- The gold price rallied from lows, but expectations from the Fed hawks are still holding it back.

- The risk sentiment has improved, the dollar is declining, and yields are also falling.

- Gold’s technical view is bearish as all eyes are on the US NFP report.

Gold price analysis shows a recovery from an 11-day low of $1,786 marked on Thursday as the bears take a breather before releasing key US jobs data for nonfarm workers.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

In addition, a strong NFP release should reinforce speculation of an aggressive Fed rate hike, which will boost government bond yields and the US dollar against gold. However, for the time being, gold’s price could benefit from a dollar pullback before major events emerge. As of now, improving market sentiment has weighed on the safe-haven dollar and supported short-term recovery.

The yellow metal fell to multi-day lows the day before after recent Fedspeak expressed support for higher interest rates after minutes from the Open Market Committee (FOMC) suggested faster rate hikes and plans for normalizing balance sheets. While St. Louis Fed President James Bullard pushed for a rate hike in March, San Francisco Fed President Mary S. Daly emphasized the need for rate hikes to keep the economy moving by maintaining equilibrium.

US Treasury yields hit a new multi-day high following mounting pressure for tighter monetary policy and rebalancing. However, the 10-year US Treasury yield rebounded from its nine-month high, climbing to 1.75% and closing around 1.728% on a 2.5 basis point daily gain. Wall Street’s benchmarks have taken a hit, too, even as the gloomy data leaves the bears content with smaller losses.

US manufacturing orders, weekly jobless claims, ISM services PMI, and a good trade balance may have been suppressed, but they did not deter US dollar bulls because the Fed’s faster rate hike was largely favorable, which, in turn improved yields.

The December US employment report is gaining much attention this month, but Omicron market concerns may amuse gold sellers. According to projections, nonfarm payrolls (NFP) will rise from 210,000 to 400,000, and the unemployment rate will drop from 4.2% to 4.1%. However, the underemployment rate is expected to rise from 7.8% to 8%. The positive results of US employment data should justify Fed’s restrictive rhetoric, which in turn could boost yields and the US dollar, as well as affect gold prices.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

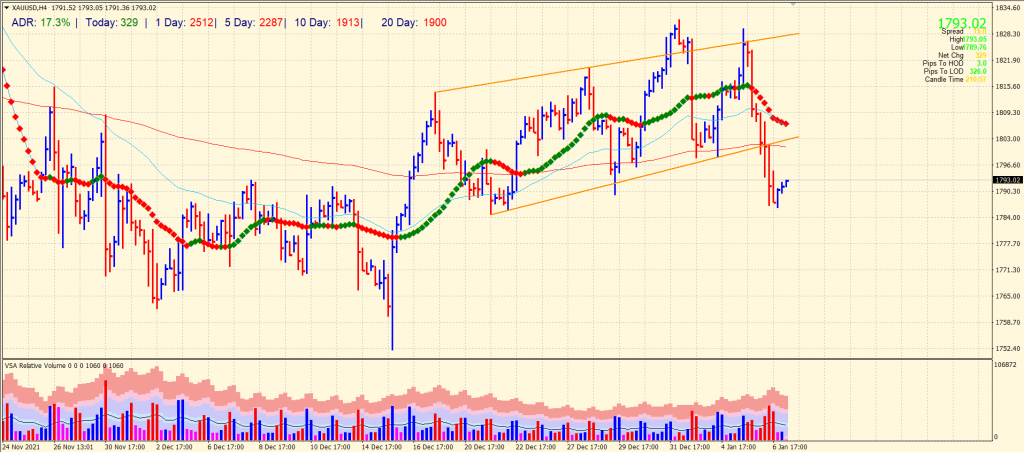

Gold price technical analysis: Pullback capped by $1,800

The gold price broke the ascending trendline support and sustains below it. The metal has been strongly negative as the volume data shows a bearish breakout with a very high volume. Moreover, the price is well below the $1,800 mark and the key SMAs on the 4-hour chart. Any pullback will be shallow and capped by the confluence of the $1,800 mark, broken trendline, and the 200-period SMA. The downside target lies at $1,784 ahead of $1,771.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.