- Gold recovers from two-day low, still keeping the weekly support line break.

- Key short-term EMAs to challenge the bullion’s further weakness.

- Buyers await a clear break of $1,765 for fresh entries.

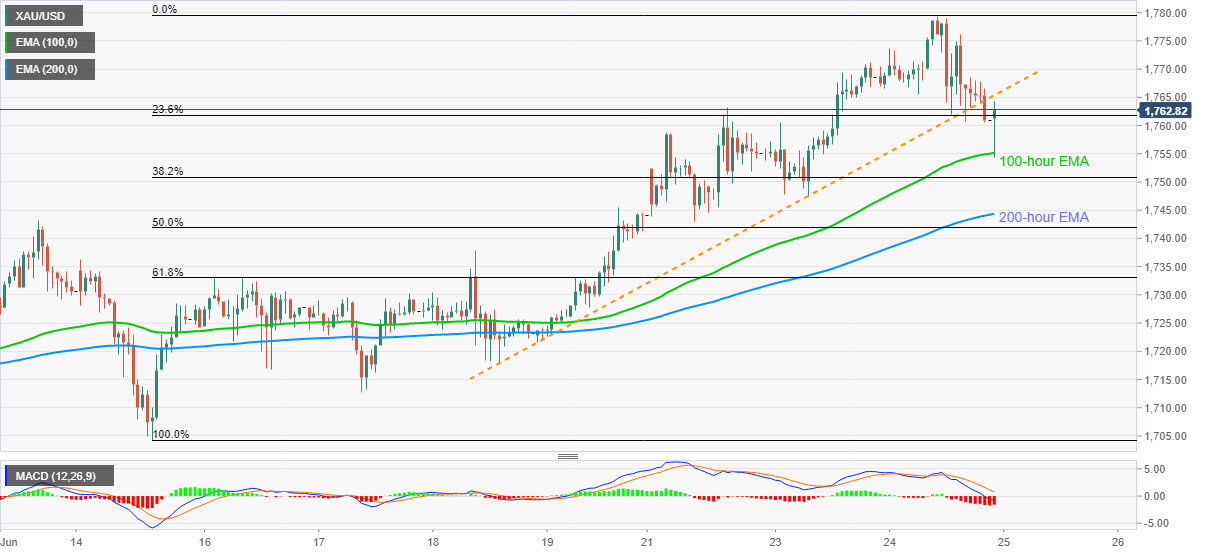

Gold prices take the bids near $1,763.14 during the early Asian session on Thursday. The bullion prices recently dropped to the lowest since Tuesday on the break of an ascending trend line stretched from June 18. However, 100-hour EMA triggered the yellow metal’s pullback afterward.

The safe-haven stays below the support-turned-resistance line, at $1,765.14 now, which in turn keeps the sellers hopeful. As a result, any fresh weakness can push the commodity traders to again target a 100-hour EMA level of $1,755.17 whereas 200-hour EMA, currently near $1,744.40, might lure sellers then after.

In a case where the bears dominate below 200-hour EMA, June 18 top near $1,737.83 could return to the charts.

On the upside, buyers will wait for a sustained rise past-trend line support, now resistance, near $1,765. Following that, there are multiple resistances around $1,773/75 ahead of watching over the recent high near $1,780.

During the yellow metal’s rise beyond $1,780, the year 2012 tops close to $1,796 and $1,800 threshold will be on the bull’s radars.

Gold hourly chart

Trend: Pullback expected