- Gold bulls fell $11 shy of $1,800 this month so far, keen to save face.

- Bears seeking a break below critical support structure.

- The coronavirus presents the most risk to rising long-term breakevens.

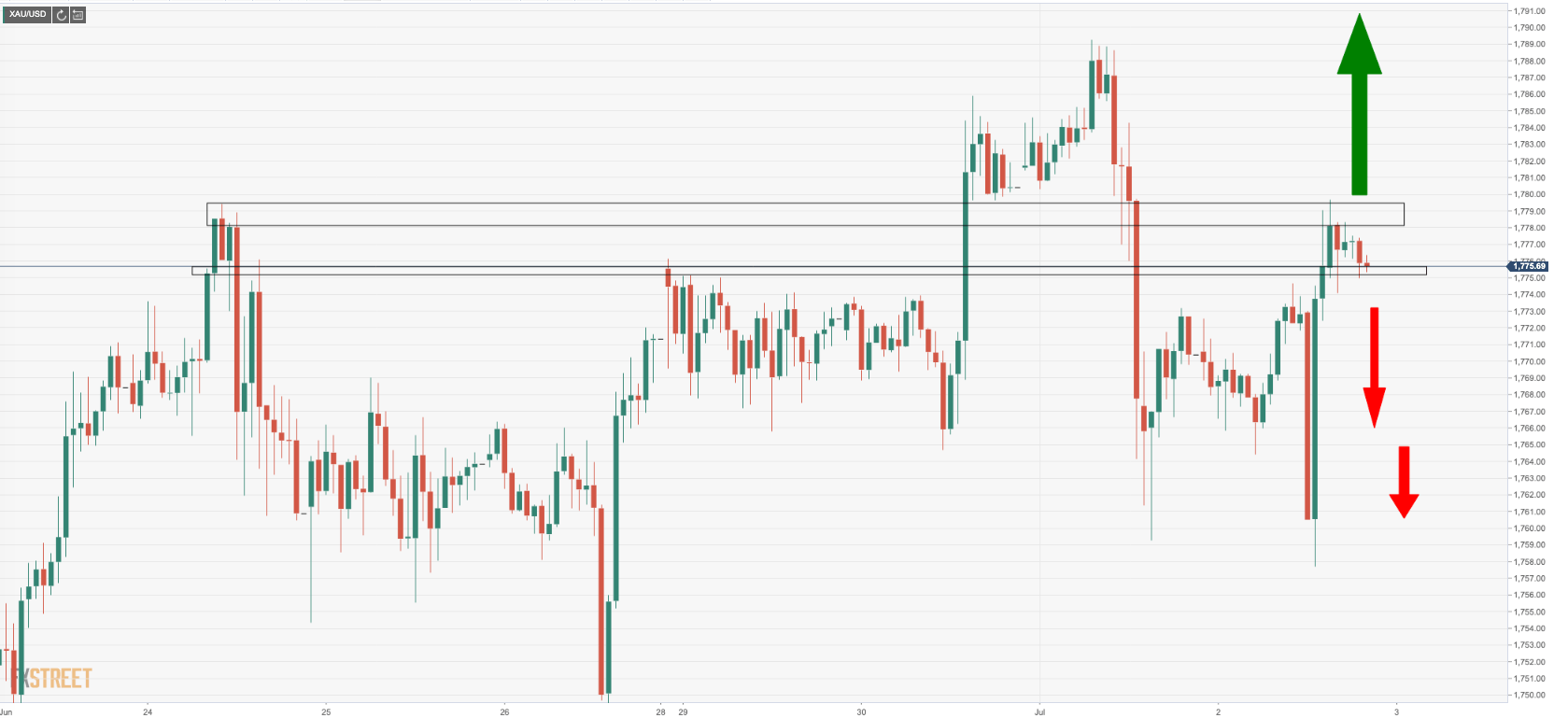

XAU/USD has been a mixed bag this week and for the start of the month, trapping bears ina recent stop hunt from the $1,757.66 level where it met a high of $1,779.69 on the last session before the US long weekend.

At the time of writing, the price of the yellow metal is trading at $1,776.07 ahead of Thursday’s close in the US session awaiting Asia to pick up the baton for the last day of the week.

Casting minds back, the precious metal had rallied steadily since mid-March, eyeing the psychological $1,800 level.

However, the bulls fell $11 shy of the figure and bears have stepped in anticipation of a phase of serious distribution.

Considering the context of rising Covid-19 cases, however, there are still prospects that a have safe-haven bid can carry the metal over the mark.

In the US, the situation is becoming out of control. The latest data published by Florida state’s health department revealed that the confirmed coronavirus cases on Thursday surged by 10,109, or 6.4%, to a total of 169,106. This print marked the biggest single-day increase since the pandemic started.

Reuters reported on the matter: “In June, Florida infections rose by 168% or over 95,000 new cases, the percent of tests coming back positive has skyrocketed to 15% from 4% at the end of May.”

And in the latest data from Arizona, it showed that the number of confirmed COVID-19 cases climbed by 3,333 on Thursday to 87,425, adding to Tuesday’s increase of 4,878.

“Conversely, the virus presents the most risk to rising long-term breakevens,” analysts at TD Securities warned.

Looking forward, however, we expect that breakevens have room to run, as the entire maturity spectrum are still priced below policy objectives.

The world-war era fiscal and central bank stimulus, the change in the central bank template that will incorporate ‘symmetric inflation targets’ and unwinding globalization, also suggest that inflation-hedge assets may grow in popularity.

- Gold might appreciate to $2,000 by late 2021 – TDS

Gold levels

Meanwhile, as per yesterday’s analysis, Gold Price Analysis: XAU/USD bears rolling up their sleeves, the right-hand shoulder of a head and shoulders is in development.

Bulls have made good progress all the way to the top of the left-hand shoulder, meeting those highs. So far, the bulls are capped here but hold the fort at a critical support level.