Gold prices stay positive near a one-week high, currently up 0.80% while easing from the intraday high of $1,900.35 to $1,895, during early Monday. In doing so, the yellow metal extends the last Wednesday’s recovery moves from $1,859 toward the monthly top as the market’s sentiment improve on US President Donald Trump’s signing of the coronavirus (COVID-19) aid package.

Following his initial rejection, Trump surprised global markets during the early Asian trading while signing the US covid aid package for $600 paycheck and an additional $300 weekly unemployment supplement, per the New York Times.

Read: Breaking: President Trump signs coronavirus relief bill

Also supporting the market sentiment could be the extension of Brexit optimism and a lack of data/events amid the year-end holiday season.

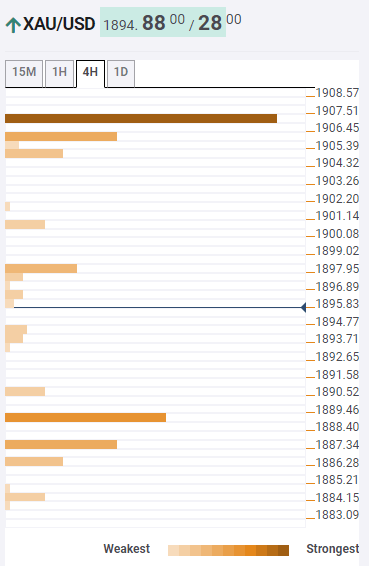

Gold: Key levels to watch

Technically, the yellow metal’s ability to stay past 61.8% Fibonacci retracement on the monthly chart, around $1,889, propels the bulls to eye 100-SMA on one day (1D), near $1,898 offers as an immediate target ahead of the $1,900 round-figure.

However, Pivot Point one-month (M1) Resistance 1, coupled with the monthly peak surrounding $1,907 lures the gold buyers for now while November’s top near $1,965 can lure the bullion buyers afterward.

Meanwhile, a downside break of $1,889 level, resistance turned into support, can offer short-term support during the quote pullback moves.

During the commodity’s weakness past-$1,889, 5-SMA on four-hour (4H) near $1,884 and the previous week’s low near $1,855 could gain the market’s attention.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence