Gold has been attempting to recover from the blow dealt by the Federal Reserve – which is reluctant to provide further stimulus despite a highly uncertain outlook. Will the precious metal receive help from Uncle Sam? Republicans and Democrats are deliberating a package worth around $1.5 trillion, but lawmakers are far from a deal.

As the trading week draws to an end, technicals may provide XAU/USD reasons to rise.

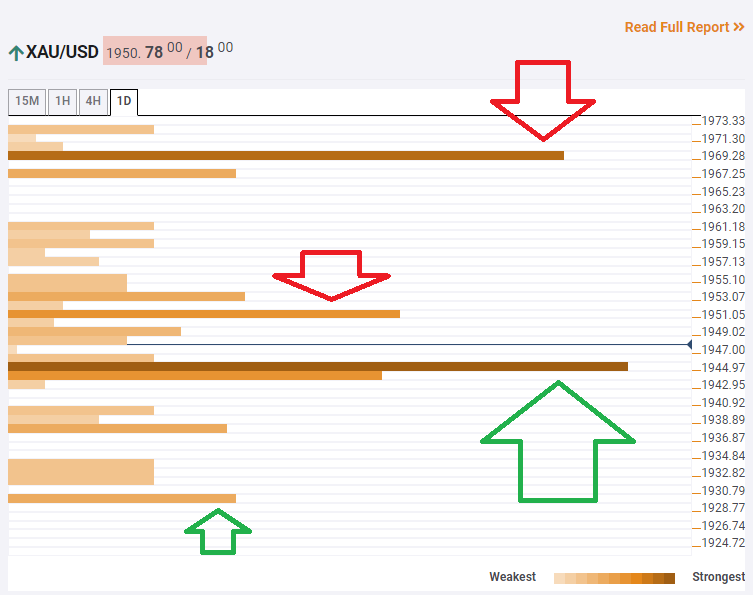

The Technical Confluences Indicator is showing that Gold has strong support at around $1,943, which is the convergence of the 10-day Simple Moving Average, the Fibonacci 38.2% one-month, the Bolinger Band one-day Middle, and more.

From there, XAU/USD may begin looking up. A significant hurdle awaits at $1,951, which is a cluster of lines including the Fibonacci 61.8% one-day, the SMA 5-4h, the SMA 5-15m, and the SMA 5-one-day.

Further above, the upside target remains the stubborn $1,969, which is where the Pivot Point one-week Resistance 1 and the previous weekly high.

If the precious metal slips lower, a noteworthy cushion awaits at $1,928, which is where the Fibonacci 61.8% one-week hits the price.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence