Gold has been looking for a fresh direction after the substantial decline last week. The precious metal was dragged lower with stocks after President Donald Trump refused to say he would accept the election results in a chaotic televised debate.

However, the market mood changed since then, and investors are focusing on a growing chance for a fiscal stimulus deal between Democrats and Republicans. More money printed by the government implies additional funds flowing into gold.

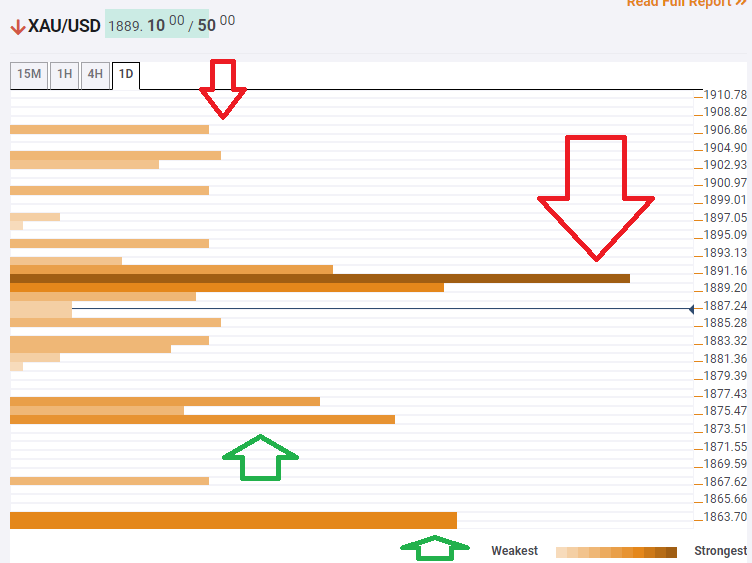

How is XAU/USD positioned on the chart?

The Technical Confluences Indicator is showing that gold faces fierce resistance at $1,890, which is the convergence of the Simple Moving Average 50-4h, the Fibonacci 38.2% one-week, and the Fibonacci 38.2% one-day.

Looking up, a noteworthy upside target is $1,906, which is where the Pivot Point one-day Resistance 1 hits the price.

Support awaits at $1,874, which is the confluence of the SMA 5-one-day, the SMA 100-1h, and the Fibonacci 23.6% one-week.

The next cushion is at $1,863, which is the meeting point between the PP one-month Support 1 and the previous monthly low.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence