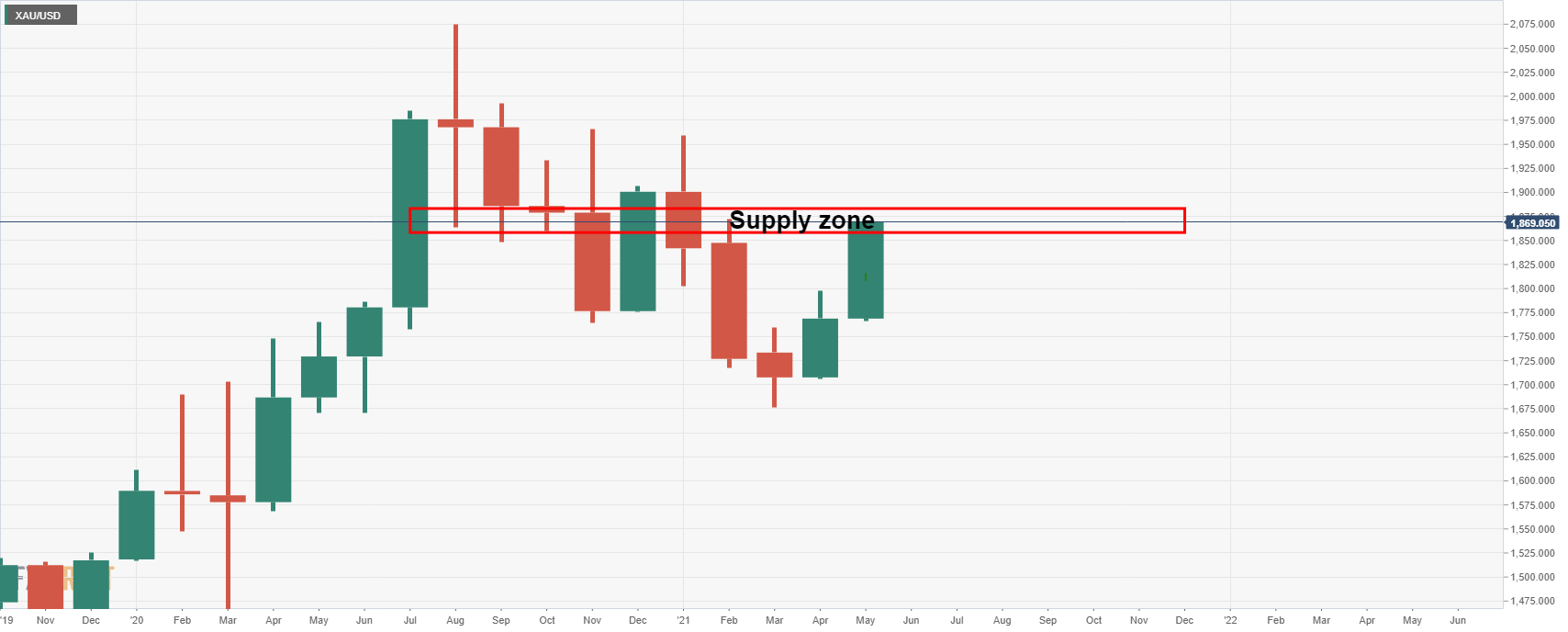

- Gold is running into a wall of resistance on the longer time frames.

- Bears will be looking for a correction to restest the prior resistance.

- Gold Price Analysis: XAU/USD to test $1,900 amid data disappointments – TDS

- Gold Price Analysis: XAU/USD bulls to defy overbought conditions on a break above $1,880

Update May 18: The XAU/USD pair advanced to its highest level since late January at $1,875 on Tuesday but lost its traction during the American trading hours. As of writing, gold was virtually unchanged on a daily basis at $1,866. Earlier in the day, the broad-based selling pressure surrounding the greenback helped XAU/USD preserve its bullish momentum. However, with Wall Street’s main indexes trading mixed after the opening bell, the USD selloff softened and XAU/USD started to edge lower. In addition, technical indicators in the short-term show overbought readings after XAU/USD gained nearly 3% in the last three days, suggesting that Tuesday’s price action could be seen as a correction.

Read: Gold is surging again, but can prices push above 1900? [Video]

Read: Gold Forecast: XAU/USD bulls eye $1,850 after regaining control

At the time of writing, the gold price is trading a touch higher in Asia by some 0.13% in XAU/USD.

XAU/USD rose by 1.26% to $1,868.50 on Monday and has added a buck to reach a new cycle high of $1,869.71 on a cautious start to the week for global financial markets.

Overnight, global equities were under pressure with bond yields edging higher making for a Goldilocks scenario for gold as markets fret over the US inflation story following last week’s CPI beat.

Meanwhile, the Federal Reserve’s vice chairman Richard Clarida has said the Fed will respond to higher inflation should that be required, but he and others, including Fed’s chair, Jerome Powell, have constantly insisted that now is not the time to start taper talk while employment remains deep in a hole.

We will see the minutes on Wednesday from the Federal Reserve’s policy meeting last month.

Investors will be on the lookout for more meat on the bone in the policymakers’ outlook of an economic rebound and clues regarding their thinking about inflation spikes and the ongoing economic recovery.

Money managers increased net length

Meanwhile, analysts at TD Securities explained that money managers ultimately increased their net length as the disappointing non-farm print catalyzed a round of algorithmic short-covering, helping prices to break out north of the $1800/oz range.

”At the same time, we’ve noted that the composition of gold flows is changing, highlighting that discretionary capital could once again be flowing into gold, but rising ETF flows alongside money manager positioning have since lent strength to this view “” particularly as the “transitory” debate surrounding inflation gathers share of mind.

Pick your poison, but the most plausible scenarios should all see gold prices ultimately firm.”

Gold forecast – Technical analysis

As per the prior analysis, Chart of the Week: Gold on the approach to $1,855, the price of gold has added to Friday’s bullish close.

Prior analysis, daily chart

‘From a daily perspective, the bulls are taking on the prior highs and closed Friday’s session strongly bid.

A run into the psychological $1,850 is on the cards with a -272% Fibo retracement of the prior correction coming in at $1,855.’

Live market, daily chart

Meanwhile, the -272% Fibo retracements of the prior correction coming in at $1,855 were cleared with ease.

In fact, we have seen a perfect touch of the -61.8% Fibo at the day’s highs.

A correction is the most probable scenario at this juncture revealing a 38.2% Fibonacci retracement level for the forthcoming sessions at $1,845.

In looking to the longer-term time frames, this also jives considering the market structure on the monthly chart as follows:

While an upside continuation is still a possibility, the monthly supply zone could be a tough nut for the bulls to crack straight away.

Additional reading:

Gold Weekly Forecast: XAU/USD bulls eye $1,850 after regaining control

Gold Forecast 2021 May 18: XAU/USD to test $1,900 amid data disappointments – TDS

Gold price has been hovering around $1,870, extending its recovery. The yellow metal tends to outperform when economic data is weakening, and underperforms when economic prospects improve. Now that there have been numerous data disappointments, forecasters will likely extend projections still lower. Subsequently, Bart Melek, Head of Commodity Strategy, believes XAU/USD is likely to near the $1,900 level.

The data expectation cycle and gold are so happy together

“As the data starts to follow a downward trajectory again and the market enters the corrective part of the data cycle, yields should be held down and the USD may be under pressure.”

Read more: XAU/USD to test $1,900 amid data disappointments – TDS

Previous Updates

Update: Gold price remains on the front foot near the four-month top, up 0.20% around $1,871, as European traders prepare for Tuesday’s bell. The gold buyers initially cheered a jump in the US Treasury yields to refresh multi-day high before recently respecting the downbeat US dollar. It should, however, be noted that the greenback bears await fresh clues and hence gold run-up stalls around the key resistance comprising late January tops. Behind the moves could be the mixed signals from the Fed and the US data, as well as the coronavirus (COVID-19) vaccine optimism. Additionally, cautious sentiment ahead of Wednesday’s FOMC might also probe gold bulls going forward.

Update: Gold price is off the highs and slips below $1870 amid a bounce in the Treasury yields across the curve, which helps cap the US dollar’s decline. The gold price refreshed three-month highs at $1874 in the last hour, as the greenback continues to remain undermined by the expectations that the Fed will maintain interest rates lower for a longer period, especially after the weaker US Retail Sales report tamed concerns about rising inflation.

Further, gold received an additional boost after Dallas Fed President Robert Kaplan on Monday reiterated his view that he does not expect rates to rise until next year. Meanwhile, mounting growing covid cases in Asia and escalating Middle East tensions keep the buoyant intact around the traditional safe-haven gold.

Update: Gold climbed to the highest level since late January, around the $1.875 heading into the North American session, albeit lacked any follow-through buying. This marked the fourth consecutive session of a positive move and was exclusively sponsored by the heavily offered tone surrounding the US dollar. Investors now seem convinced that the Fed will keep interest rates low for a longer period. This was seen as a key factor that dragged the key USD Index to four-month lows and benefitted the dollar-denominated commodity.

However, a combination of factor held bullish traders from placing aggressive bets and kept a lid on any further gains for gold. A generally positive tone around the equity markets acted as a headwind for the traditional safe-haven XAU/USD. Apart from this, a modest uptick in the US Treasury bond yields further collaborated towards capping gains for the non-yielding yellow metal amid slightly overbought conditions on short-term charts.

That said, the overnight sustained breakthrough the very important 200-day SMA supports prospects for an extension of the recent strong positive move witnessed over the past one-and-half-month or so. Hence, any meaningful pullback might still be seen as a buying opportunity and remain limited ahead of Wednesday’s release of the latest FOMC monetary policy meeting minutes.

Update: Gold price has entered a phase of upside consolidation, having faced rejection once again above $1870. The gold price looks unimpressed by the latest leg down in the US dollar, amid dovish Fed expectations. The US Treasury yields, however, hold onto the recent recovery gains, which limits the further upside in the yieldless gold. The optimism around the economic reopening in the Euro area lifts the market mood, collaborating with the stalled rally in gold prices. Markets now await the US housing data and the sentiment on Wall Street for fresh impetus on gold. At the time of writing, gold price trades at $1868, up 0.10% on the day, having refreshed three-month highs at $1874 earlier in the Asian session.

Gold buyers prepare for gold’s breakout

After the surprise CPI data from the US last week there are growing concerns about rising inflation. These fears increased with the University of Michigan consumer sentiment print on Friday. The US University of Michigan May prelim consumer sentiment was a big miss at 82.8 vs 90.0 expected. The 1 year inflation expectations rose to 4.6% vs 3.5% expected. The rise in CPI will trouble the Federal Reserve. In simple terms when prices rise cash has less value. The more inflation rises, the more prices rise, the less value cash has. One solution for investors may be to buy gold. However, as soon as the Fed announce bond tapering then gold will fall.

Read more:Gold buyers prepare for gold’s breakout