Gold (XAU/USD) looks to extend its recent bullish momentum starting out a fresh week amid hopes of additional fiscal stimulus under US President-elect Joe Biden. Biden is a presumptive victor, as the legal challenges by the Trump campaign remain.

Markets also cheer the prospects of continuity of the current policy environment even on a divided government, with Republicans taking hold of the Senate. The upbeat market mood continues to dimmish the US dollar’s attractiveness as a safe-haven. However, the gains in the global stocks and rising coronavirus cases could likely limit the upside in the metal. Let’s see how gold is positioned on the charts.

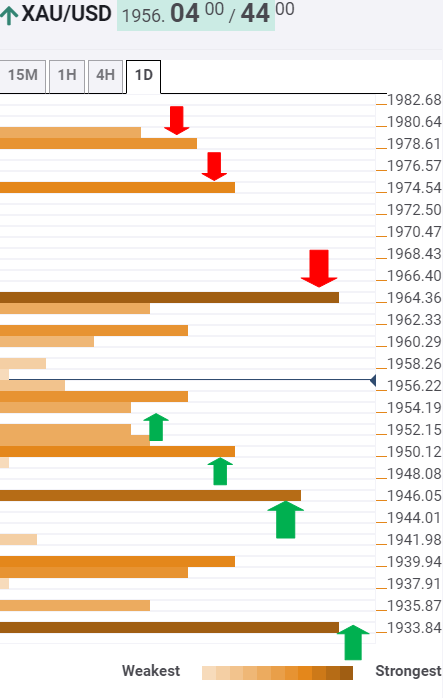

Gold: Key resistances and supports

The Technical Confluences Indicator shows that the yellow metal remains on track to test the critical resistance at $1965, which is the pivot point one-month R2.

Ahead of that level, the confluence of the previous day high and Bollinger Band one-hour Upper at $1961 could challenge the bulls’ commitment.

Should the XAU bulls recapture the $1965 hurdle, the next upside target is seen at $1975, which is the intersection of the pivot point one-day S2 and Bollinger Band four-hour Upper.

Further up, $1980 is the level to beat for the bulls. That level is the Fibonacci 161.8% one-month.

Alternatively, a stack of healthy support levels is found $1953-51 levels, which could continue to guard the downside.

Acceptance below the SMA10 four-hour at $1950 is needed to fuel a corrective decline towards $1947, the convergence of the Fibonacci 61.8% one-day and Bollinger Band one-day Upper.

The next downside target is aligned at $1940, where the Fibonacci 23.6% one-week awaits.

The $1934 strong support, the previous month high, will be a tough nut to crack for the sellers.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence