Gold (XAU/USD) has pulled back from the recent troughs amid a sharp sell-off in the global markets. The bounce, however, lacks follow-through, as the traders remain on the side-lines ahead of the critical US Non-farm payrolls data.

Meanwhile, the dollar clings onto the higher levels, helped by the bounce in the Treasury yields, which limits the upside attempts in gold. How is gold positioned technically, as the US economy is expected to add 1400K jobs in August?

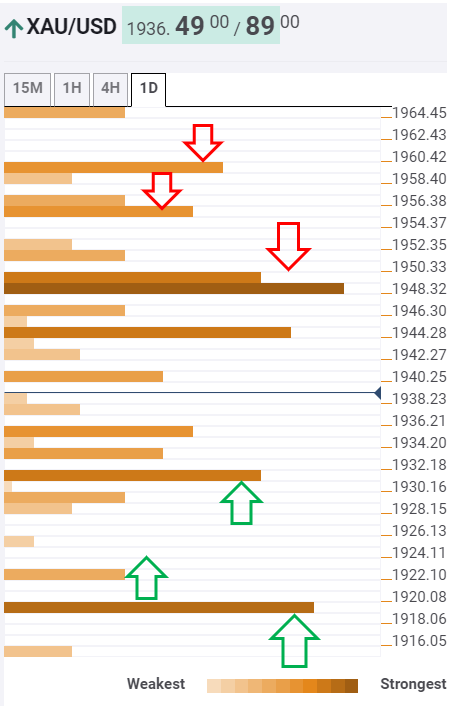

Gold: Key resistances and supports

The tool shows that gold is trapped between powerful barriers aligned at either sides.

Therefore, the bull-bear tug-of-war extends while the price remains capped below the strong hurdle of $1944, the convergence of the SMA50 one-hour and Fibonacci 38.2% one-month.

The next resistance at $1950 is a fierce one, as the Fibonacci 38.2% one-week coincides with the pivot point one-day R1 at the point.

A sustained move above the latter will boost the buying pressure towards the next soft cap at $1951, the previous day high.

Further north, the SMA5 one-day at $1955 will challenge the bulls above which the firm resistance at $1960 will get tested. That level is the intersection of the SMA100 one-hour and Fibonacci 23.6% one-week.

To the downside, the immediate robust support is seen at 1931, which is the convergence of the Fibonacci 61.8% one-week and SMA5 four-hour.

Acceptance below the latter will trigger a fresh sell-off towards the next powerful cushion at $1920, the confluence of the pivot point one-day and one-week S1.

Here is how it looks on the tool

About the Confluence Detector

With the TCI (Technical Confluences Indicator) tool, you can easily locate areas where the price can find a support zone or resistance zone and make trading decisions. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points each time. If you are a medium- and long-term trader, this tool will allow you to know in advance the price levels in which a medium / long-term trend can stop your travel and rest, where to undo positions or where to increase your position.

Learn more about Technical Confluence