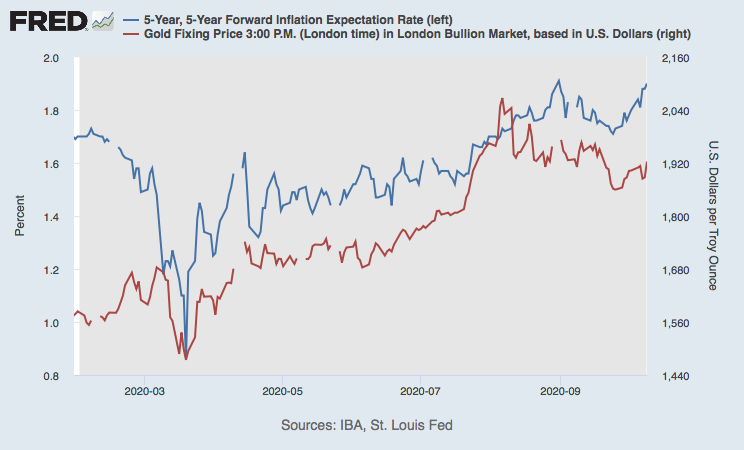

- Gold looks to be tracking the US inflation expectations.

- The yellow metal has cleared the bearish trendline from August highs.

Gold is moving in lockstep with the US inflation expectations, which have risen back to highs seen in August.

The yellow metal is currently trading largely unchanged on the day near $1,927 per ounce, having peaked at a record of $2,075 in August and pulled back to $1,848 on Sept. 24.

According to data source Federal Reserve Bank of St. Louis, the US 5y5y forward inflation expectation rate was 1.9% on Friday – just short of the August high of 1.91%, having seen a low of 1.71% on Sept. 24.

Indeed, inflation expectations are closing on the Federal Reserve’s (Fed) 2% price target. However, the central bank is now targeting an average inflation of 2%. In other words, the bank intends to allow inflation to rise above the 2% target for some time before raising interest rates.

As such, the path of least resistance for gold, a proven inflation hedge, is to the higher side.

The yellow metal has cleared the resistance of the trendline connecting Aug. 7 and Sept. 16 highs.

The breakout indicates the pullback from the record high of $2,075 has ended, and the broader uptrend has resumed.

Supporting the bullish case is the resurgence of the coronavirus cases, especially across Europe. However, if virus concerns lead to risk aversion, the US dollar will likely find bids, complicating matters for gold bulls.

Technical levels