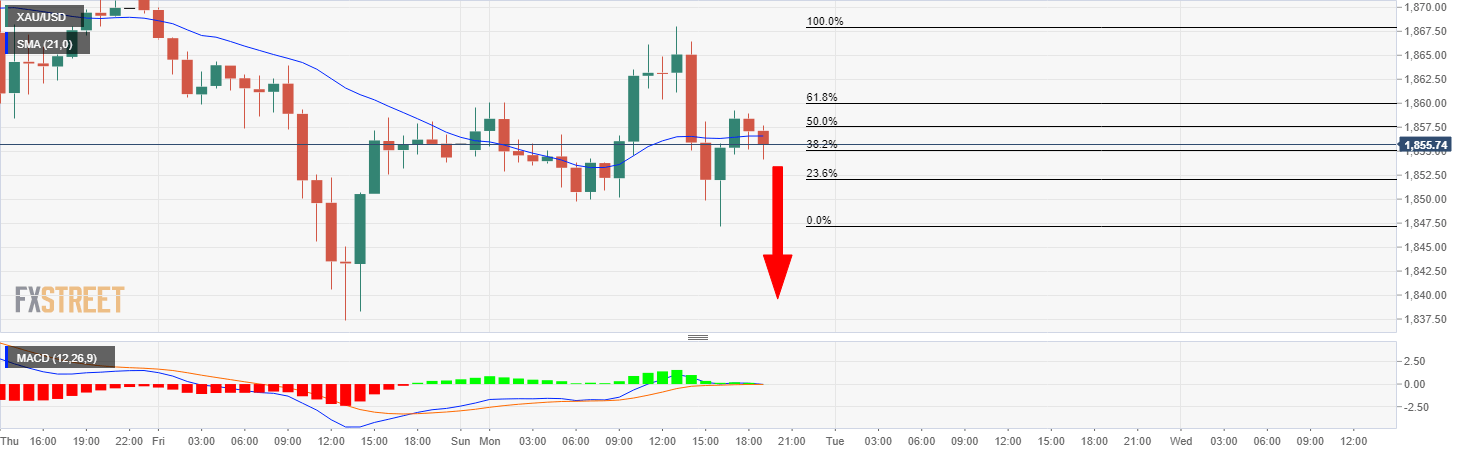

The 1-hour chart and conditions are bearish with the price expected to extend lower following the significant Fibonacci retracement of the bearish impulse.

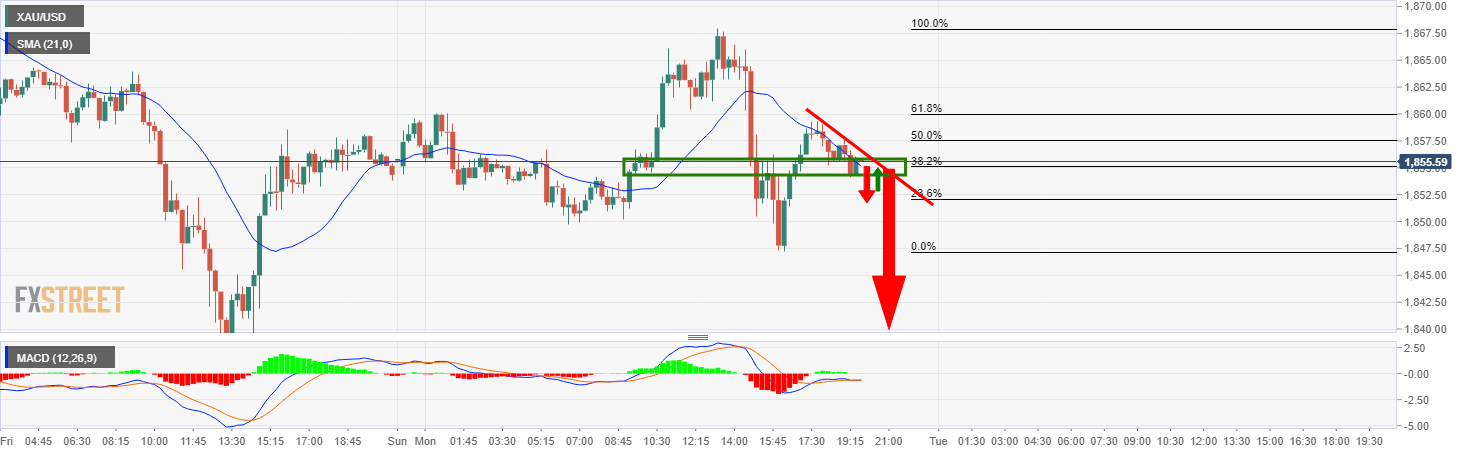

In the 15-min chart below, the price is being resisted at critical support, a break of which will open prospects for the downside continuation.