- Gold prices are under pressure as the US dollar flexes its muscles in Asia.

- The dollar is attempting to correct the post-Fed sell-off.

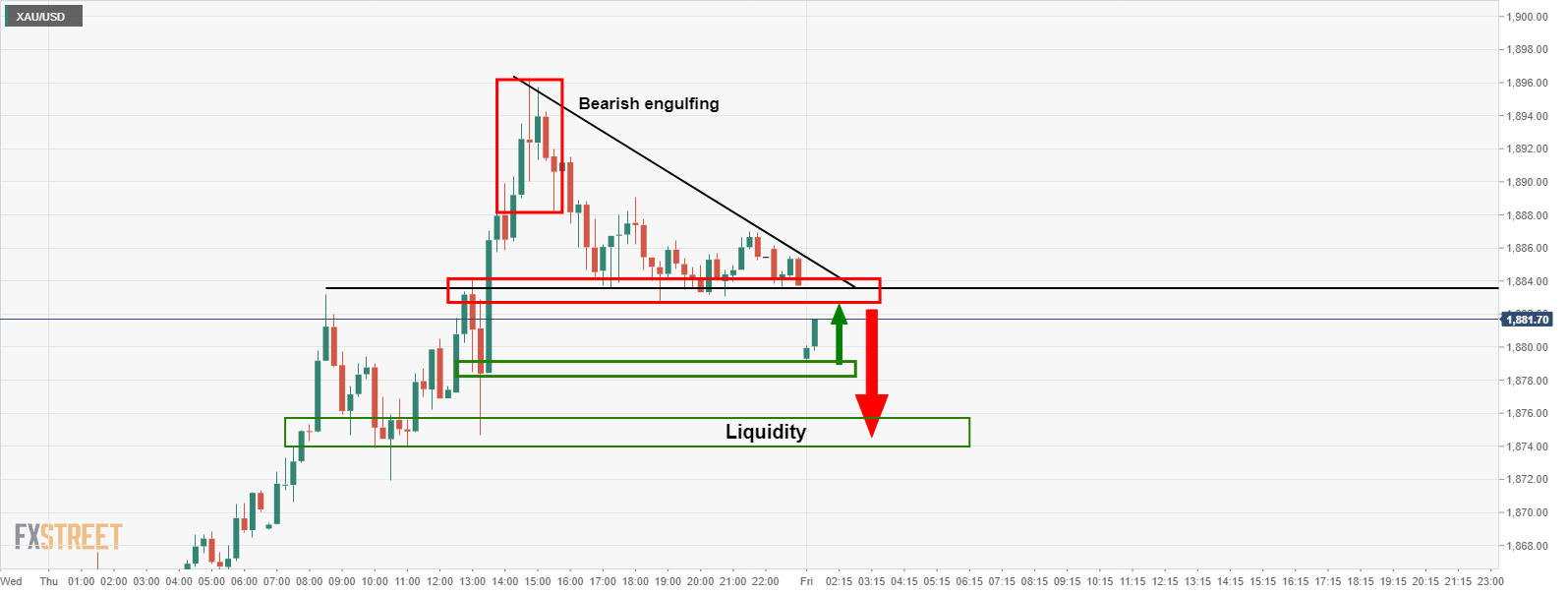

Gold prices in the Tokyo session have fallen below a technical triangle following a bearish engulfing top established in late New York trade.

The US dollar has caught a bid which is fueling some long covering elsewhere and weighing on the precious metal in what could be the beginnings of a cash-in following the prior day’s post-Fed sell-off in the greenback.

”While the Fed didn’t deliver on the WAM extension, the market wasn’t left disappointed as this outcome was already baked into the cake,” analysts at TD Securities explained

”With the FOMC out of the way, gold continues to trade on the basis of its relative cheapness to global macro factors, following the recent capitulation in positioning.”

”The Fed’s lower-for-longer and QE-infinity stance still support the notion of a growth and inflation overshoot narrative which should support gold in the longer-term.”

Meanwhile, the markets traded with a risk-on theme overnight.

US congressional leaders are working on the details of a nearly $900 billion coronavirus relief plan and there is the hope of an announcement later today that a deal has been struck.

Wall Street Close: Record highs ahoy in anticipation of stimulus

”Senate Majority Leader McConnell, House Speaker Pelosi, Senate Democratic leader Schumer and House Republican leader McCarthy have been directly involved in the negotiations, raising prospects for a package that can pass both the House and Senate,” analysts at Westpac explained.

Gold technical analysis

The analysts at TD Securities explained ”the immediate impulse for higher prices is rather associated with the start of a CTA buying program in response to strengthening upside momentum, which would be confirmed should prices close north of the $1875/oz range.”

15-min chart

As illustrated, following the bearish engulfing tops, the price has fallen out of the triangle’s bottom.

On a retest of what will be expected to now act as resistance, there could be a downside extension towards liquidity.