- Gold is in the hands of the bulls but a correction is on the cards.

- The monthly outlook is critical which makes the next few weeks testing for the gold market.

The price of gold is firmly in the bull’s hands and that can be seen not only in the spot market but in the most recent CFTC positioning data and futures markets.

Of late, money managers increased gold length in covering relatively large amounts of their short exposure.

From a fundamental standpoint, the rate environment became more favourable.

The recent Nonfarm Payrolls data, counterintuitively, has sent markets into a buying frenzy for riskier asset classes which have hammered down the nail for the US dollar and have underpinned the price of the yellow metal.

”While statements from the US central bank pointed to unwavering support for a full employment policy, even if inflation trends move convincingly above target, some specs (likely trend-following funds) still reduced longs by a small amount,” analysts at TD Securities explained.

”A disappointing jobs report, which featured higher than expected wage increases and unemployment rates, suggests that gold is well-positioned to challenge technical resistance near $1,850/oz,” the analysts added, which brings us to the following charts.

Gold price technical analysis

Monthly chart

The monthly conditions are ripe for a good test of the psychological 1,850 level and the 61.8% Fibonacci retracement of the prior bearish impulse.

Should the market be firm there with plenty of offers, then the liquidity could expel the bulls and could be the basis to see an onwards downside continuation over the coming months.

With that being said, and in line with the current fundamentals which are supporting the prospects of a full-on supercycle in commodity prices and relation, then a break of the foreseen resistance would be another string to the bow for a bullish continuation.

Indeed, the next weeks will be an important one for the gold market and bulls will need to see a bullish month-end close.

Weekly chart

As for the weekly chart, the W-formation was completed in a textbook fashion.

The price made a perfect retest of the W-formation’s neckline prior to extending higher in a new bullish impulse.

However, the impulse has been very strong and has surpassed a -61.8% Fibonacci retracement of the prior correction.

Nevertheless, markets like to push the barriers and following perhaps a healthy daily correction, then the 1,850’s may even give way to a deeper test of the expected supply zone.

A break of the supply zone should leave the bulls in good stead for the forthcoming weeks.

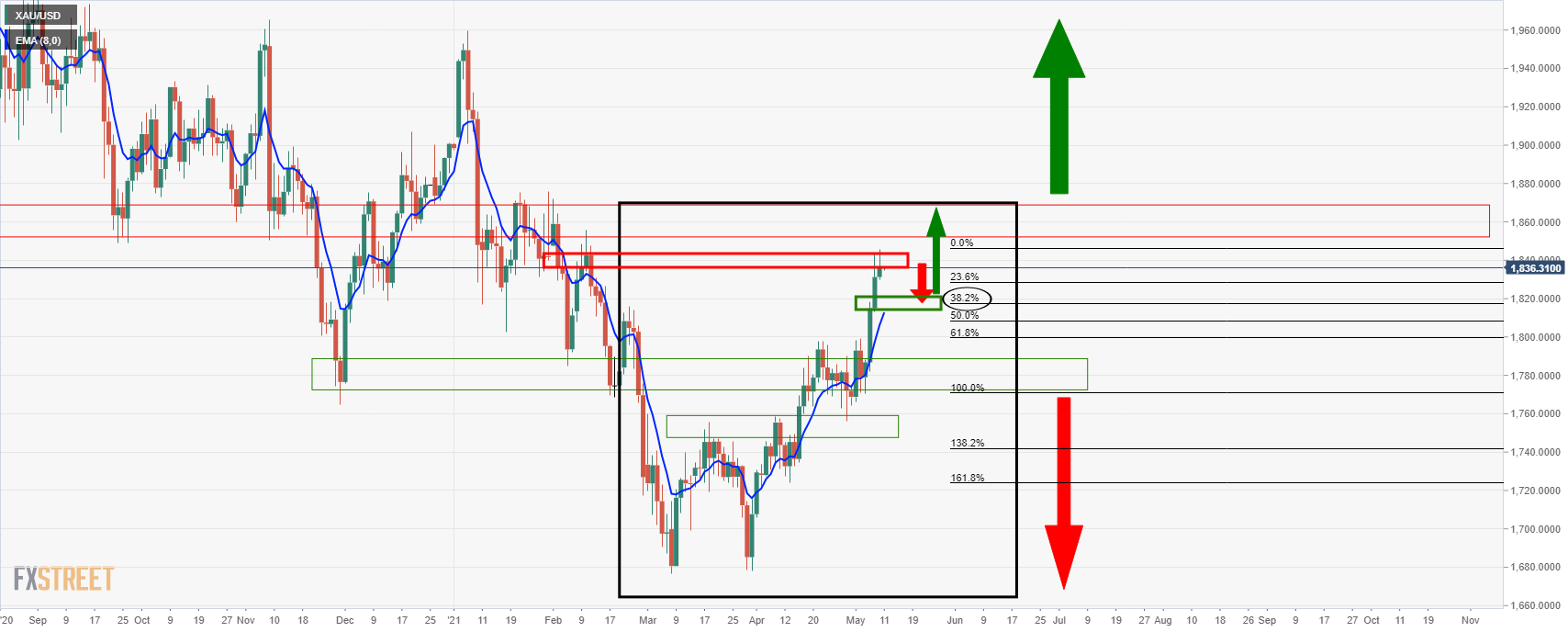

Daily chart

As pointed out, the current bullish leg is somewhat overextended and the daily chart illustrates just that.

A correction to at least a 38.2% Fibo that meets structure on the lower time frames, such as the 4-hour chart, would have a confluence with the 8 EMA.

If bulls step in there, then it could be the making for an onwards daily bullish market to test deeper into the monthly supply zone, with 1,850 the first port of call.