- Gold reaches 1700 level, bears looking for bearish technical conditions for fresh entries.

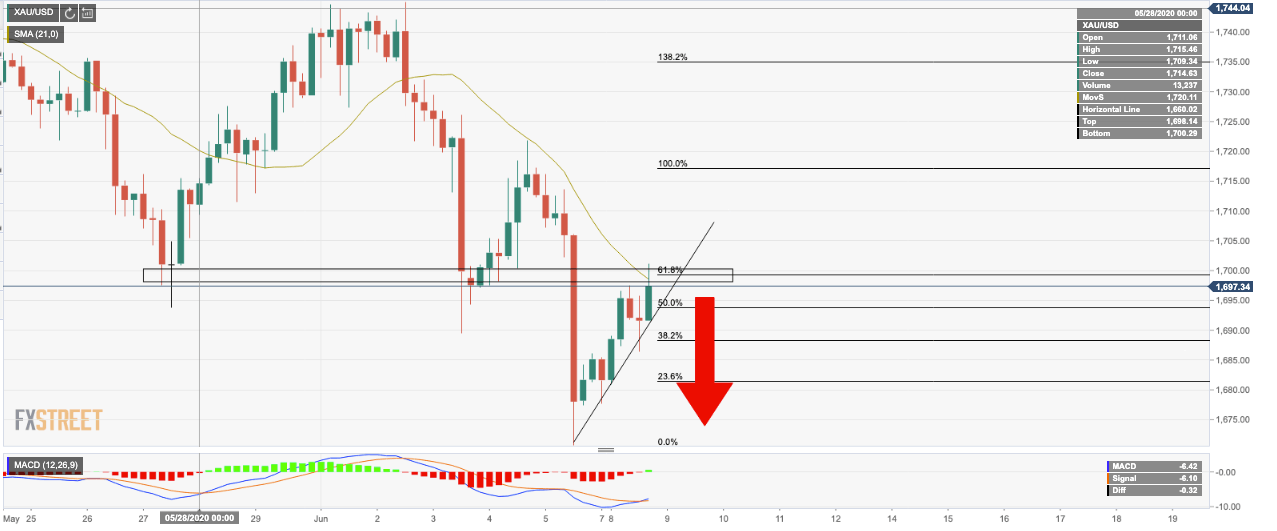

- 4HR conditions need to ripen below trendline support, buy stops will go above there.

Gold has reached a fresh high for the US session in its correction within a series of bearish impulses.

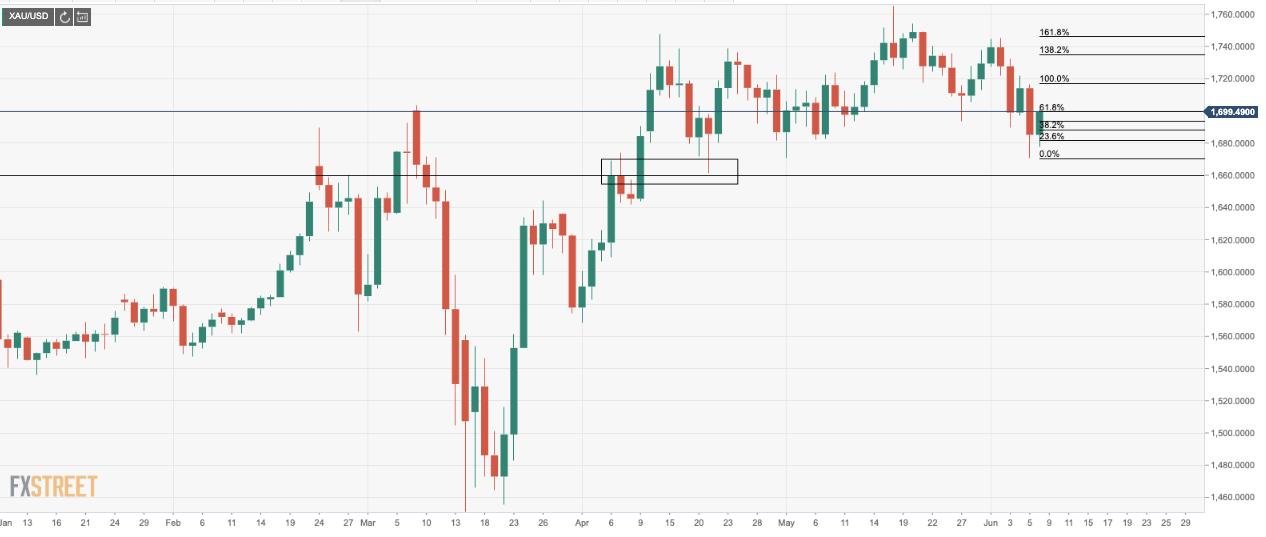

At the start of the week, the bearish case for gold was as a result of the following analysis: Chart of The Week: Gold bears burst into the barroom-brawl zone.

The price of gold had continued within the bearish trajectory in the open highlighted in last week’s analysis here: Gold Price Analysis: XAU/USD bearish case for the contrarians out there.

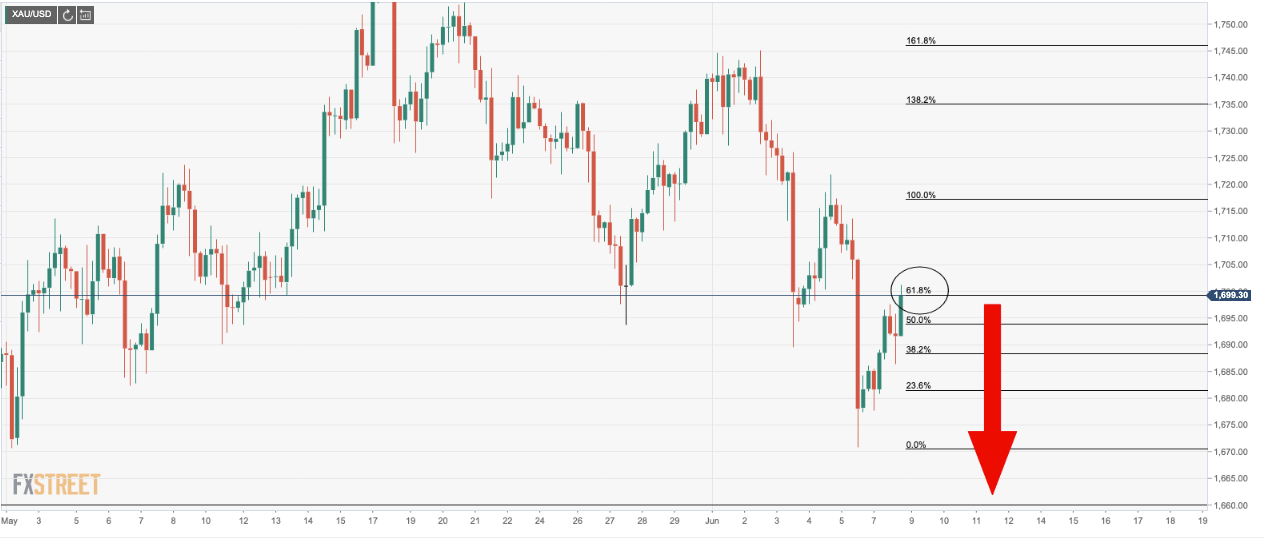

However, a correction of the last daily bearish impulse was expected to reach 1700 as a golden Fibonacci retracement, the 61.8%. This has indeed played out today.

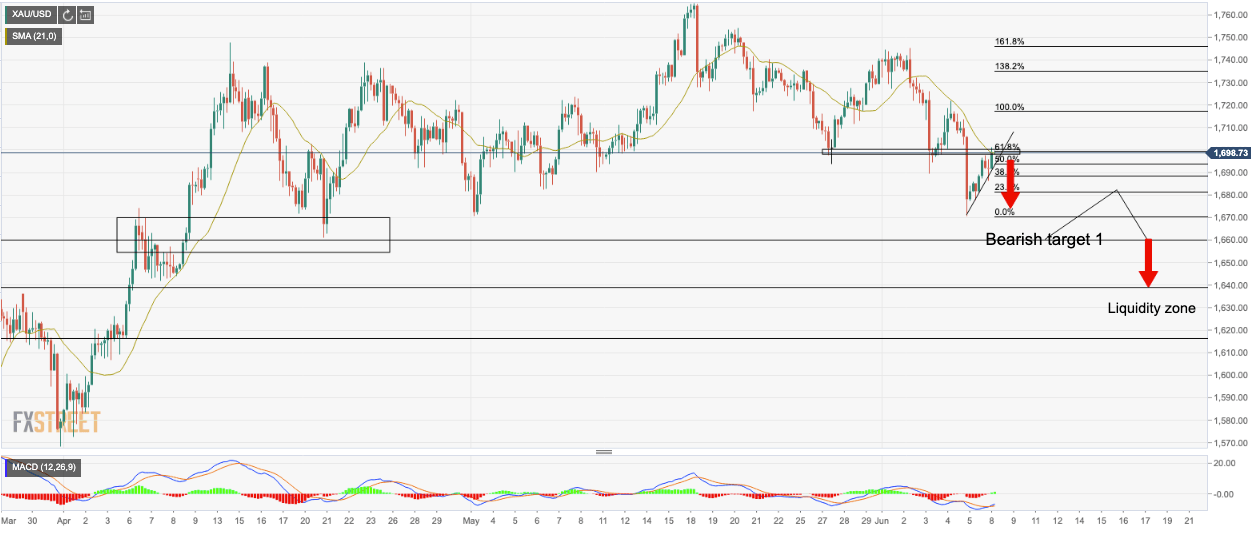

The following are a series of charts that path the way for a potential bearish extension in a fresh impulse towards liquidity:

Market structure

61.8% Fibonacci level reached

4HR trendline intact, price needs to break below it

MACD is negative, price is below 21 moving average and has been rejected by the hard resistance and a 61.8% Fib retracement level.

Bearish targets towards liquidity