- Gold prices pulling back from session highs as the US dollar firms.

- Markets are torn between positive news on Phase-4 US stimulus and the ongoing surge in global COVID cases.

XAU/USD is trading at $1,871.58 having travelled between a range of $1,857.13 and $1,878.61.

The precious metal is up over 0.6% at the time of writing, riding the day’s underperformance in the US dollar that has suffered in an environment of rebounding risk sentiment.

Markets in a holiday-shortened week this week have been torn between positive news on Phase-4 US stimulus and the ongoing surge in global COVID cases.

There have been reports of a more infectious strain which had been spooking markets, although there is a sense of calm as various reports suggest at least four drugmakers expect their COVID-19 vaccines will be effective against the new fast-spreading variant.

Companies are performing tests that should provide confirmation in a few weeks. Ugur Sahin, chief executive of Germany’s BioNTech, which with partner Pfizer Inc, took less than a year to get a vaccine approved, said on Tuesday he expects its messenger RNA (mRNA) vaccine to still work well.

Moderna Inc, Germany’s CureVac and British drugmaker AstraZeneca Plc also believe their products will work also.

“Scientifically it is highly likely that the immune response by this vaccine can also deal with this virus variant,” he said on a call with reporters.

Sahin said it will take another two weeks or so of study and data collection to get a definitive answer.

Meanwhile, the Federal Reserve and combination of fiscal stimulus continues to support optimism for gold prices.

However, in a video posted Tuesday night, the US President Donald Trump called the $900 billion Covid relief bill passed by Congress an unsuitable “disgrace” and urged lawmakers to make a number of changes, including increasing the $600 stimulus checks to $2,000.

The two Democratic Senate candidates, who have advocated for larger direct payments, wasted no time in responding to Trump’s move and criticizing their opponents.

Democrats are backing Mr. Trump’s request for $2,000 checks. However, it’s not clear how many Republicans will join in because the proposal for bigger payouts would cost an estimated $530 billion.

This will be $385 billion more than what Congress approved with the $600 checks, according to Heights Securities.

That being said, the Fed’s decision to tie QE to economic outcomes still supports the notion of a growth and inflation overshoot, which should provide macro tailwinds for gold in the longer-term.

”The immediate impulse for higher prices is rather associated with a CTA buying program, in response to strengthening upside momentum. The algos are looking for prices to remain above the $1880/oz range for the buying flow to be sustained,” analysts at TD Securities argued.

”Gold bugs are also looking for a break north of the $1920/oz range, which would technically represent the end of the consolidation period with prices breaking away from the bull flag.

Given gold’s relative cheapness and the ongoing algorithmic buying flow, we could imminently see a breakout.”

Gold technical analysis

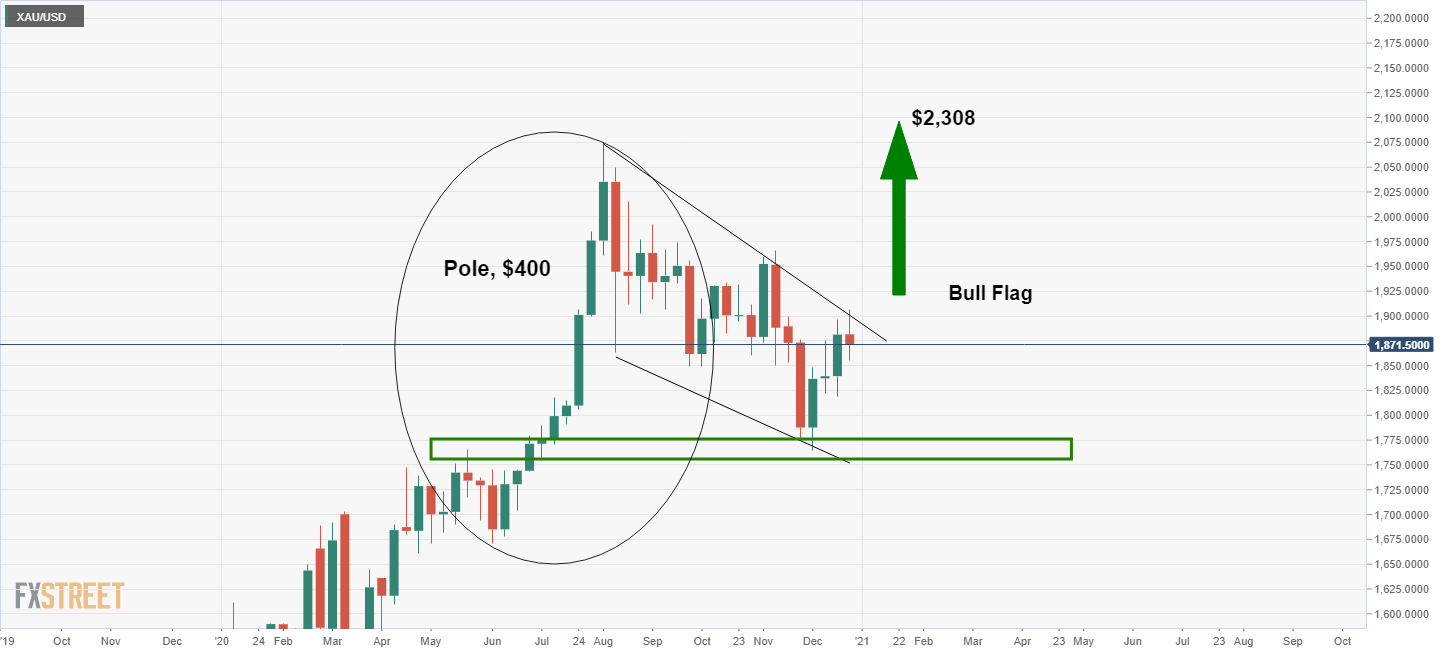

The above chart illustrates the aforementioned bull flag which the analysts at TD Securities are referring to.

The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole.

In this case, in using the analyst’s ay TD securities $1920/oz as a breakout level, there would be $400 at stake to the upside.