Although US stimulus deadlock is still far from breaking, gold prices stay above $1,900, currently down 0.07% to $1,929, while heading into the European open on Monday.

With the US Treasuries off from trading, due to the Columbus Day holiday, commodities couldn’t react to the weekend challenges to American President Donald Trump’s coronavirus (COVID-19) aid package. Although the Republican leaders’ readiness to offer $1.8 trillion propelled markets on Friday, House Speaker Nancy Pelosi’s rejection suggests no more money is going to flow through the Congress before the US presidential election.

Even so, the risk-on sentiment gains mildly optimism from Asia as the Chinese central bank reused FX trading routes to ease the strong domestic currency. Also favoring the market mood could be Australia’s easing of travel restrictions.

On the contrary, Brexit and COVID-19 woes in Europe raise bars for the risk-takers, which in turn challenge the gold prices’ further upside.

Key levels to watch

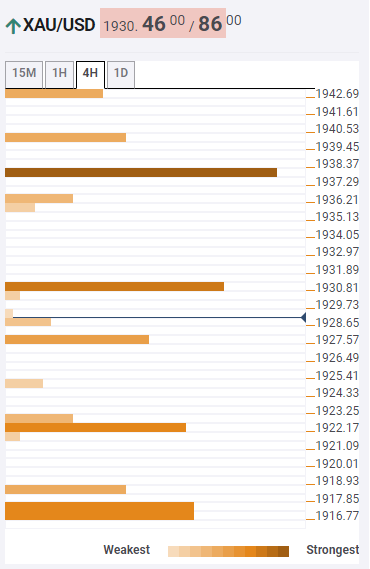

The previous highs on the hourly (H1), four-hour (4H) and 1-day (D1) chart highlight $1,931 as the immediate upside barrier holding the keys for the metal’s run-up towards $1,939 resistance including 61.8% Fibonacci retracement of the monthly move.

It’s worth mentioning that the 50-day SMA on the daily chart, around $1,940, adds to the upside barriers for the yellow metal bulls ahead of propelling gold buyers towards the mid-September tops near $1,973.

Meanwhile, the previous low on the 4H and 23.6% Fibonacci retracement of D1 near $1,922 can entertain sellers if the adjacent rest-point close to $1,928 breaks, comprising the middle Bollinger and SMA 50 on the 15-minutes chart.

In a case where the bears dominate past-$1,922, the 23.6% Fibonacci retracement of weekly moves and SMA 10 on 4H will challenge the further downside around $1,918 and $1,916.50.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence