- Gold remains pressured towards $1730 amid a broadly firmer US dollar.

- US infrastructure plans help the rebound in the Treasury yields.

- Technical setup favors XAU/USD bears ahead of US data, Powell.

Having faced rejection above $1740 on several occasions, Gold (XAU/USD) lost ground on Wednesday, now heading towards $1730 amid higher US dollar as well as Treasury yields.

Gold remains on the defensive, as the greenback holds the higher ground amid a tepid risk tone, as Treasury yields resume its uptrend on hopes of President Joe Biden’s $2.25 trillion infrastructure plan making it through Congress.

Meanwhile, markets ignored the dovish FOMC March meeting’s minutes, as worries over the US economic recovery and nervousness ahead of the earnings season tempered the mood. Risk-aversion boded well for the greenback while exerting downward pressure on gold.

At the time of writing, gold posts small losses on the day, trading at $1736. The bears look to retest Wednesday low at $1731 ahead of the Fed Chair Powell’s speech due later in NA session this Thursday. The weekly US Jobless Claims will also gain some market attention.

Gold: Technical outlook

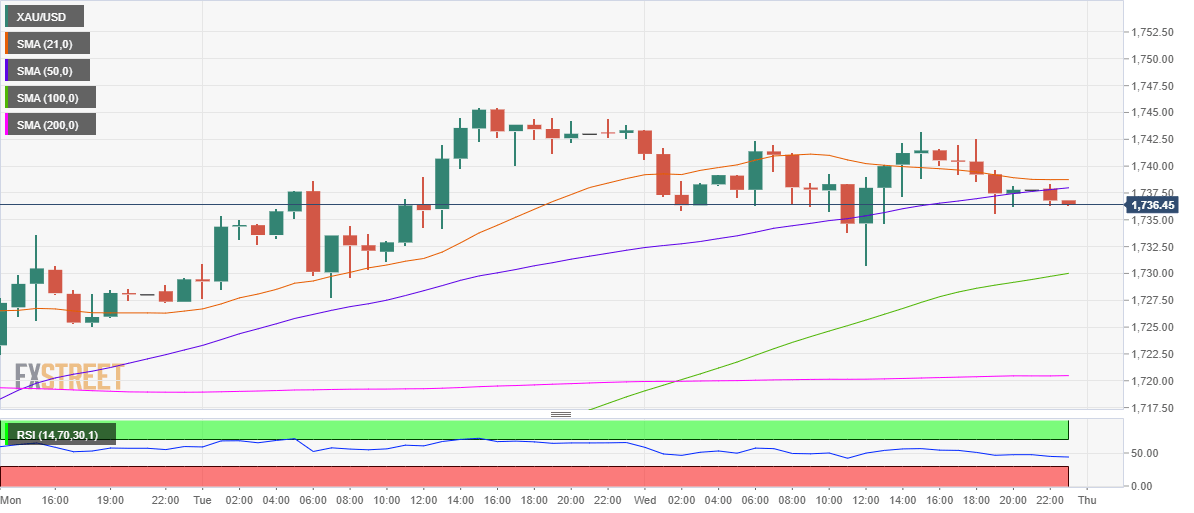

Gold seems to have found a strong foothold below the upward-sloping 50-hourly moving average (HMA) at $1738, as the Relative Strength Index edges lower near 44.00, as of writing.

Gold Price Chart: One-hour

The XAU/USD pair risks breaching the Wednesday low, which also coincides with the ascending 100-HMA.

Further south, the critical horizontal 200-HMA at $1720 remains on the sellers’ radars if the downside momentum accelerates.

Alternatively, the XAU buyers need acceptance above the powerful resistance around $1738 (confluence zone of the 21 and 50-HMAs) for any meaningful recovery towards the $1750 mark.

Gold: Additional levels