- Gold prices step back from the highest since November 2012.

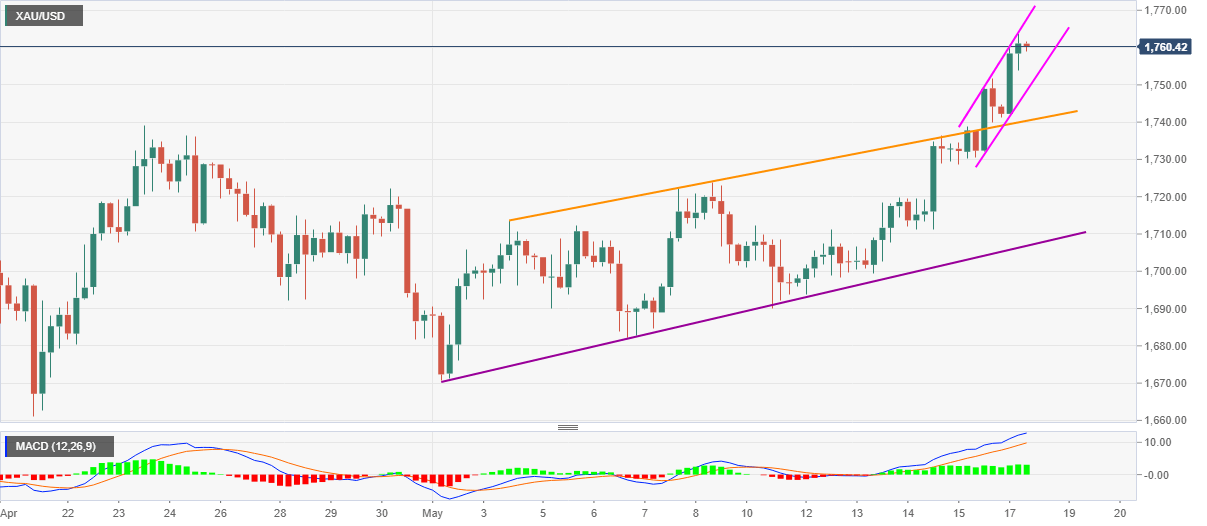

- The short-term rising channel, sustained break of two-week-old resistance (now support) and bullish MACD keep buyers hopeful.

- Monthly ascending trend line adds to the support, the year 2012 high lures the bulls.

Gold prices step back from the intraday top, also the highest since October 2012, up 1.06% on a day, while taking rounds to $1,760 amid the early Monday.

Although pull back from the short-term ascending trend channel suggests the return of $1,748, the bullion’s further downside is likely to be capped by a two-week-old support line, at $1,740.

In a case where the bears sneak in around $1,740, the monthly support line, close to $1,706, will be the key to watch.

Meanwhile, an upside break of the said channel’s resistance, at $1,768 now, might not hesitate to channel the year 2012 peak surrounding $1,795/96.

Gold four-hour chart

Trend: Bullish