- Gold sees some signs of life amid weaker Treasury yields.

- The DXY rebound could cap the gains in XAU/USD.

- Gold clings onto the 21-DMA support ahead of the critical US CPI.

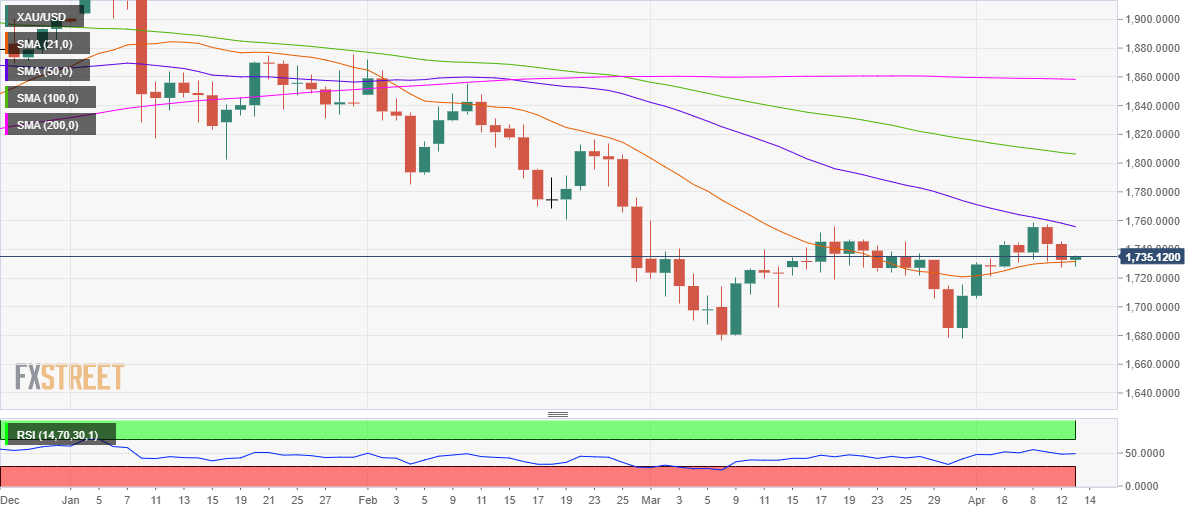

Gold (XAU/USD) is challenging the bearish commitments near the critical support at $1731, with all eyes on the US CPI for a fresh direction.

That level is the 21-daily moving average (DMA), which has been holding the fort for the past week.

The yellow metal fell nearly $11 on Monday, extending its two days of declines, as the Treasury yields reversed course and edged slightly higher following a good three-year note auction.

Meanwhile, a mixed closed on Wall Street, a positive tone in the Asian markets and a broad comeback in the US dollar keep the gold buyers on the edge.

The recent strong US PPI data has lifted inflation expectations, which seem to be offering support to the traditional hedge against inflation, gold. Markets await the US CPI release for fresh insights on the strength of the economy and the Fed rate hike outlook.

Gold: Technical outlook

With the 14-day Relative Strength Index (RSI) inching higher to probe the midline, the price of gold is looking to extend its bounce from the abovementioned 21-DMA support.

Gold Price Chart: One-day

Monday’s high at $1745 would offer initial resistance, as the bulls eye a sustained move above the bearish 50-DMA at $1756.

If the 21-DMA support is breached, a sell-off towards the April 1 low of $1706 cannot be ruled out.

The next relevant support awaits at the $1700 round figure.

Gold: Additional levels