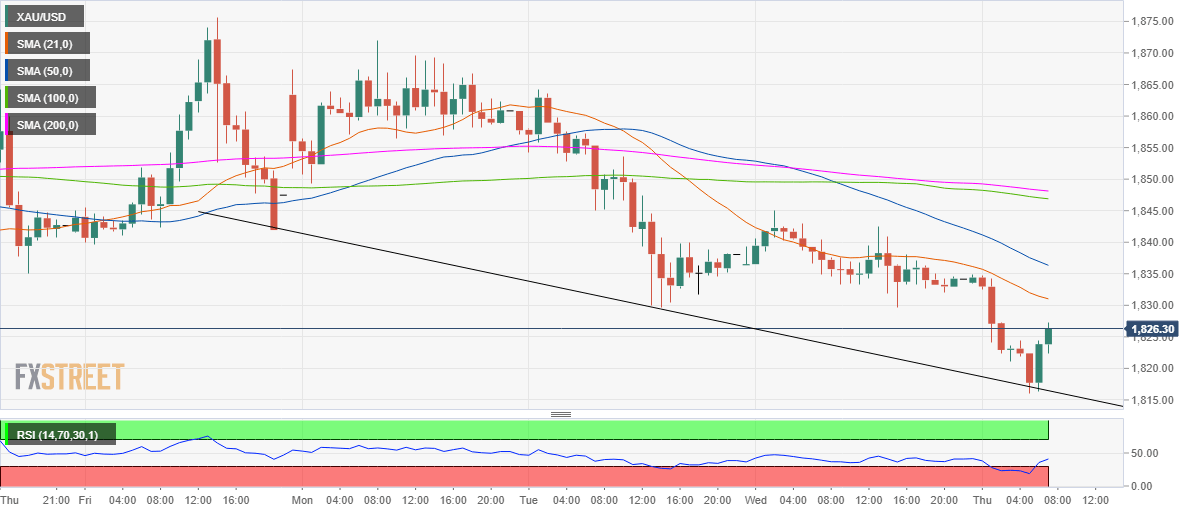

- XAU/USD attempts a bounce after finding bids at $1816.

- Bearish 21-HMA is the level to beat on the road to recovery.

- RSI bounces off oversold conditions but remains bearish.

Gold (XAU/USD) bears have taken a breather in early European trading, prompting a rebound towards the critical bearish 21-hourly moving average (HMA) at $1831.

Acceptance above the latter could accelerate the recovery towards the next resistance at the 50-HMA of $1836.

Powerful resistance around $1848 could likely keep the further recovery elusive. That level is the confluence of the 100 and 200-HMAs.

To the downside, a breach of the four-day-old falling trendline support at $1816 could trigger a steep drop towards the January 18 low of $1803.

Further down, the November 30 high of $1790 could come to the rescue of the XAU bulls.

The relative strength index (RSI) has bounced-off from the oversold territory but remains below the 50 level, keeping the sellers hopeful.

Gold Price Chart: Hourly

Gold Additional levels