Gold (XAU/USD) remains on the backfoot following the rejection above the $1950 level for the second straight day. The yellow metal failed to sustain the rally fuelled by the ECB’s optimism on the economy, as the US dollar demand returned on the sell-off in Wall Street stocks.

The greenback is likely to hold the reigns amid negative tone on the global markets, as the US-China tensions, Brexit woes and US fiscal deadlock continue to weigh. Let’s look at how gold is positioned in the lead up to the US CPI release.

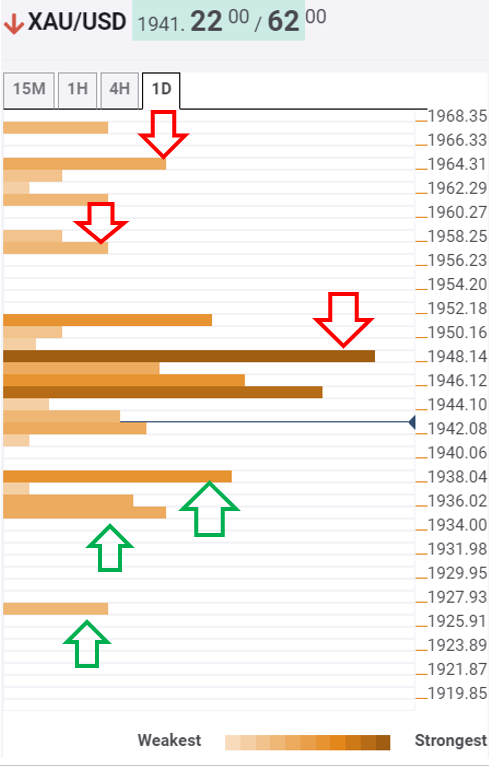

Gold: Key resistances and supports

The Technical Confluence tool shows that gold continues to face stiff resistance around $1945-1950 region, which is the convergence of the Fibonacci 23.6% one-day, Fibonacci 38.2% one-week and one-month.

A firm break above the latter is critical for the further upside, as buyers aim at the soft cap at $1952, the Fibonacci 38.2% one-day.

A sharp rally is likely to follow towards the next significant resistance at $1964-1966, the confluence of the Fibonacci 61.8% one-week and previous day high.

To the downside, immediate cushion awaits at $1938, where the SMA5 one-day, previous low four-hour and Bollinger Band four-hour Middle coincide.

The bears will then test minor support at $1934, the Fibonacci 23..6% one-week, below which the pivot point one-day S2 at $1926 will be put at risk.

Here is how it looks on the tool

About the Confluence Detector

With the TCI (Technical Confluences Indicator) tool, you can easily locate areas where the price can find a support zone or resistance zone and make trading decisions. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points each time. If you are a medium- and long-term trader, this tool will allow you to know in advance the price levels in which a medium / long-term trend can stop your travel and rest, where to undo positions or where to increase your position.

Learn more about Technical Confluence