- Gold nears the monthly high flashed the previous day.

- Tops marked during late-February, early-March and short-term resistance line guard immediate upside.

- Sellers will look for entry below the weekly low.

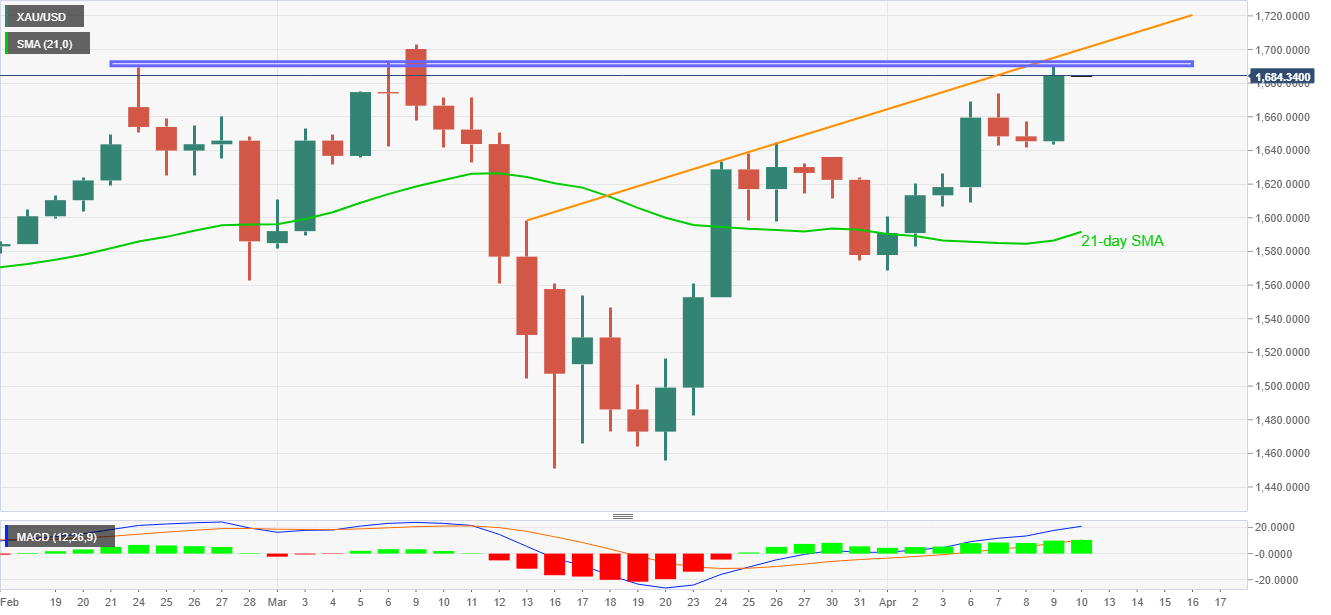

Despite probing the multi-year high, marked on Thursday, Gold prices near the key resistances while taking rounds to $1,685 at the start of Friday’s Asian session. The Good Friday holidays in major markets are expected to limit the yellow metal’s moves.

Among the important upside barriers, an area including highs marked during late-February and early-March, around $1,690/93, will be the first one to challenge the bulls.

If buyers manage to take clues from the bullish MACD and cross $1,693, an upward sloping trend line from March 13, currently at $1,700, will be crucial to watch as it holds the gate for the bullion’s further rise to the March month top around $1,703.

On the downside, the weekly low surrounding $1,641 acts as the immediate support ahead of $1,600 and 21-day SMA close to $1,591.

In a case where the bears sneak in below $1,591, the monthly bottom around $1,568.50/40 could lure the sellers.

Gold daily chart

Trend: Pullback expected