- XAU/USD remains on track to close the day in positive territory.

- Sharp drop witnessed in US T-bond yields helps gold find demand.

- Next near-term resistance for XAU/USD aligns at $1,790.

The XAU/USD gained traction in the early American session and climbed to a daily high of $1,780. Although the greenback started to gather strength in the second half of the day, the pair stayed relatively resilient and was last seen rising 0.35% on the day at $1,778.

The sharp drop witnessed in the US Treasury bond yields and the risk-averse market environment seems to be helping gold find demand. Currently, the benchmark 10-year US T-bond yield is losing more than 3% and the S&P 500 Index is down nearly 1% at 4,121.

Gold technical outlook

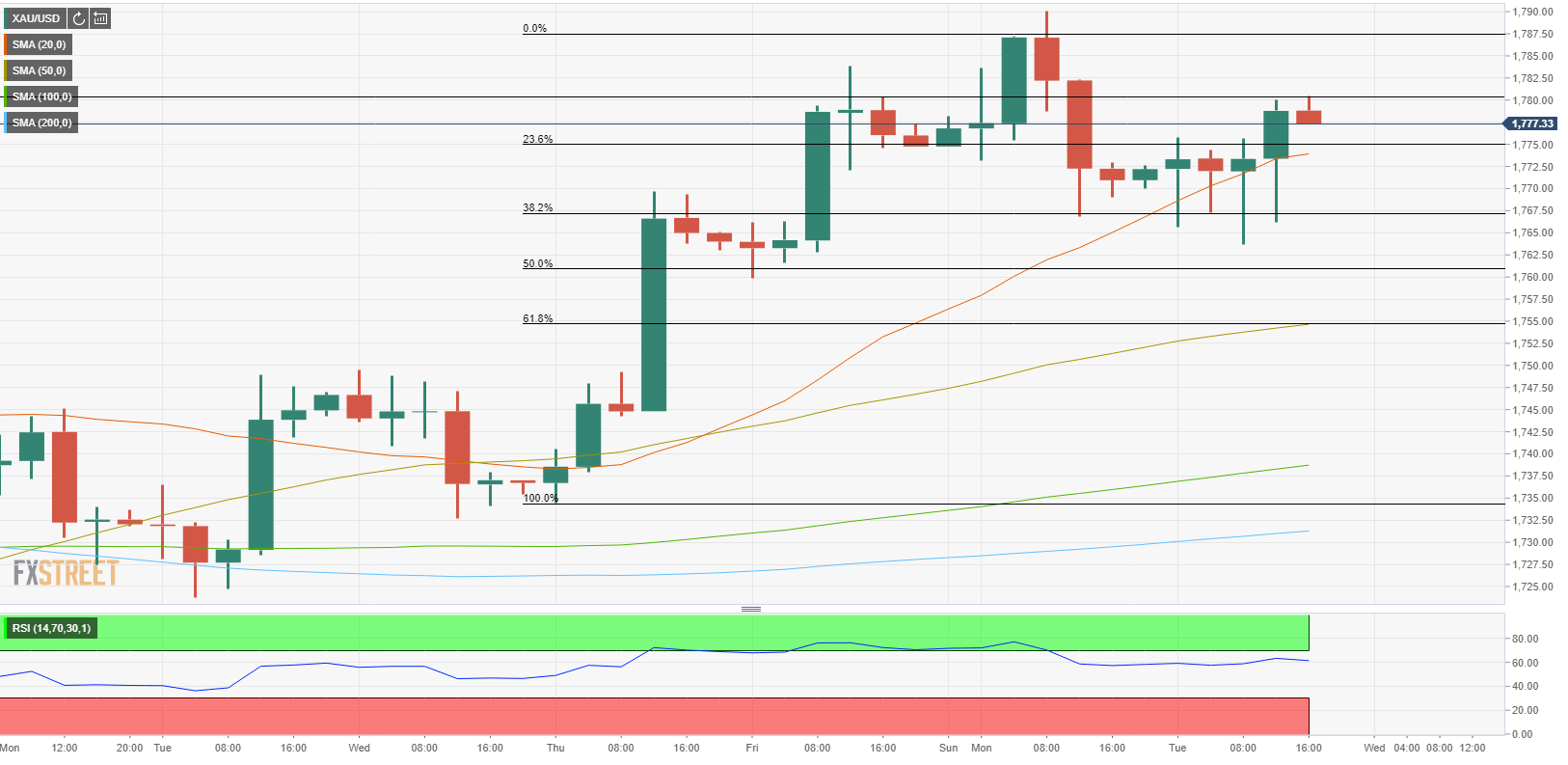

With the latest climb, XAU/USD managed to close a four-hour candle above $1,775, where the Fibonacci 23.6% retracement of the latest uptrend is located. The next target on the upside is located at $1,790 (Monday high) but bulls seem to be struggling to lift the price above $1,780, which could be seen as interim resistance.

In the meantime, the Relative Strength Index (RSI) indicator on the four-hour chart is staying around 60, suggesting that the pair could continue to edge higher before turning technically overbought.

On the other hand, the initial support is located at $1,775 (Fibonacci 23.6% retracement, 20-period SMA) ahead of $1,767 (Fibonacci 38.2% retracement) and $1,760 (Fibonacci 50% retracement).