- Gold failed to preserve its early gains and refreshed daily lows in the last hour.

- Sustained USD buying was seen as a key factor exerting pressure on the metal.

- Oversold conditions on the daily chart warrant some caution for bearish traders.

Gold struggled to capitalize its modest intraday recovery gains, instead met with some fresh supply near the $1721 region. The commodity refreshed daily lows, around $1707-06 region in the last hour and remained well within the striking distance of nine-month lows touched on Wednesday.

The US dollar buying picked up pace since the early European session, which, in turn, was seen as a key factor exerting downward pressure on the dollar-denominated commodity. A softer risk tone around the equity markets and the US bond yields might help limit losses for the XAU/USD.

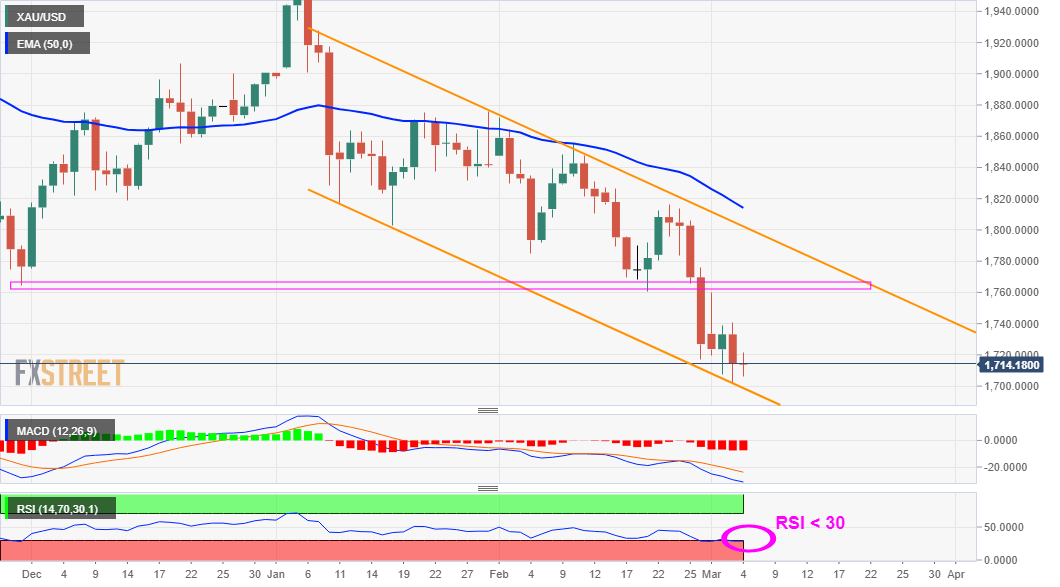

From a technical perspective, the commodity has been trending lower along a downward sloping channel over the past one month or so. The formation points to a well-established short-term bearish trend and supports prospects for an extension of the ongoing downward trajectory.

That said, the XAU/USD, so far, has managed to defend the $1700 mark, which coincides with the lower boundary of the mentioned channel. Moreover, technical indicators on the daily chart are flashing oversold conditions and warrants some caution for bearish traders.

This makes it prudent to wait for sustained breakthrough the channel support before positioning for any further depreciating move. The XAU/USD might then accelerate the fall towards testing the $1675-70 horizontal support en-route the next major support near mid-$1600s.

On the flip side, the daily swing highs, around the $1721-23 region now seems to act as an immediate hurdle. This is followed by resistance near the $1740 supply zone, which if cleared might trigger a short-covering move towards the $1760-65 strong support breakpoint.

Only a sustained move beyond will negate the near-term bearish outlook and push the XAU/USD back towards the $1800 mark. However, any subsequent positive move is more likely to remain capped near the trend-channel resistance, currently around the $1809-10 region.

XAU/USD daily chart

Technical levels to watch