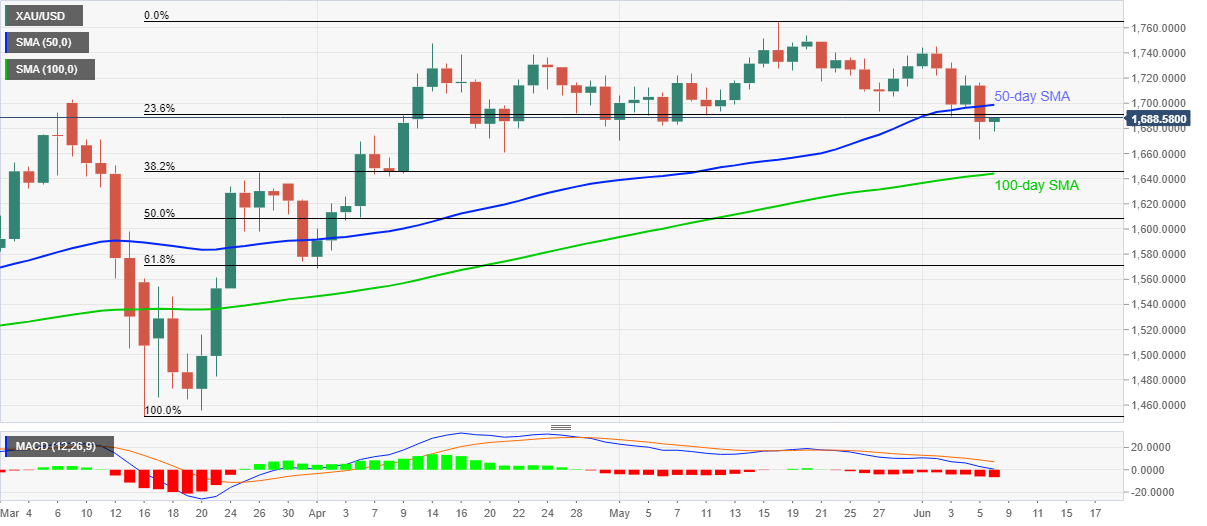

- Gold prices extend pullbacks from $1,677.73 to print the intraday high of $1,688.85.

- Bearish MACD, 50-day SMA question the bullion’s further upside.

- A confluence of 100-day SMA, 38.2% Fibonacci retracement restricts short-term declines.

Gold prices pick up the bids near $1,687.90, up 0.15% on a day, during the early Monday’s trading.

Despite bouncing off five-week low, the bullion stays below 50-day SMA amid bearish MACD. As a result, sellers remain hopeful of the fresh downside.

Though, a clear break below Friday’s low of $1,670.76 becomes necessary for the bears to return.

In doing so, 100-day SMA and 38.2% Fibonacci retracement level of March-May upside, near $1,644/46 becomes the key.

Meanwhile, an upside clearance of a 50-day SMA level of $1,698.75 can escalate the safe-haven’s recovery moves towards the monthly high near $1,745.12.

Gold daily chart

Trend: Further weakness expected