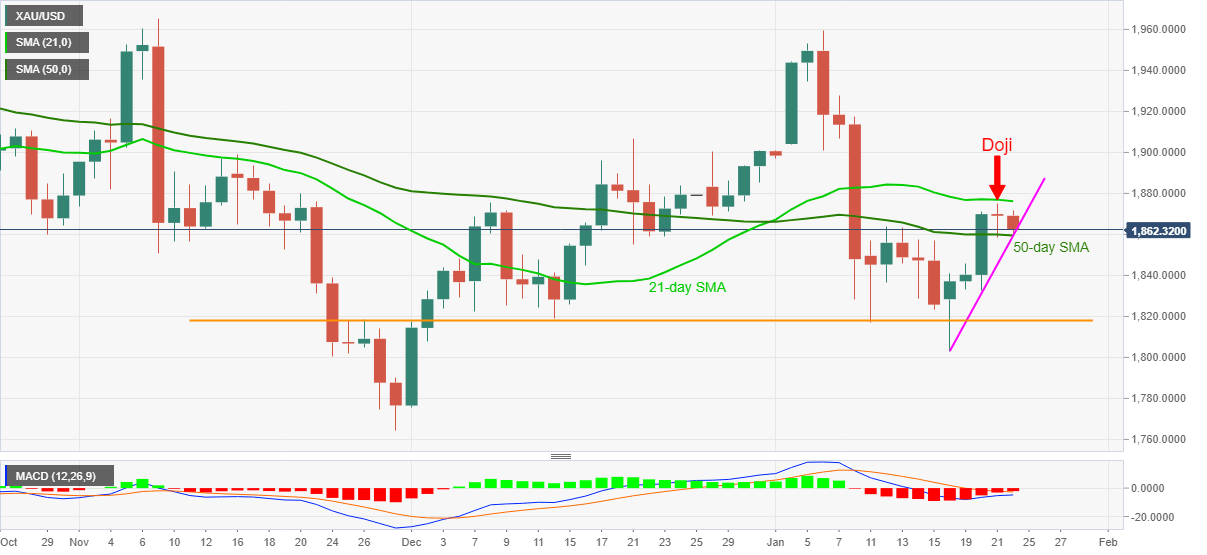

- Gold extends previous day’s pullback to retest 50-day SMA, weekly support line.

- Bearish MACD, trend reversal suggesting candlestick favor sellers.

- Bulls can eye $1,900 beyond 21-day SMA, bears may aim for monthly low.

Gold bounces off intraday low of $1,859.00 to $1,862.10, down 0.37% on a day, during early Friday. The yellow metal refreshed two-week high the previous day but failed to cross a 21-day SMA.

The resulted moves portrayed a Doji candlestick on the daily (D1) chart, which in turn gained support from the bearish MACD signals to portray today’s downtick.

However, gold sellers seem to struggle off-late as 50-day SMA and an upward sloping trend line from Monday limits immediate declines around $1,859.

Considering the latest risk-off mood, coupled with Thursday’s Doji and bearish MACD, the bullion is expected to break the $1,859 support confluence, which in turn can direct the sellers toward $1,840.

Read: Gold Price Analysis: XAU/USD bulls catch a breather above $1,850 amid virus woes

Though, a horizontal area around $1,818 will question the commodity’s downside past-$1,840, if not then the monthly low near $1,802 and the $1,800 threshold will be in the spotlight.

Meanwhile, a daily closing beyond the 21-day SMA level of $1,876 will attack the $1,900 round-figure before confronting the key hurdle around $1,965 comprising highs marked in November and January.

Overall, the gold prices are likely to trim some of the latest gains but the overall uptrend is less likely to be affected.

Gold daily chart

Trend: Further declines expected