- Gold bears extend their control amid rising Treasury yields, DXY.

- XAU/USD looks to test $1760 amid rising wedge breakdown on the 1CH chart.

- All eyes on the all-important FOMC decision

Gold (XAU/USD) is extending Tuesday’s decline towards $1760, having faced rejection once again at higher levels.

The US Treasury yields keep rallying on expectations of the Fed’s upbeat outlook on the economy, which could likely fuel tapering bets in the coming months. The surge in the US rate exerts additional upward pressure on the greenback.

From a near-term perspective, gold is now targeting the $1762-60 support area, as the technical setup on the hourly chart remains in favor of the bears.

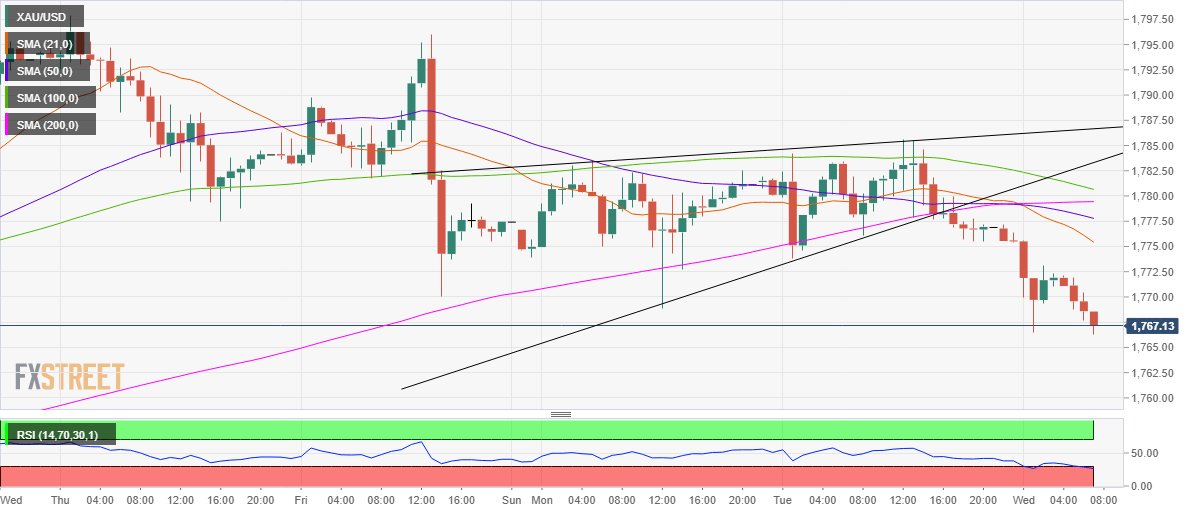

Gold Price Chart: Hourly

The spot has charted a rising wedge breakdown on the hourly chart earlier on, exposing the pattern target measured near $1760.

The bears flexed their muscles after the 21-hourly moving average (HMA) pierced through the 200 and 50-HMAs from above, representing a bearish crossover.

The Relative Strength Index (RSI) has entered into the oversold region, suggesting that the downside could stall at that level.

However, the psychological $1750 level could come into the picture should the sell-off gather steam.

Alternatively, any pullbacks could challenge the bearish 21-HMA at $1775, above powerful resistance awaits at $1780. That level is the convergence of the 100 and 200-HMAs.

Further up, Tuesday’s high at $1786 will be retested.

Gold: Additional levels