Gold has been suffering in response to the Federal Reserve’s decision. The world’s most powerful central bank only reiterated its commitment to low rates but refrained from pledging more bond-buying. The lack of new funds is weighing on the precious metal.

Moreover, Federal Reserve Chairman Jerome Powell seemed to signal that the next move depends on the federal government by saying that further stimulus would help.

XAU/USD dropped to around $1,950. Can it recover?

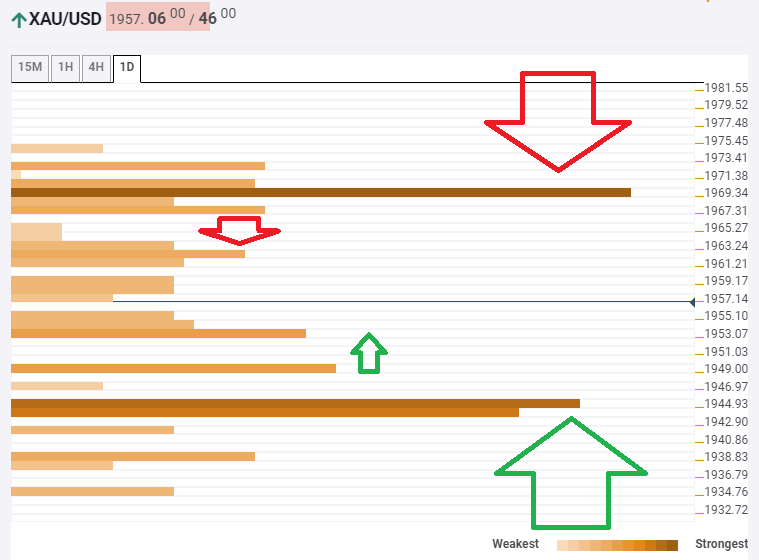

The Technical Confluences Indicator is showing that gold continues facing fierce resistance at around $1,969, which is the convergence of the Bollinger Band 1h-Upper, the BB one-day Upper, the Pivot Point one-week Resistance 1, and the previous weekly high.

A minor hurlde awaits at $1,961, which is where the Simple Moving Averge 5-4h, the SMA 200-4h, the BB 1h-Middle, and the SMA 10-15m meet up.

Some support is at $1,952, which is the confluence of the Fibonacci 23.6% one-week and the previous 1h-low.

A more significant cushion is at $1,944, which is a juncture including the SMA 200-1h, the Fibonacci 38.2% one-month, and the PP one-day S1.

Overall, the path of least resistance is down.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence