Gold prices refresh intraday low near $1,938 while extending pullbacks from the six-week top, flashed the previous day, during early Friday.

The yellow metal recently eased after US election updates suggest President Donald Trump’s lead in Pennsylvanian voting count. Earlier in Asia, news from Georgia and Arizona marked Joe Biden as the front-runner for the US presidency while keeping his 260+ electoral votes, versus 270 required.

Although fears of a hung decision over the blue wave in America probe the US dollar bears, optimism surrounding further easy money, be it from the central banks or governments, enthuses the global risk sentiment.

As a result, equities and commodities cheered the US dollar’s downside during Thursday before portraying a consolidation so far today. That said, S&P 500 Futures print 0.60% intraday losses while stocks in Asia-Pacific trade mixed by press time.

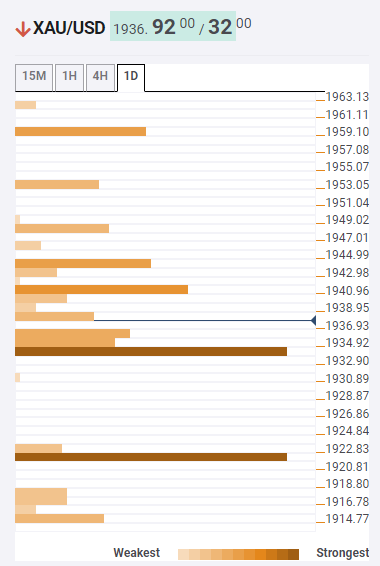

Key levels to watch

Despite the recent pullback, gold prices stay past-$1,934 key support, comprising 38.2% Fibonacci retracement one-day, which in turn favors the bulls to jostle with the immediate resistances.

Among them, 5-SMA on 15-minute, upper band the Bollinger Band (BB) on one-day and 23.6% Fibonacci retracement on daily comprise $1,941 as immediate key upside barrier.

Following that, the middle band of the BB on 15-minutes and 161.8% Fibonacci retracement on one-week, surrounding $1,945, can precede R3 on the weekly pivot point near $1,965 to entertain the gold buyers.

Alternatively, a downside break below $1,934 support will quickly drag the quote towards $1,921 support including SMA10 on the four-hour (4H) as well as R1 on the monthly pivot and 61.8% Fibonacci retracement on one-day.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence