Gold prices ease from the early-day record high level of $1,988 to $1,973.87, down 0.11%, during the pre-European session on Monday. The yellow metal keeps the higher high formation intact despite its repeated failures to pierce $2,0000 after each run-up.

The latest pullback could be attributed to the US dollar’s extended recoveries from the lowest since May 2018. The US dollar index (DXY) stays mildly positive near 93.45 by the press time. Given the absence of positive fundamentals concerning the US, the greenback gauge might have taken clues from the month-end consolidation. The US Senators are still struggling to offer the much-awaited fiscal package despite the expiry of the unemployment claims. Also, the coronavirus (COVID-19) conditions in the world’s largest economy keep challenging US President Donald Trump’s economic optimism.

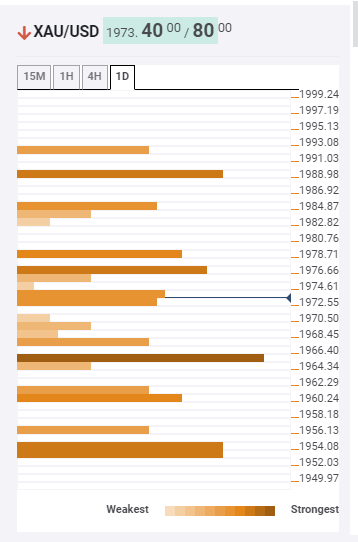

Key levels to watch…

Our technical tool, Confluence Detector, highlights $1,966/65 as the strong support comprising 23.6% Fibonacci retracement on one-week and 200-SMA on a 15-minute chart. The confluence also includes 50-HMA on the hourly play.

If the bears sneak in around $1,965, $1,955/53 could add an extra downside filter to challenge the bulls. The support gains clues from 38.2% Fibonacci retracement of the weekly chart.

It should also be noted that any downside past-$1953, may find tough support of the previous record high, marked around $1,920, before revisiting the sub-1,900 area.

On the contrary, the previous low on the four-hour chart and middle-band of the Bollinger on the 15-minute chart can question the metal’s immediate upside around $1,977.

Though, major attention will be given to an upside clearance of $1,989 resistance mark encompassing R1 of the Pivot Point on the daily chart as well as the previous high on 4H chart.

Hence, while the bulls keep the reins, area between $1,965 and $1,989 becomes the range not worth watching.

Here is how it looks on the tool

About the Confluence Detector

The Confluence Detector helps gauge the path of least resistance. It locates and points out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc.

Learn more about Technical Confluence