- Gold is firm at the start of the week, testing critical resistance.

- The US dollar bumps along an important support structure.

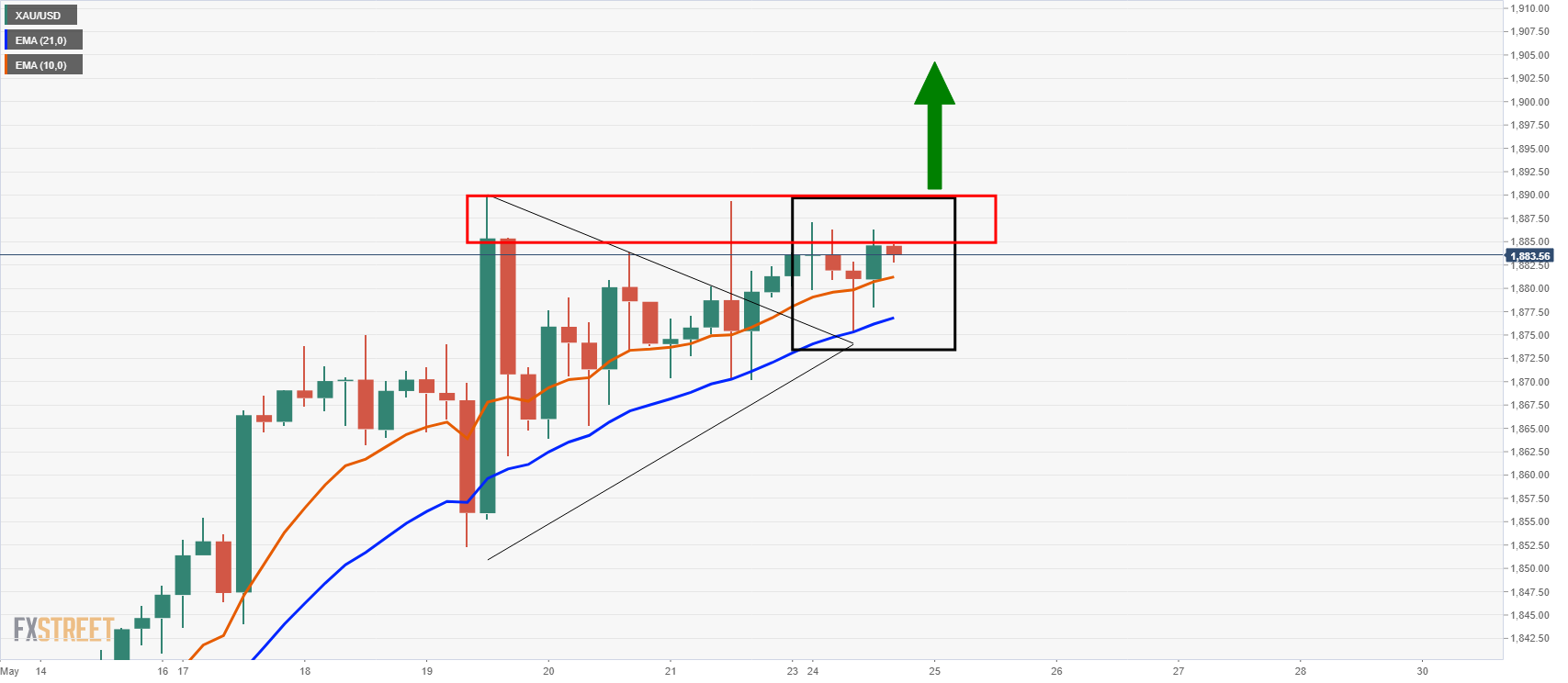

The price of gold is rising 0.11% at the time of writing, riding the 10 and 20 EMAs on the 4-hour chart while the greenback languishes near four-month lows.

At the time of writing, XAU/USD is trading at $1,883.47 and has travelled from a low of $1,875.20 to a high of $1,887.07.

The dollar index, DXY, has traded around the 90 mark and is currently down 0.22% on the day, treading water above a four-month low on Friday of 89.646.

Meanwhile, there are plenty of Fed speakers lurking and there are key data towards the end of the week that should prevent markets from getting too bearish on the greenback

The dollar can hold firmer in a market where traders ”have to start pricing in a slightly more hawkish Fed going forward,” Win Thin, global head of currency strategy at Brown Brothers Harriman (BBH) wrote today.

In recent sessions, we have heard Fed officials turning more hawkish of late who are embracing the notion of tapering coming sooner rather than later.

”The upcoming June Dot Plots will be very interesting, and we suspect that more than four will see the first hike coming in 2022. Yet we are disappointed that the US 10-year yield begins this week at 1.62%, near the bottom of recent ranges,” analysts at BBH said.

”However, the bigger drop in inflation breakevens has pushed US real yields higher, with the real 10-year at -0.82%, the highest since April 30. A continued rise should help the dollar get more traction.”

Looking forward, data due on Friday, including US personal consumption and inflation figures, could move the markets to anticipate a more hawkish tone from the next Fed policy meeting on June 15-16.

Another theme that markets are watching out for is progress on a new stimulus package in the United States after the White House pared down its infrastructure bill to $1.7 trillion on Friday but failed to gain Senate Republican backing.

Meanwhile, analysts at TD Securities argued that ”it’s too early for talk of taper talk to dent markets.”

”Ultimately, our rates strategists also caution that it is still too early for taper talk, which suggests gold bugs are likely to benefit from the ongoing increase in flows for the time being.”

Gold technical analysis

As per the start of the week’s analysis, Chart of the Week: Gold bears lurking at monthly resistance, the 4-hour chart is being monitored as the price creeps up on the critical resistance as follows: