- XAU/USD rises on Thursday supported by falling US T-bond yields.

- Gold faces a resistance at $1,750 in the near term.

- A downward correction to $1,740 is likely if XAU/USD fails to clear $1,750.

The XAU/USD pair closed in the negative territory on Wednesday but didn’t have a difficult time reversing its direction on Thursday as US Treasury bond yields continue to drive gold’s movements ahead. The benchmark 10-year US T-bond yield, which rose 1.4% on Wednesday, is currently losing 1.6% at 1.613%, helping XAU/USD preserve its bullish momentum.

Gold technical outlook

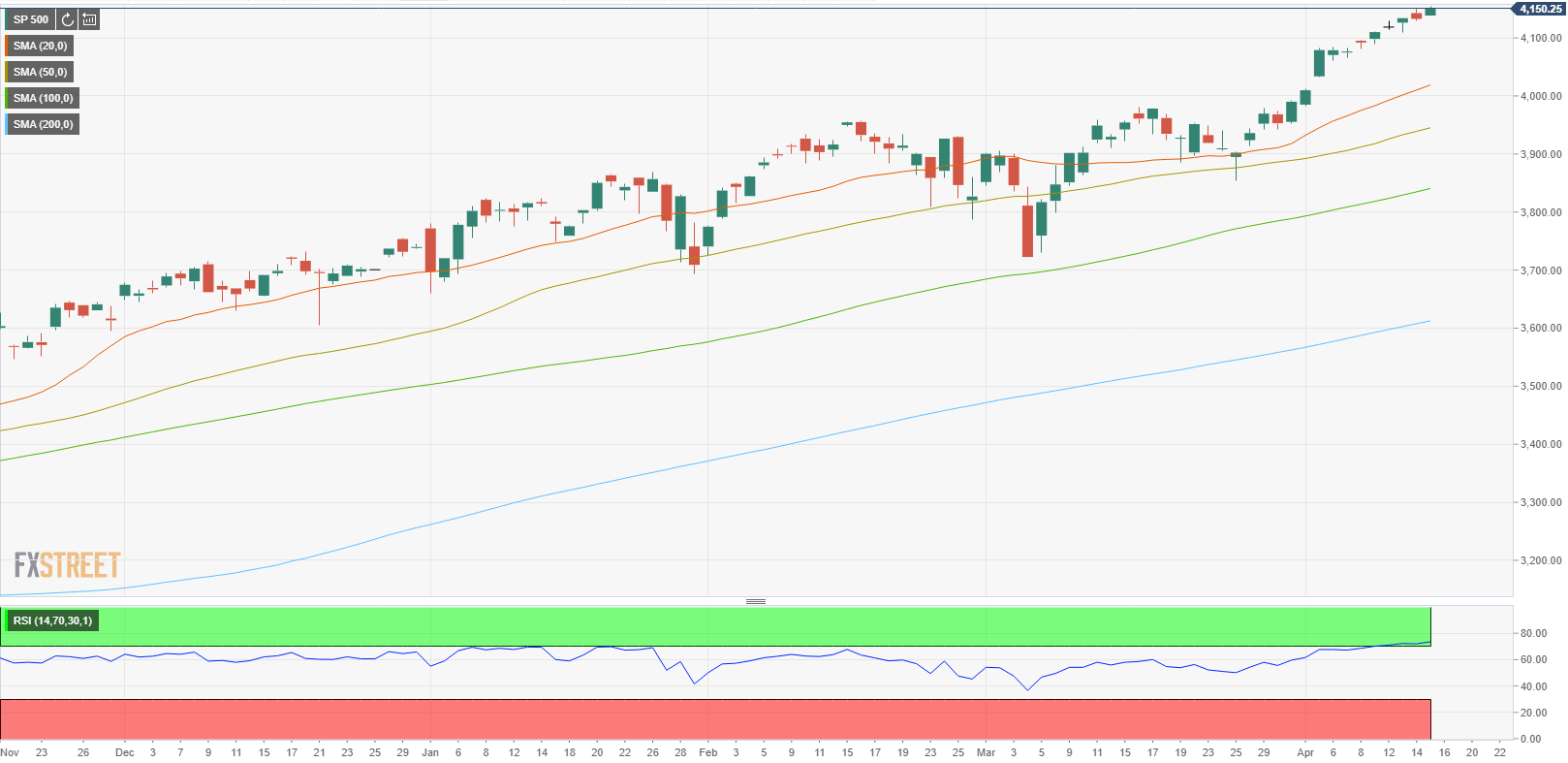

On the four-hour chart, the Relative Strength Index (RSI) indicator edged higher to 60, suggesting that buyers are trying to remain in control of the price. However, gold lost its traction near $1,750 in the last two trading days and it could have a difficult time gathering bullish momentum unless it manages to make a daily close above that level. The next resistance could be seen at $1,758 (Apr. 8 high).

On the downside, the initial support is located at $1,740 (Fibonacci 23.6% retracement of Mar. 31-Apr. 8 rally, 50-period SMA) ahead of $1,730 (Fibonacci 38.2% retracement, 100-period SMA) and $1,725 (200-period SMA).

Additional levels to watch for