Gold has been on the back foot after Federal Reserve Chair Jerome Powell seemed reluctant to intervene and lower bond yields. Higher returns on US debt make the yieldless precious metal less attractive to investors. However, markets seem to have stabilized after US Nonfarm Payrolls rose by 379,000.

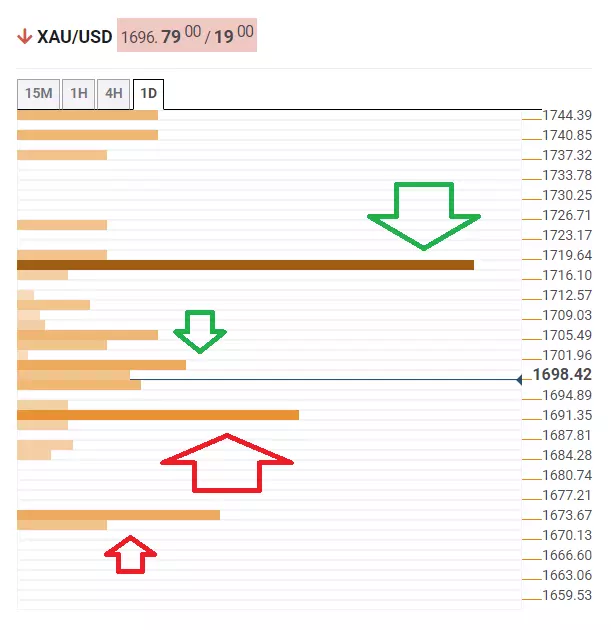

In the meantime, here is how XAU/USD is positioned on the charts.

The Technical Confluences Detector is showing that gold faces some resistance at around $1,700. Apart from being a round number, that level is also the convergence of the Bollinger Band one-day Lower, the Simple Moving Average 100-15m, the previous 4h-high, and the BB 1h-Upper.

Critical resistance awaits at $1,718, which is a cluster of lines including the Pivot Point one-day Resistance 1, the previous monthly low, and the SMA 100-1h.

Support awaits at $1,691, which is the confluence of the previous daily low, the PP one-week S1, and the previous 4h-low.

Further down, the downside target is $1,673, which is the meeting point of the PP one-month S1 and the PP one-day S2.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence