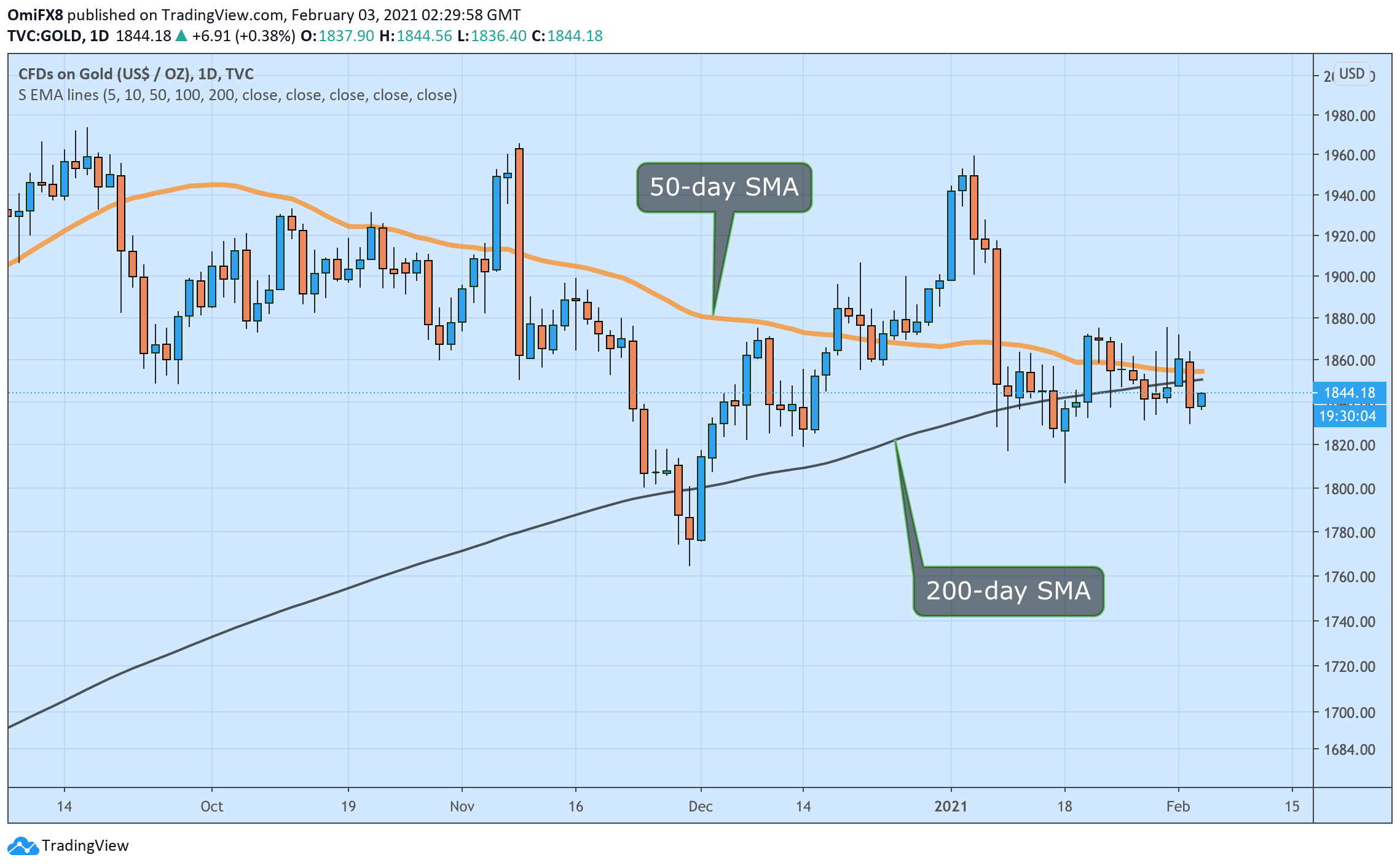

Gold is trading higher on Wednesday despite an impending death cross – a bearish crossover of the 50- and 200-day Simple Moving Averages (SMA).

The death cross is a long-term bearish indicator, according to technical analysis textbooks. However, it is based on backward-looking SMAs and lags price trends, often trapping traders on the wrong side of the market.

Put simply, it is not a reliable indicator and has limited predictive prowess at best.

The immediate bias remains neutral, with prices trapped in the recent $1,830 to $1,875 range. A break above the upper end (Jan. 21 and 29 high) would put the bulls back into the driver’s seat, exposing resistance at $1,959 (Jan. 6 high).

A breakdown could bring in more selling pressure, yielding a drop to at least $1,800. At press time, gold is trading 0.30% higher on the day near $1,843. Prices fell over 1% to $1,829 on Tuesday.

Daily chart

Trend: Neutral

Technical levels