- Gold remains capped below 200-DMA while awaiting Yellen.

- Bearish prospects are intact as RSI trades below the 50 level.

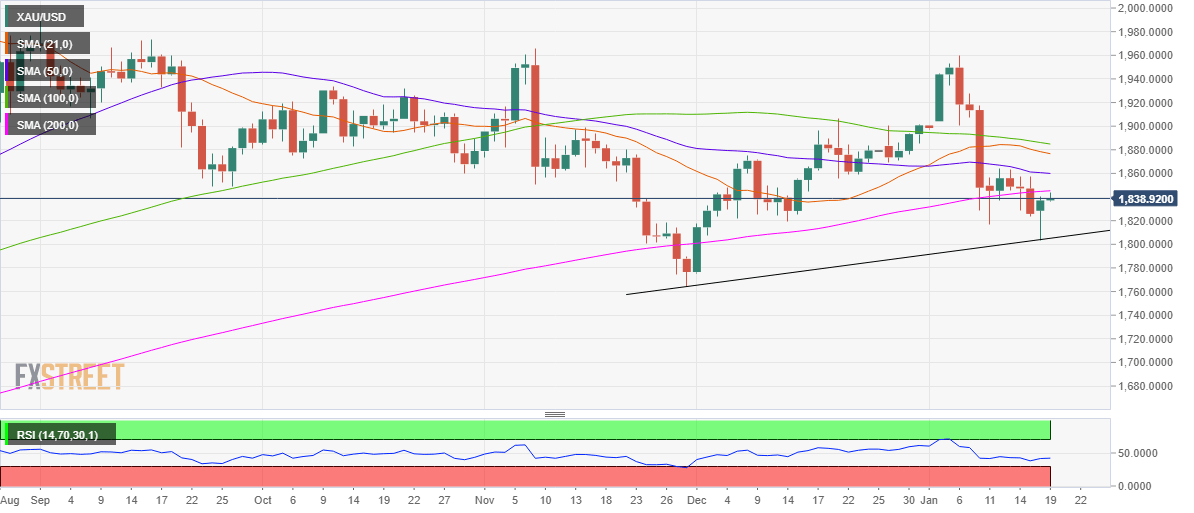

- XAU/USD trades below all major averages on the 1D chart.

Gold (XAU/USD) is struggling to extend Monday’s impressive bounce from seven-week lows of $1803, as the 200-daily moving average (DMA) appears to be a tough nut to crack for the bulls.

Investors await US Treasury Secretary nominee Janet Yellen’s testimony due later in the NA session for fresh direction.

In her prepared remarks, Yellen called on Congress to do more to fight a deep pandemic-induced recession. She said: “Neither the president-elect, nor I, propose this relief package without an appreciation for the country’s debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big.”

Gold Price Chart: Daily

Acceptance above the 200-DMA hurdle is critical to extending the recovery moves towards the horizontal 50-DMA at $1860.

The next relevant upside barrier is aligned at $1876, which is the 21-DMA.

The upside moves appear limited by the key averages while the 14-day Relative Strength Index (RSI) remains in the bearish region.

To the downside, the rising trendline support at $1805 could be tested if the sellers regain control.

The multi-week lows of $1803 would be next on the bears’ radar, below which a test of the December 1 low at $1775.52 cannot be ruled.

Gold Additional levels