- Gold has defied gravity below the bearish head and shoulders, rallying beyond the right-hand shoulder’s ceiling.

- Weakness in the greenback is assisting gold to keep its head above water in the $1,850s.

- Eyes are on the Fed, US stimulus talks, Brexit and ultimately, the vaccine roll-out.

Gold is trading at $1,849.46, up some 1.2% on the day having travelled between a low of $1,825.66 and $1,855.41.

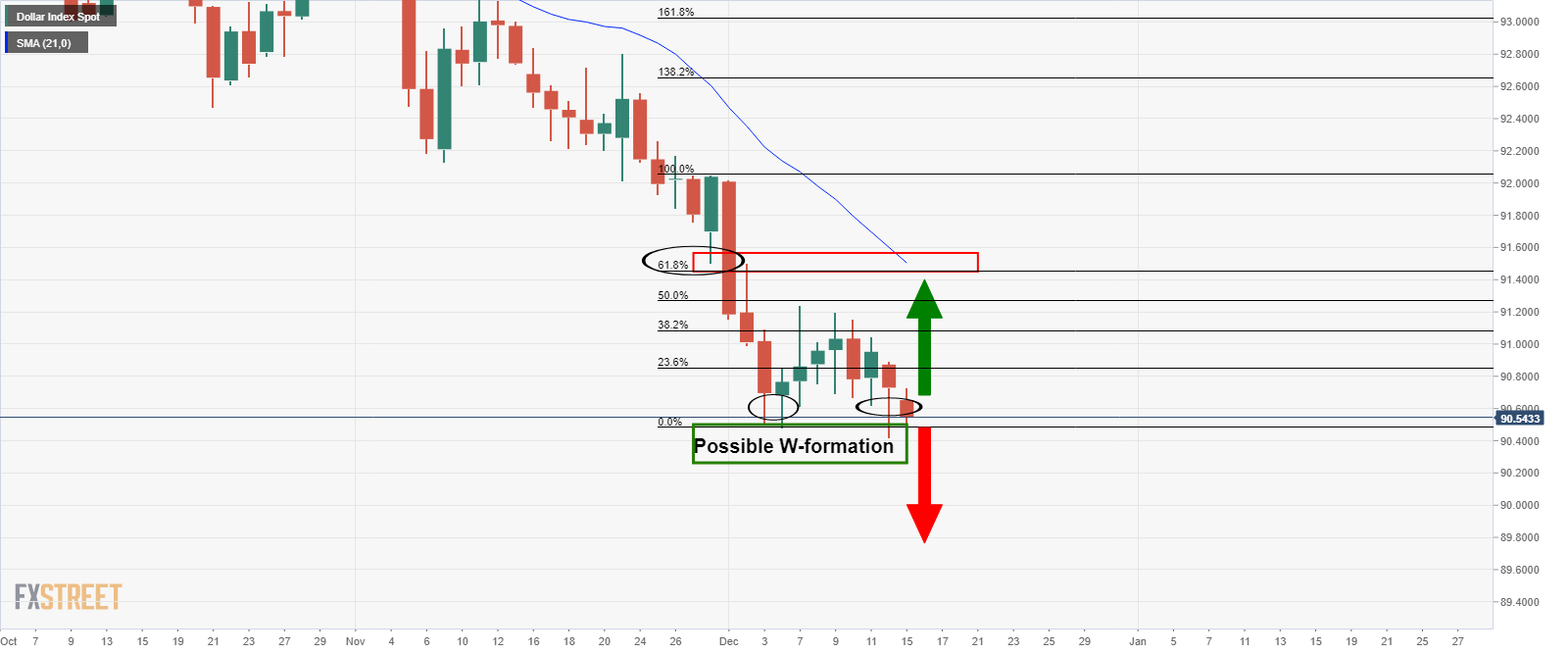

The US dollar continues to bleed out and has moved into a critical position on the DXY index where it is either about to run higher from a double bottom, consolidate or continue lower.

DXY daily chart

The last Federal Open Market Committee of the year draws nearer and markets are positioning for a dovish outcome which is likely weighing on the dollar and reinvigorating speculative interest in gold again.

”Tweaks to the pace and composition of purchases (shifting to more long-end purchases) and strengthening QE guidance (linking it to recovery progress) the odds on favourites for any material Fed changes,” analysts at Westpac argued.

Meanwhile, the dollar could find some solace on any continued uncertainty in Brexit negotiations as well as Congressional efforts in sealing a Covid relief deal.

Moreover, there would be a huge demand for safe-haven US dollars if there were any threats to a vaccine-led global recovery which is by far the most crucial dynamic for 2021.

However, for the here and now, as analysts at TD Securities stress, ”the combination of additional stimulus and lower yields should keep real rates reverting on a downward trajectory and weigh on the USD, fueling capital allocations into precious metals.”

”Indeed, the nearest trigger in gold is now to the upside, as a break above the $1900/oz level would prompt a fresh round of CTA long accumulations.”

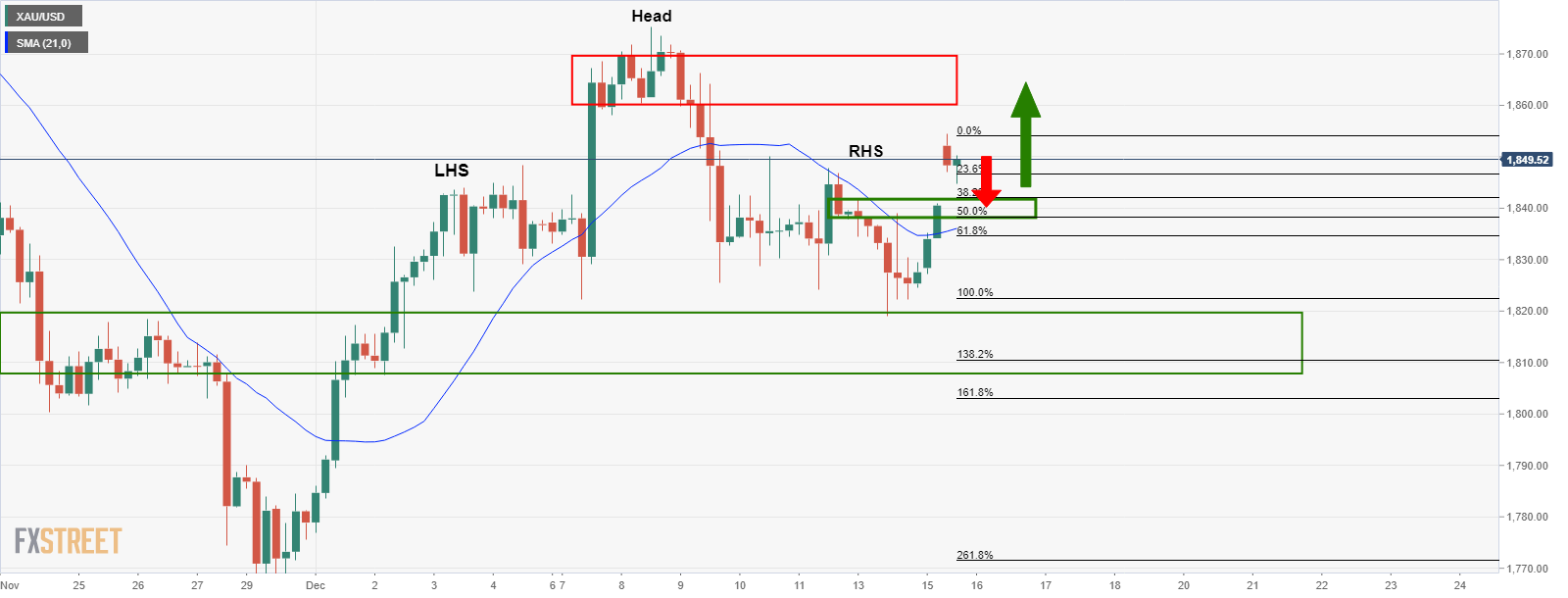

Gold technical analysis

From a 4-hour perspective, gold did not respect the bearish head and shoulders, gapping through the 21-moving average and invalidating any near-term bearish bets.

Following a rally of such magnitude, a correction can be expected to at least a 38.2% Fibonacci retracement of the impulse prior to an extension:

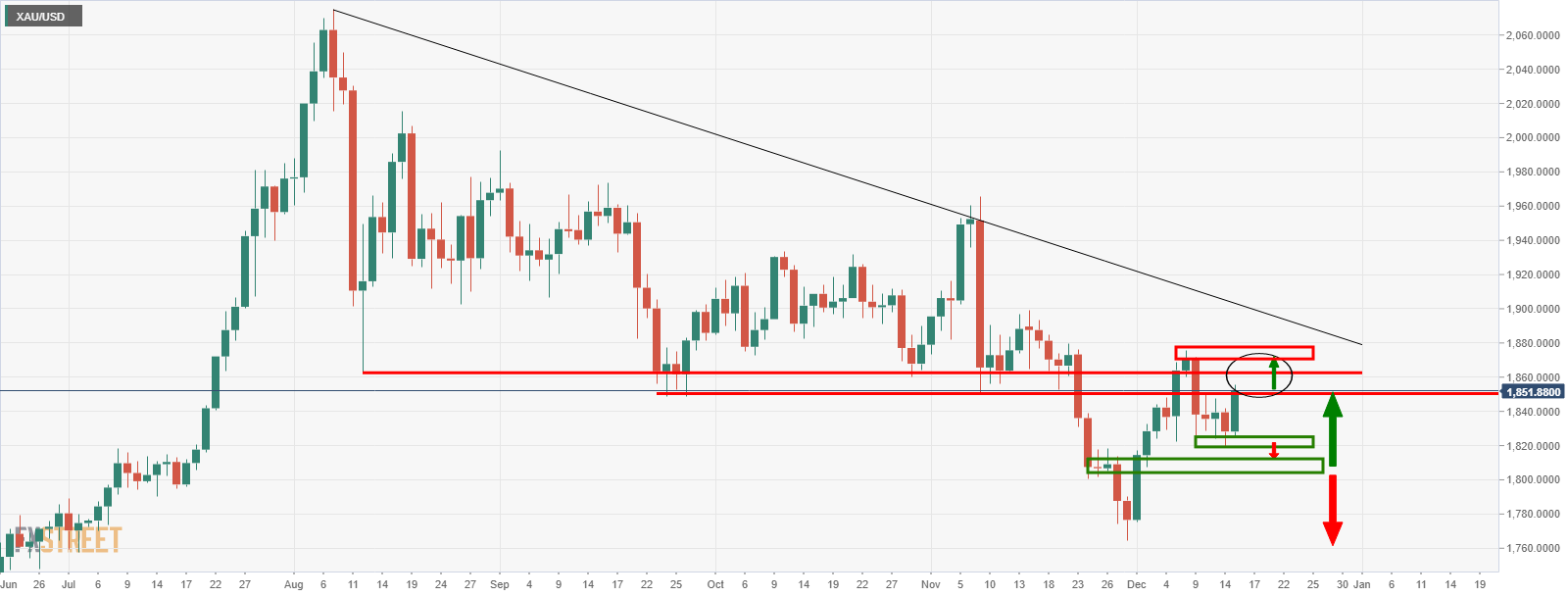

However, from a daily and weekly perspective, the bulls are still not out of the woods yet, not until we see a weekly close above $1,850.

Conversely, a daily close below $1,823 will be semi-bearish, but a break below structure around $1,806 would be uber bearish: